China journalist

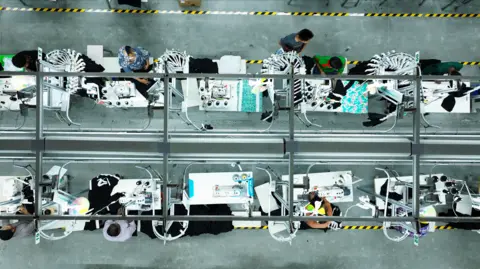

The smooth leather is shaped by a shriek and breath of compressed air, which recreates an all-American cowboys shoe produced on China’s eastern coast.

Next comes another one as the assembly line continues, the sound of sewing, stitching, cutting and soldering echoing off the higher ceilings.

” We used to buy around a million pairs of boots a time”, says the 45-year-old selling boss, Mr Peng, who did not wish to disclose his first name.

That is, until Donald Trump came on.

In his first term as president, a slew of taxes led to a trade war between the country’s two largest economy. Six years later, now that he is back in office, Chinese companies are expecting a movie.

” What path if we get in the future”? Mr Peng asks, questionable of what Trump 2.0 methods for him, his acquaintances- and China.

A challenge looms

For Western markets that are increasingly wary of Beijing’s ambitions, trade has become a powerful bargaining chip – especially as a sluggish Chinese economy relies ever more on exports. Trump returned on a campaign promise that included crushing tariffs against Chinese-made goods, and has since threatened a 10% levy that is expected to take effect on 1 February.

He has even ordered a review of US-China industry- which buys Beijing period and Washington, negotiating room. And for the moment, harsher rhetoric ( and higher tariffs ) appear to be directed at US allies like Canada and Mexico.

Trump does have put a halt to the looming conflict with Beijing. But some believe it’s also coming. Although it’s difficult to estimate how many companies are emigrating from China, big players like Nike, Adidas, and Puma have now done so. Foreign companies too have been moving, reshaping supply chains, although Beijing remains a crucial person.

Mr Peng says his employer, who owns the stock, has considered moving output to South East Asia, along with many of their companies.

It would save the company, but they would lose their workplace. The majority of the team has been employed in the adjacent town of Nantong for more than 20 years.

Mr Peng, whose wife died when their child was younger, says the manufacturer has been his relatives:” Our manager is determined not to leave these workers”.

Xiqing Wang / BBC

Xiqing Wang / BBCHe is aware of the geography at play, but he claims that he and his employees are simply trying to make a life. They are also reeling from the effects of 2019, when a third round of Trump tariffs- 15 %- hit Chinese-made consumer items, like as clothes and shoes.

Since then, commands have decreased, and staff numbers, after more than 500, have dropped to just over 200. The proof is in the clear work stations, as Mr Peng shows us about.

Workers are arranging the set so that it is in the best shape before handing it to the machinist. Because errors can damage the pricey leather, which is most often imported from the US, they must be accurate.

Due to some of their American customers now considering moving their company away from China and the risk of tariffs, the manufacturer is trying to keep prices low.

However, experienced workers would lose as a result: from flattening the leather to polishing the done boots before shipping them for export, it can take up to a month.

This is what made China the leading producer in the world: labor-intensive creation that is also affordable when scaled up and supported by a world-class supply chain. And it has taken years to create.

I felt satisfied after going through the continuous cycle of inspecting and shipping products, says Mr. Peng, who has been employed these since 2015. ” But commands have decreased, which makes me feel very lost and anxious”.

These cowboy shoes have been produced in this area for more than ten years and were originally designed to destroy the Wild West. And this is a well-known tale in the north of Jiangsu state, a manufacturing gateway along the Yangtze River that produces almost anything, from electric cars to fabric.

Xiqing Wang / BBC

Xiqing Wang / BBCThese items come in the hundreds of billions of dollars worth of money that China boats to the United States annually, a quantity that gradually increased as Washington became its biggest trading partner.

That reputation slipped under Trump. But it was not restored under his son Joe Biden, who kept most Trump-era levies in position, as relations with Beijing frayed.

In truth, the European Union to has imposed tariffs on energy automobile imports, accusing China of making very far, often with the assistance of state subsidies. Trump has echoed this- that China’s “unfair” business methods risk international comeptitors.

Beijing interprets this language as Western attempts to restrict its development, and it has frequently warned Washington that there will be no victors in a trade war. But it has also said it’s ready to talk and “properly tackle differences”.

And President Trump, who has described taxes as his “one big strength” over China, truly wants to talk.

It’s unclear as yet what he might want in return. During Trump’s honeymoon period with China in his first term he came to Beijing to ask for Xi’s help in meeting North Korea’s leader Kim Jong Un. This time it is believed he might need Xi’s support to make a deal with Russian President Vladimir Putin to end the war in Ukraine. He recently said that China had “a great deal of power over that situation”.

The notion that China is” sending fentanyl to Mexico and Canada” is causing the threat of a 10 % tariff. He was therefore desire that it put an end to that flow.

