Taxes are back on the agenda because Trump is about to reoccupy the White House. Basically, they never left — Biden , slapped large tariffs , on a variety of Taiwanese products, including electric cars, cards, and other things.

But Trump is contemplating tariffs that are  , far broader in scope , — a 60 % tariff on all Chinese-made products, and a 20 % tariff on all imports from anywhere.

There are important differences between cover levies like Trump’s and targeted tariffs like Biden’s. I’m not certain whether Trump’s business individuals, including , Robert Lighthizer, are informed this distinction or never, but it’s important. Like the fact that , imports do n’t subtract from GDP, it’s something that people who debate trade policy often seem not to understand.

What is the goal of levies?

First, let’s discuss about two different things you might want tariffs to perform.

One purpose of taxes is to , lower US dependence on China , — or on the outside world in general — , in a particular set of essential business. For instance, if China makes all the chargers, they may just decide to cut you off whenever they want to — as , China just did to America’s top aircraft manufacturer, Skydio.

Uavs are a key tool of modern war — perhaps , the , vital tool. And some robots are battery-powered. So if the US goods all its capacitors from China, it kind of puts the US at China’s kindness. Thus, we might want to use tariffs to make sure that China does n’t make all our batteries.

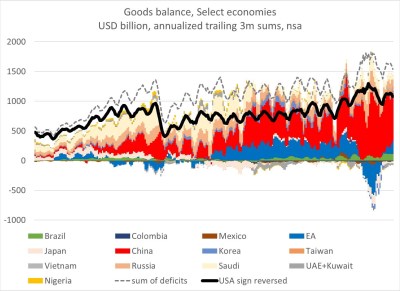

A second purpose of taxes is to , lower business imbalances. The US runs a very big deal deficit, and China runs a very large trade deficit. In fact, trade is currently essentially balanced across all of the world’s nations, with the exception of the US and China. China’s trade deficit accounts for , the vast majority of all international trade deficits, and America’s trade gap accounts for , the vast majority of international trade imbalances:

Many nations ‘ trade deficits with China and their trade surpluses with America result in healthy business. That does n’t mean they’re buying stuff from China, slapping a new label on it, and selling it on to America. However, what it does mean is that China is the nation’s key” country that sells more than it buys,” while America is the world’s key” state that buys more than it sells.”

Many people want to reduce those imbalances. Some people ( probably correctly ) think that because of these significant trade deficits, American manufacturers lose important markets overseas.

Others believe that global trade imbalances lead to various other economic problems — for example, Michael Pettis, who believes , imbalances drive inequality. Still others simply view trade deficits as a “loss” and trade surpluses as a “win” .1 , Reducing America’s trade deficit was one of , the major goals of Trump’s first term in office.

In fact, trade deficits are severely affected by both broad and targeted tariffs. But targeted tariffs , are  , capable of reducing US dependencies in specific areas like batteries — in fact, they’re better than broad tariffs for this purpose. Let me explain.

Broad tariffs struggle to reduce trade deficits

There are actually two reasons that broad tariffs, like the ones Trump is proposing, have difficulty reducing trade deficits. The first reason is , exchange rate adjustment.

When you trade stuff internationally, you have to , swap currencies. As anyone who has traveled overseas knows, to buy Chinese goods, you need 2024/11/trump-tariffs-threaten-to-torpedo-the-yuan/”>yuan. 2 , So if you’re an American, you need to swap your dollars for 2024/11/trump-tariffs-threaten-to-torpedo-the-yuan/”>yuan in order to buy stuff from China. The exchange rate refers to the price at which dollars and 2024/11/trump-tariffs-threaten-to-torpedo-the-yuan/”>yuan exchange each other are exchanged.

China’s demand for Chinese goods is slowed when the US imposes tariffs on it. And that reduces US demand for Chinese , yuan, because when Americans do n’t need to buy as much Chinese stuff, they do n’t need as much yuan.

And when demand for yuan goes down, the price of yuan, in terms of dollars, goes down. This is just basic Econ 101, supply-and-demand stuff. The dollar , appreciates , in value and the yuan , depreciates , in value. This is called “exchange rate adjustment”.

The impact of the tariffs is partially offset by the exchange rate adjustment. When tariffs make the yuan get cheaper for Americans, that makes , Chinese goods cheaper for American customers. And when tariffs make the dollar get more expensive for Chinese people, that makes , American goods get more expensive for Chinese customers.

This does n’t completely cancel out the effect of tariffs, but it , partially , cancels it out. Similar to how pizza restaurants would reduce their prices in response to the government’s taxation of pizza in order to reduce the number of people who no longer eat it.

Of course in the real world, there are more than just two currencies, and more than just two countries trading with each other. However, if you examine the data, it is obvious how much Trump’s tariffs affected China during his first term.

