Shares fell in Asia on Thursday ( Nov 7 ) after US stocks broke records as investors speculated on what Donald Trump’s victory in the White House will mean for the country and the world.

Markets were likewise paying close attention to the Federal Reserve’s decision regarding interest rates, which was scheduled for later in the day.

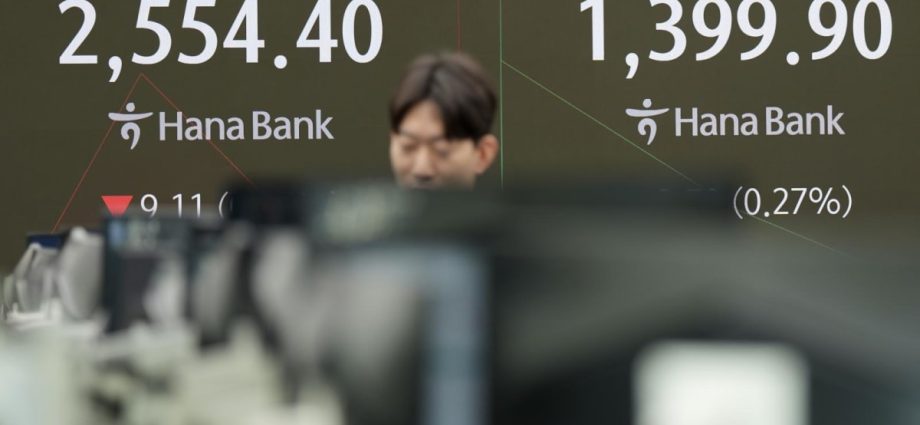

Japan’s Nikkei 225 shed first profits to drop 0.6 per share to 39, 246.86, while the Kospi in Seoul fell 0.4 per share to 2, 554.57.

Australia’s S&, P/ASX 200 edged 0.1 per share lower, to 8, 191.00.

Chinese securities even declined. Hong Kong’s Hang Seng dropped 0.7 per share to 20, 386.36. The Shanghai Composite index likewise fell 0.7 per cent, to 3, 359.99.

Trump has promised to impose blanket 60 percent taxes on all Chinese exports, which will increase the taxes even further if Beijing invades Taiwan, the island nation that governs itself.

Buyers are adding to bet built before on what the , higher taxes, lower tax rates and lighter regulation , that Trump favours may think. Higher taxes on imports from China may contribute to the , burdens Beijing is facing , as it struggles to resurrect slowing growth in the nation’s second-largest business.

Additionally, higher import tariffs from China, Mexico, and other nations do increase the possibility of trade war and other hiccups that might occur.

On Wednesday, the US stock market, Elon Musk ‘s , Tesla, businesses and , bitcoin , all stormed higher, but, as investors made stakes on what , Donald Trump’s returning to the White House , may mean for the business and the , earth.

Among the losers the business sees: The renewable-energy business and likely everyone concerned about , higher inflation.

The S&, P 500 rallied 2.5 per share to 5, 929.04 for its best moment in nearly two years. The Dow Jones Industrial Average surged 3.6 per share to 43, 729.93, while the Nasdaq hybrid jumped 3 per share to 18, 983.47. All three stocks had recently broken information for them.