Apple has slipped to second place in China’s smartphone sales position, outsold by regional rivals Huawei, OPPO, Honor and live.

Apple’s iPhone and Chinese smartphones are closing the achievement distance, while some Americans are stifling the US government’s attempts to support local businesses has resulted in buying local.

Due to security concerns, Chinese authorities have also placed local regulations on Apple, including restrictions on using smartphones at some state agencies and state-linked businesses in at least eight provinces.

Employees at the aforementioned organizations and firms, including those in rich maritime areas, have been advised to instead purchase and employ local cellphone brands since December. Apple was given a Chinese law enforcement notice earlier this month to stop selling the social media platform Threads and Meta’s WhatsApp messaging service from its China software store.

The effects of those restrictions on Apple’s declining regional income is hard to disaggregate. Apple has slipped in nearby positions despite using more, not fewer, Chinese manufacturers and Apple CEO Tim Cook’s regular visits to China to proclaim his company’s responsibility to China’s business.

Apple’s smartphone unit revenue dropped 25 % yr- on- year in the second quarter of 2024 while its market share fell from 20 % to 15 % over the same time, according to tech industry research firm Canalys.

Huawei’s sales were up 71 %, lifting its market share from 10 % to 17 %. Additionally, OPPO and vivo lost market share, though not as much as Apple. Honor, a discount brand spun off from Huawei, increased its share from 14 % to 16 %. Xiaomi ranked sixth, close behind Apple.

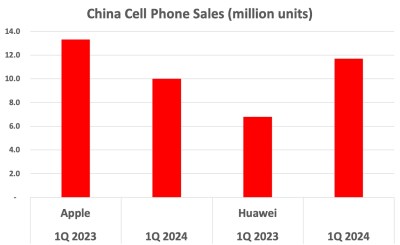

The data from Counterpoint Market Pulse is slightly different, but it also shows significant declines for Apple and significant gains for Huawei.

According to Apple’s supplier list for the previous fiscal year, Chinese companies have increased their lead, increasing by 30 %. Taiwanese, American and Japanese companies continued to rank second, third and fourth, though all their numbers declined.

The list includes 187 companies which, according to Apple, accounted for 98 % of the company’s direct spending on materials, manufacturing and assembly in fiscal 2023, which ended last September.

Vietnamese and Thai businesses on the list increased in response to the exodus of low-cost assembly operations from Southeast Asia to China.

Nikkei Asia’s analysis shows 40 % growth in the number operating in Vietnam to 35 but 13 of them are actually Chinese suppliers.

Although the number of South Korean businesses on the list decreased while the number of European ones increased, their shares of the total were each less than 10 %. 14 Indian companies remain, or 2 % of the total.

More surprising, perhaps, is that Apple’s list shows that more than 80 % of the company’s suppliers have a presence in China.

” There’s no supply chain in the world that’s more critical to us than China. Apple CEO Cook stated on a March trip to China that “we’ve been building up and investing more and more.” ” Today’s factories are so much more modern. And in 10 years from now, we will keep advancing”.

Among the eight new recent Apple suppliers in China, identified are Baoji Titanium Industry, thermal interface and graphite supplier Jones Tech, ultra-fine wire producer Zhejiang Tony Electronic, printing and packaging company Paishing, San’an Optoelectronics, and precision component and manufacturing service provider Shenzhen BSC Technology.

DigiTimes also noticed that four Chinese businesses had been taken off of Apple’s list of suppliers in order to win over the Chinese government. Additionally, Apple is actively expanding its production in India and Southeast Asia.

However, it is clearly not reducing its involvement with China, where it still accounts for 17 % of its manufacturing output in the fourth quarter of 2023 and contributed to its growth. How it will deal with its accelerating loss of market share in China, however, is another story.

Follow this writer on , X: @ScottFo83517667