The price of the yuan is represented by the red line in this Jeanne and Son’s ( 2023 ) chart, which shows the dollar’s value.

You can see that when Trump put tariffs on many Chinese goods, the dollar got stronger ( in fact, it got stronger a little , before , the tariffs officially went into effect, because people knew the tariffs were about to go into effect ), and the yuan got weaker.

China’s tariffs were less impactful, partly because China buys relatively little from the US in the first place. According to Jeanne and Son,” the US’s tariffs implemented by the US account for about 22 % of the dollar’s appreciation and 65 % of the renminbi depreciation observed in 2018-19.”

How much of the tariffs ‘ effect is canceled out by this exchange rate movement?  , In theory, it’s possible , for it to cancel out 100 %! Everyone who is involved in the exchange rate exchange can say” OK, tariffs made Chinese goods more expensive in America, so we’ll just say that the actual price of Chinese goods is the same, so everyone in America can just keep buying exactly the same amount as before. Good job everyone, glad we got that sorted out”.

Remember that this is not a free market; instead, the Chinese government likely intentionally devalues the yuan to prevent losing market share in export markets.

In reality, exchange rates only cancel out , part , of the effect of tariffs. A number of factors prevent exchange rates from fully adapting to the new tax, including the fact that most trade imbalances would be eliminated if one billion percent tariffs were applied to everything. So it’s really anempirical , question as to how much exchange rates cancel out tariffs.

A theoretical model that Jeanne and Son use to arrive at a number range of 30 to 35 % is used. That’s a substantial decrease already, and I actually think the true number is likely to be higher, especially where China is concerned3. If all of the yuan’s movement against the dollar during this time were due to Trump’s tariffs, it would mean that , exchange rate adjustment canceled out around 75 %  , of the tariffs ‘ effect!

And this is n’t the only factor in broad tariffs ‘ efforts to lessen trade imbalances! There’s at least one more. Broad tariffs also , raise costs for American manufacturers, without increasing costs for Chinese manufacturers.

Take the automobile market for instance. Automobile manufacturers make a lot of steel and aluminum. Costs for American car manufacturers increase as steel and aluminum cost more. That makes them less competitive, both in the domestic market and abroad.

Steel and aluminum will be among the products that the US will impose broad tariffs on. Due to the tariffs, GM, Ford, and Tesla will have to raise the prices of their cars in order to avoid having to pay higher steel and aluminum prices.

But BYD and other Chinese car companies , wo n’t  , have higher costs, because the tariff only applies in America. Thus, Chinese automakers will have a clear advantage over American automakers. That will lower the cost of Chinese car imports and increase the cost of American car exports.

In fact, we have good evidence that this happens.  , Lake and Liu ( 2022 )  , study the effects of Bush-era tariffs on steel and aluminum, and found that they hurt steel-consuming industries like the auto industry:

In response to the local labor market’s dependence on steel both as an input and as a component of local production, President Bush imposed safeguard tariffs on steel in early 2002. [ W]e analyze the local labor market’s employment effects of these tariffs.

After Bush removed the tariffs, local steel employment did not significantly decline after the tariffs were removed, but local employment in the steel-consuming industries did for years. The tariffs also caused steel-intensive manufacturing facilities to leave the workforce, which suggests that plant-level fixed entry costs play a role in converting temporary shock into long-lasting outcomes.

The same effect will apply to trade balances as Lake and Liu are examining employment outcomes. Across-the-board tariffs make US-made cars and semiconductors and washing machines and refrigerators and farm equipment and robots more expensive, because they raise the cost of imported inputs like steel, aluminum, photoresist, batteries, and so on. But foreign-made products can still get cheap inputs, because they are n’t paying tariffs.

It will obviously reduce some of the impact of tariffs on trade balances by making American manufacturers pay more in price than their foreign competitors.

So between these two effects, we can expect Trump’s big “tariffs on everything” to have a disappointingly small effect on the US trade deficit — not , zero , effect, but less than Trump would like.

This is what happened in Trump’s first term, when the US trade deficit did n’t shrink at all4 , despite his tariffs:

Now, Trump’s tariffs did have  , some , effect in shifting US deficits away from China, as I’ll discuss in the next section. They were a total bust, however, in terms of reducing the US’ total trade deficit with the rest of the world. It’s not difficult to understand why that was the case when we consider intermediate goods and exchange rate appreciation.

Targeted tariffs can effectively lower particular US dependencies.

Far from it, I do n’t want to suggest that tariffs are ineffective. Effectively, limiting tariffs on particular imported goods can divert the demand away from those imports.

Suppose we put a 1000 % tariff on Chinese-made computers. In 2022, the US , bought$ 51 billion worth of computers from China , — about 9.4 % of our total imports from China.

Imagine that we inflated the cost of Chinese computers by ten times using tariffs. Americans would no longer purchase computers from China, choosing to purchase ones made in America, Mexico, Taiwan, and Vietnam.