Or, given he welcomed a bidding war over TikTok, he may want to negotiate its ownership – or the prized technology that powers the app – because Beijing would need to agree to any such sale.

Xiqing Wang/BBC

Xiqing Wang/BBCWhatever the bargain may remain, it may help restore US-China relationships. However, the presence of one was immediately stop the possibility of a subsequent honeymoon, setting up Trump and Xi for a far more aggressive relationship.

Business sentiment is currently skeptical: according to a study conducted annually by the American Chamber of Commerce in China, only over half of them were concerned about the US-China relationship’s further deterioration.

Trump’s apparently softer attitude on China delivers offers some comfort. However, he also hopes that the threat of tariffs does encourage exports to China and re-enter US production.

Some Taiwanese companies are really moving, but not to America.

Moving buy

Businessman Huang Zhaodong, who is located an hour from Cambodia’s investment Phnom Penh, has constructed a new stock to meet the demand for a flurry of purchases from US supermarket chains Walmart and Costco.

This is his next stock in Cambodia, and jointly they produce half a million clothes a month, from tops to underwear. As the elastic neck is inserted and the hemlines are finished, passengers carrying cotton pants pass past us on an automatic series, moving from one place to the next.

Xiqing Wang / BBC

Xiqing Wang / BBCThen, Mr. Huang has the correct response when future US customers ask the first question, which he has come to expect, about his hometown. Never in China.

” In the case of some Taiwanese businesses, their clients have told them: ‘ If you don’t walk production overseas, I’ll cancel your purchases'”.

Manufacturers and retailers face difficult decisions due to the tariffs, but it’s not always obvious who will bear the brunt of the cost. Often it will be the client, Mr Huang says.

” Get Walmart as an example. I sell them clothing at$ 5, but they usually mark it up 3.5 days. The price I sell to them might increase to$ 6 if the price rises as a result of higher tariffs. If they mark it up by 3.5 days, the wholesale price would improve”.

But often, he says, it is the dealer. If his production line was in China, he estimates an extra 10 % tariff could take an extra$ 800, 000 ( £644, 000 ) from his earnings.

” That’s more than what I make as income. It’s great and we can’t manage it. If you’re making garments in China under such price problems, it’s unsustainable”, he says.

Current US tariffs on Chinese products range from 100 % on steel and aluminum to 25 % on electric cars. Until now, some top-selling products have been free, including electronics, quite as TVs and iPhones.

However, the 10 % cover price that Trump proposes could have an impact on the cost of everything that is produced in China and shipped to the US. That includes everything from tablets and drink cups to products and drink cups.

Xiqing Wang / BBC

Xiqing Wang / BBCAccording to Mr. Huang, this may encourage more businesses to relocate elsewhere. Around him have some brand-new factories opened, and Taiwanese companies from the textile industry’s heartlands like Shandong, Zhejiang, Jiangsu, and Guangdong are settling in to produce winter jackets and wool clothing.

Around 90 % of clothing businesses in Cambodia are then Chinese-run or Chinese-owned, according to a report by information and research group Research and Markets.

Half of the country’s foreign investment flows from China. Seventy percent of roads and bridges were built using loans Beijing dispensed, according to Chinese state media.

Many of the evidence on local restaurants and shops are written in Chinese as well as Khmer, the native language. In honor of the Taiwanese president, there is even a band road known as Xi Jinping Boulevard.

Cambodia is not a lone recipient. China has invested heavily in different parts of the world under President Xi’s Belt and Road Initiative – a trade and infrastructure project that also increases Beijing’s influence.

That means China has decisions.

According to Chinese express advertising, Belt and Road nations, primarily in South East Asia, account for more than half of China’s imports and exports.

Xiqing Wang/BBC

Xiqing Wang/BBCThis has not happened immediately, says Kenny Yao from AlixPartners, who advises Chinese companies on how to deal with taxes.

During Trump’s second expression, some Chinese companies doubted his price danger, he told the BBC. They then question whether he will follow the supply network and impose tariffs on other nations.

Just in case he does, Mr Yao says, it would be sensible for Taiwanese companies to look more afield:” For instance, Africa or Latin America. This is more difficult, but it is good to look at areas you have not explored before”.

Beijing is making its best effort to appear to be a stable business partner, and there is some proof it is working, as America vows to put itself first.

China has outperformed the US in terms of preference for nations in South East Asia, according to a survey conducted by the Singapore think tank Iseas Yusof-Ishak.

Even though the production has moved abroad, money is still flowing to China, where 60 % of the ingredients used to make clothing at Mr. Huang’s factories in Phnom Penh are Chinese.

And exports are thriving, with Beijing investing more heavily in high-end manufacturing, from solar panels to artificial intelligence. Last year’s trade surplus with the world- on the back of a nearly 6 % year-on-year jump in exports- was a record$ 992bn.

Chinese companies in Jiangsu and Phnom Penh are already getting ready for a turbulent, if not uncertain period.

Mr. Peng wants a “micable and calm” discussion between the US and China to keep the tariffs “within a reasonable range” and avert a trade war.

” Americans still need to purchase these products”, he said, before driving off to meet new customers.