BBC News

BBC News

BBC Indonesian

Getty Images

Getty ImagesWhen US President Donald Trump hit China with levies in his first term, Asian investor Hao Le saw an option.

His business is one of thousands of ones that have come into direct competition with West-restricted Foreign exports.

Le’s SHDC Electronics, based in Hai Duong, is a budding industrial hub that sells$ 2 million ( £1.5 million ) worth of phone and computer accessories to the US each month.

But that income may dry up if Trump imposes 46 % tariffs on Asian goods, a program that is currently on hold until earlier July. That would be” fatal for our company,” Le claims.

He continues,” We may compete with Chinese materials, and selling to Asian customers is not an option.” This is not just our issue. Some Asian businesses are having trouble in their own apartment market.

Some local suppliers were harmed by Trump’s tariffs in South East Asia as a result of a abundance of cheap Chinese imports that were originally intended for the US. But they also opened new doors for other companies, usually into global supply chains that wanted to cut their dependency on China.

Trump 2.0, however, threatens to opened those windows. And that’s a blow to rapidly expanding nations like Vietnam and Indonesia, who are poised to become important people in fields ranging from bits to electric cars.

They even find themselves stuck between the country’s two biggest economies- China, a powerful ally and their biggest trading lover, and the US, a key trade industry, which could be looking to reach a deal at Beijing’s expense.

Getty Images

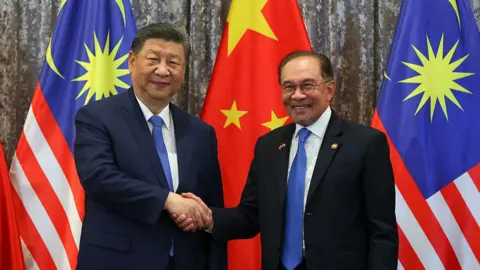

Getty ImagesThis week, Chinese President Xi Jinping has been speaking to Vietnam, Malaysia, and Cambodia, urging people to unite against Trump’s taxes. Given how important South East Asia is to the Taiwanese economy, the journey was much planned but has a new urgency.

China earned a history$ 3.5tn from imports in 2024- 16 % of its exports go to South East Asia, making it the biggest industry.

Prior to Xi’s attend, Malaysia’s trade secretary Tengku Zafrul Aziz told the BBC on Tuesday,” We can’t decide, and we will never choose between China and the US.”

” We will protect [ourself ] if the issue is about something that we feel is against our interests.”

A wake-up phone

Trump called Asian head To Lam, who he described as a “very successful call,” to offer to fully repeal tariffs on US products.

The US business is essential to Vietnam, an emerging technology superstar where manufacturing companies like Samsung, Intel and Foxconn, the Chinese company contracted to produce handsets, have set up shop.

In the interim, Thai authorities have a plan that calls for higher US goods and assets. Since the US is their largest import business, they are hoping to avoid Trump’s 36 % tax on Thailand.

” We will show the US government that Thailand is not only an supplier but also an ally and economic mate that the US can rely on in the long term”, Prime Minister Paetongtarn Shinawatra said.

The Association of Southeast Asian Nations ( Asean ) has ruled out reprisals for Trump’s tariffs, instead choosing to emphasize both the US’s economic and political significance.

Getty Images

Getty Images” We understand the concerns of the US,” Mr. Zafrul told the BBC. ” That’s why we need to show that really we, Asean, particularly Malaysia, can be that gate”.

South East Asia’s export-focused markets have benefited from both Chinese and US trade and investment. However, Trump’s paused charges was stifle that.

Indonesia, which may confront 32 % taxes, is home to vast copper resources and has its sights set on the global energy vehicle supply network. Malaysia, which is becoming a hub for semiconductors, could become subject to 24 % taxes.

Cambodia, a Taiwanese alliance, is subject to the highest charges: 49 %. One of the poorest countries in the region, it has thrived as a trans-shipment hotspot for Chinese companies seeking to skirt US taxes. 90 % of the clothing companies, which are primarily exported to the US, are presently owned or run by Chinese companies.

Trump may have put a stop to these taxes, but” the damage has been done,” according to Doris Liew, an scholar from Malaysia’s Institute for Democracy and Economic Affairs.

