- delivered y-o-y revenue growth of 32 %, US PAT of US$ 5.04mil ,

- One company exited with five new deals into its investment portfolio.

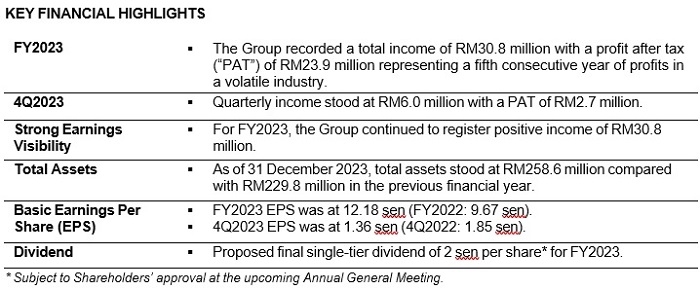

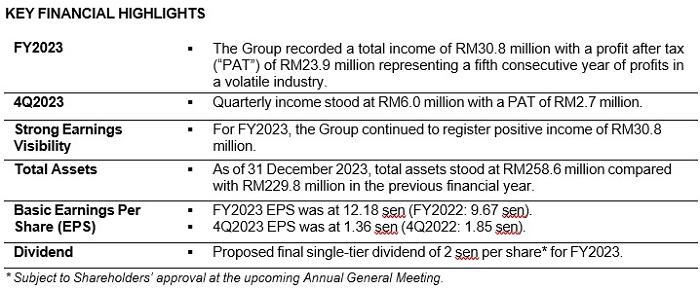

In a filing to Bursa Malaysia last week, OSK Ventures International Bhd, a private equity company, disclosed its fourth quarter ( 4Q2023 ) and full-year results for the financial year ended 31 December 2023. The company recorded income of US$ 6.5 million ( RM30.8 million ), a 32 % increase over US$ 4.93 million ( RM23.4 million ) in FY2023, with a profit after tax of RM23.9 million.

[RM1 = US$ 0 211]

The Group claimed that despite hard business conditions in both the public and private sectors, it delivered a strong financial performance that was characterized by regular development across its venture capital segments.

The endurance of our investment strategy and the persistence of our investment companies are a testament to our progress performance. We continue to expand our goods offerings, taking advantage of this interest and understanding of other assets like opportunity equity and venture debt, as prompted by the growing interest in modern companies in the personal markets, said Amelia Ong, OSKVI CEO.

The Group properly exited one investment firm for FY2023, welcoming five new transactions into its secret purchase collection in the business tech, fintech, and e-commerce sectors. It is developing a new account and has 37 businesses in its portfolio.

Amelia ( pic ) stated in a statement to Digital News Asia that Project Tapir and OSKVI had just announced a strategic partnership. By combining, OSKVI aims to help the smooth integration of Singapore fintechs into the Indonesian business landscape, creating a powerful expansion chance for both parties involved.

Amelia ( pic ) stated in a statement to Digital News Asia that Project Tapir and OSKVI had just announced a strategic partnership. By combining, OSKVI aims to help the smooth integration of Singapore fintechs into the Indonesian business landscape, creating a powerful expansion chance for both parties involved.

By promoting their respective hobbies in neighboring nations,” This program will benefit the desires of both the Singaporean and Malaysian governments,” said Amelia. She added that Malaysia is highlighted as an attractive location for international investments while Singapore fintechs are supported in expanding overseas.

Following shareholder approval at the approaching Annual General Meeting, OSKVI proposed a final single-tier income of 2 sen per discuss for FY2023.

The Group’s shareholders ‘ funds as of December 31st, 2023, had a total of RM258.6 million in total assets and a total market capitalization of RM106.1 million ( based on OSKVI’s most recently quoted share price at the end of the FY2023 ).