In fact, Mexico, Taiwan, and Vietnam are currently our biggest foreign sources of computers besides China, and along with local American factories, they’re probably perfectly capable of ramping up production to meet our needs:

Now, at this point, you may say,” Well, but the Mexican-made computers and the Vietnamese-made computers will have a bunch of Chinese chips and screens in them, so we’ll still be importing stuff from China”.

And you’re absolutely right! There is no reliable way for America to determine how many Chinese components are present in the finished goods we import. Similarly, if we taxed imports of Chinese batteries, we would n’t currently be able to apply those tariffs to Chinese-made batteries contained in Mexican-made cars or Vietnamese-made phones.

But suppose we , improved our data , so that we , did , know which parts came from where. Then, using tariffs, we could completely eliminate Chinese manufacturers from our supply chains for chips, batteries, or anything else.

And broad tariffs significantly outperform targeted tariffs in terms of achieving the objective of securing particular supply chains. One reason is that targeted tariffs , do n’t have nearly as big an effect on exchange rates , as broad tariffs.

If you put a 1000 % tariff on Chinese computers, that only affects 9.4 % of the US demand for Chinese goods. That wo n’t significantly affect exchange rates. US demand for Chinese goods overall wo n’t fall much, but it will shift to other stuff — plastic, clothes, broadcasting equipment, machinery, or whatever.

The exchange rate will change significantly more, which will largely offset any significant impact on any particular imported good, while applying a tariff on all Chinese goods, including the plastics, clothing, broadcasting equipment, machinery, and everything else.

Additionally, targeted tariffs address the intermediate-goods issue that I previously covered. Yes, if you put a 1000 % tariff on Chinese batteries, that will hurt American EV manufacturers. However, this might be okay if you believe the battery supply chain is more strategic than the EV supply chain, perhaps because batteries also enter drones.

Targeted tariffs work like a scalpel, allowing you to cut out exactly the import types you do n’t want while keeping the less crucial items untouched. Targeted tariffs are very effective if your goal is to secure specific strategic supply chains, even though they wo n’t reduce trade deficits. Fortunately, Robert Lighthizer is probably thinking about this, as evidenced by this passage from his book,  ,” No Trade is Free“:

But this means that Trump’s 20 % tariff on all imports from all countries would actually , weaken , the effect of his 60 % tariffs on China! If we only tax Chinese imports, we can shift demand away from China to other countries. But if we tax imports from everywhere, the dollar will appreciate, which will cancel out some of the impact of the China tariffs.

Therefore, tariffs should n’t be applied to imports from other nations if what the US wants to achieve is to reduce its bilateral trade deficit with China. Trump’s 20 % across-the-board tariff idea would n’t reduce our trade deficit meaningfully, but it would make it harder to shift our supply chain out of China.

So how , do  , you reduce global trade imbalances?

Anyway, that’s all well and good. But suppose we really , do  , want to reduce the US trade deficit. How do we do that? And how do we do it without kneecapping our own manufacturers?

I’ll write a lot more about this, but the short answer is to reduce trade deficits,  , you need to depreciate the US dollar. Remember that Americans are encouraged to purchase more foreign-made goods while the price of a higher dollar forces them to compete for US exports? Well, if you’re going to reduce the trade deficit, you need to counteract that somehow.

Stephen Miran of Hudson Bay Capital has  , a good post , explaining that the real problem here is the US dollar’s status as the world’s reserve currency. Here, from X, is the upshot:

The truth is that the” strong dollar” is probably the root cause of America’s chronic, persistent trade deficits. A strong dollar or a strong manufacturing and export sector are the choices for US leaders. So far, we’ve always chosen the former. If Trump really wants to get rid of the US trade deficit, he’s going to have to dump this long-standing policy. But that’s a topic for another day.

Notes:

1 This attitude often goes by the name of “mercantilism”, though it’s a bit different from the original , early modern European version.

2 Yuan is actually a nickname for China’s currency, the renminbi or RMB.

3 Personally, I think Jeanne and Son’s approach to China is incorrect because it assumes that Chinese government policies share the same goals as American government policies.

In reality, Xi Jinping cares a LOT about establishing China’s position in global manufacturing markets, so he’ll likely devalue the Chinese currency in response to US tariffs. China has the power to manage its capital account if it so desires and frequently does.

4 This is true as a percent of GDP, as shown in the chart. In dollar terms, the trade deficit , actually got worse under Trump. In fact, these trade deficit numbers have some big problems — they do n’t measure , value-added trade, and some of the trade they do measure is basically , faked for tax avoidance purposes. No matter what method we use, the US trade deficit is still unaffected by Trump’s tariffs.

This , article , was first published on Noah Smith’s Noahpinion , Substack and is republished with kind permission. Become a Noahopinion , subscriber , here.