” This serves as a wake-up visit for the region, not only to minimize reliance on the US, but also to re-balance overdependence on any one business and trade mate”.

South East Asia’s get and China’s lost

That is no easy job because South East Asia also has trade hostilities with Beijing.

Isma Savitri, a business owner in Indonesia, worries that Trump’s 145 percent tariffs on China will cause more opposition from Chinese rivals, who are unable to trade to the US.

Smaller companies like us feel constrained, according to Helopopy’s user of the nightgowns line. ” We are struggling to survive against an onslaught of ultra-cheap Foreign items”.

One of Helopopy’s well-known pyjamas is available for$ 7.10 ( 119, 000 Indonesian rupiah ). According to Isma, she has seen comparable pieces of art in China for roughly half the price.

” South East Asia, being near by, with empty trade systems and fast-growing industry, naturally became the dumping terrain”, says Nguyen Khac Giang, visiting fellow at the ISEAS Yusof-Ishak Institute in Singapore. ” Politically, many nations are reluctant to confront Beijing, which adds another layer of vulnerability.”

Getty Images

Getty ImagesDespite consumers ‘ requests for more reasonably priced Chinese goods, including everything from shoes to phones, thousands of small businesses have been unable to match these low prices.

More than 100 factories in Thailand have closed every month for the last two years, according to an estimate from a Thai think tank. Local trade associations claim that around 250, 000 textile workers were fired in Indonesia during the same time, including Sritex, the region’s largest textile manufacturer, after about 60 garment manufacturers shut down.

According to Mujiati, a worker who was fired from Sritex in February after 30 years,” When we see the news, there are many imported products flooding the domestic market, messing up our own market.”

” Maybe it just wasn’t our luck”, says the 50-year-old, who is still hunting for work. Who can we contact with complaints? There is no one.

South East Asian governments responded with a wave of protectionism, as local businesses demanded to be shielded from the impact of Chinese imports.

Indonesia blocked the popular Chinese online retailer Temu and considered 200 % tariffs on a range of Chinese goods in the previous year. Thailand increased import inspections and added a tax on goods worth less than 1,500 Thai baht ($ 45, £34).

This year Vietnam has twice imposed temporary anti-dumping duties on Chinese steel products. Additionally, Vietnam is rumored to be planning to impose a stricter tariff regime on Chinese goods that are being shipped from its territory to the US following Trump’s most recent tariff announcement.

Getty Images

Getty ImagesThis week, Xi’s agenda would have been to address these worries.

China is concerned that channelling its US-bound exports to the rest of the world would “end up really alienating and aggravating” its trading partners, David Rennie, the former Beijing bureau chief for the Economist newspaper, told BBC’s Newshour.

The Chinese leadership faces a significant diplomatic and geopolitical problem if a tidal wave of Chinese exports ends up stifling those markets and causing employment and jobs.

China hasn’t always had a positive relationship with this area. Barring Laos, Cambodia and a war-torn Myanmar, the others are wary of Beijing’s ambitions. South China’s territorial disputes have strained ties with the Philippines. Trade has been a balancing factor in other countries like Vietnam and Malaysia, but this is also an issue.

But that might change now, experts say.

Getty Images

Getty ImagesSouth East Asia “had to consider whether they actually wanted to offend China.” This makes things more complicated, according to Chong Ja-Ian, associate professor at the National University of Singapore.

China’s loss could be South East Asia’s gain.

In Vietnam, Hao Le claims that there have been more inquiries from American customers looking for new electronics suppliers outside of China. Such decisions are currently made within days.

Malaysia, with sprawling rubber plantations and the world’s largest medical rubber glove maker, has nearly half the world’s market for rubber gloves. However, it is on track to surpass China as its main market sharer.

Like most of the rest of the world, the region still has a 10 % base tariff. And that is bad news, says Oon Kim Hung, president of the Malaysian Rubber Glove Manufacturers Association.

Customers will find paying an additional 24 % on Malaysian gloves to be much preferable to the 145 % levy they will have to pay for Chinese-made gloves, he claims.

” We’re not exactly jumping off the cliff, but this may be a good thing for our manufacturers as well as those in Thailand, Vietnam, and Cambodia,” we said.

Additional reporting by Bui Thu and Tessa Wong