Honda and Nissan are expected to begin negotiations on a consolidation next year, which will mark a turning point for the Japanese automobile industry. The two organizations, both of which have been overtaken by BYD and which, combined, buy fewer than three-quarters as some vehicles as Toyota, wish to step a healing by combining their technologies and achieving greater economies of scale.

However, the strategy appears to be a tribute to Japan Inc’s reduction of twilight business in the past and a knee-jerk nationalist response to Foxconn’s desire to acquire a stake in Nissan, or even to take over it. Foxconn is the global manufacturer of Taiwan’s Hon Hai Precision Industry.

The investment market’s decision came quickly and clearly. The proposed merger was headline news on the morning of Wednesday, December 18, by the time the market closed, Honda’s stock price was down 3 %, while Nissan’s was up 24 %. Put into words, this is a loan: a fortune for Nissan, terrible news for Honda’s owners. The stock price of Renault, which owns 17.0 % of Nissan directly and 18.7 % through a trust, was up 5 %. Hon Hai’s was down 1 %.

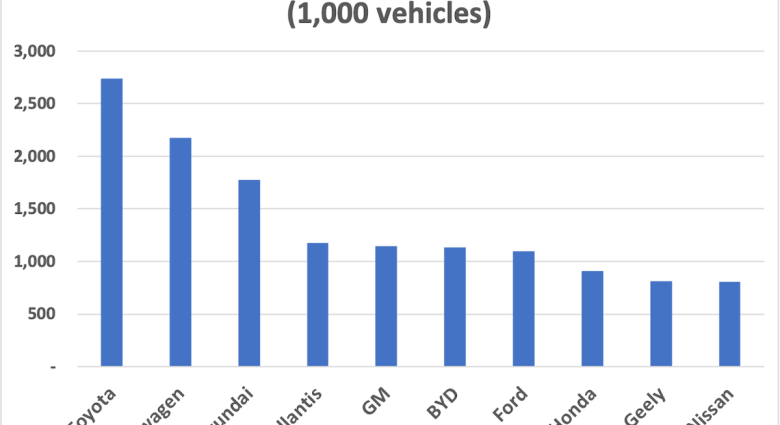

Toyota, Tesla, and BYD have all fallen way behind Honda and Nissan, both of whom were market leaders in the past, in the market for electric and hybrid vehicles. According to information for the three weeks to September, BYD is the sixth-largest manufacturer in terms of vehicle sales, trailing only Honda and Ford. Perhaps even more humiliating, Chinese automaker Geely ( which owns Volvo ) overtook Nissan to rank ninth.

Of program, the consolidation is pitched as forth looking. The two businesses will discuss a merger, according to NikkeiAsia, the English-language type of Japan’s major business regularly,” to better engage against Tesla and Chinese electric vehicle makers in a rapidly changing automotive industry.” According to The Financial Times, Nikkei owns the two businesses, “are in exploratory discussions about a merger of the two carmakers that would create a$ 52 billion Japanese behemoth.”

However, the Japanese language Nikkei’s title for Thursday morning read,” Hon Hai order, sense of problems.” Honda, which had begun discussing a” proper relationship” with Nissan next March, said it would withdraw if Nissan tied up with Hon Hai.

Hon Hai is expanding its electric car company, adding pressure to Honda and Nissan. In 2020, it established the Freedom in Harmony ( MIH) Consortium in hopes of becoming the “android structure of the Vehicle business” and” creating a’ software-defined’ available ecosystem for the Vehicle manufacturing business”. Additionally, Hon Hai and Taiwanese manufacturer Yulon work together to create electronic vehicles under their own design.

The MIH Consortium, which develops guide patterns and open requirements, now has more than 2, 700 people, including more than 100 in Japan. Jun Seki, the CEO of Dongfeng Nissan ( Nissan’s joint venture with Dongfeng Motor in China ), the CEO of Japanese automaker Nidec, and most recently, the CEO of Hon Hai’s electric vehicle operations, is the head of the company.

Seki apparently sees possible synergies with Nissan, which launched its founding electric car, the Nissan LEAF, in 2010, and is said to be interested in acquiring Renault’s communicate of Nissan.

Renault has been backing away from its alliance with Nissan and Mitsubishi Motors, while Honda and Nissan are considering bringing Mitsubishi Motors into a novel, all-Japanese, three-way ally. After cutting back on the production of gasoline-powered cars, this alliance would be no more than 80 % the size of Toyota today, but probably no more than 70 % as large. Despite this, it may conceivably be comparable to the size of the Hyundai Motor Group, which presently leads Toyota and Volkswagen in terms of size.

Note that only three of the world’s top 10 automakers reported year-on-year unit sales increases in the three months to September 2024: BYD ( 38 % ), Geely ( 20 % ) and Ford ( 1 % ). The others reported single-digit declines, except for GM (-13 % ) and Honda (-12 % ). On current trends, BYD perhaps soon beat GM and Stellantis, while Geely catches up with Honda.

Nissan’s overall product sales decreased by only 3 % in the previous quarter, but both sales and prices dropped in China. As a result, the bank’s online income dropped by more than 90 % in the first quarter of this fiscal year, which ends in March 2025. Honda’s online profit was over 20 % in the same time, for the same purpose.

Honda also needs a self-driving car alternative after failing to work with GM on its Cruise robotaxi next week, leaving Honda in the dark. Cruise and GM had a lot in mind when they were planning to visit Tokyo in 2026.

The solution may already be in the works. At the beginning of August, Honda and Nissan announced plans to do joint study into next-generation software-defined cars, autonomous driving and AI, as well as chargers, power paying, and electric car engine and transmission systems (e-axles ). With time, this could lead to self-driving taxis.

Honda intends to follow Toyota and BYD into the passenger car market, where they are already the most popular brand.

Although it is easy to be cynical about these developments, we need to remember that Toyota’s commitment to hybrid vehicles was criticized for years by those who believed pure electric, battery-powered vehicles were the future’s car of the future. They were wrong, and those who are skeptical of the Honda-Nissan merger may also be mistaken. But fighting back against Toyota, Hyundai, BYD, Geely and other aggressive competitors won’t be easy.

Follow this writer on , X: @ScottFo83517667