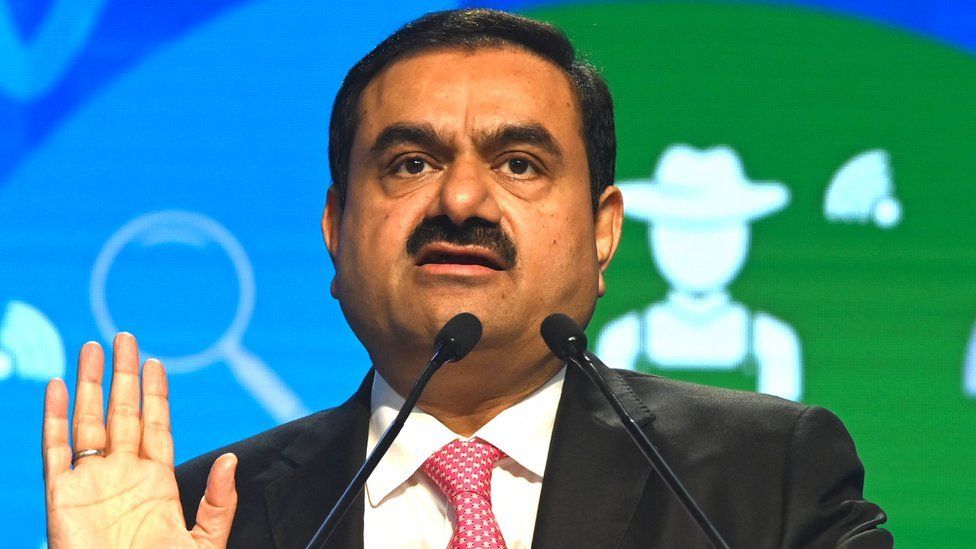

Native indian billionaire Gautam Adani saw more than $20bn (£16bn) wiped away from his fortune upon Friday, after traders fled his businesses for a second day prompted by scams claims made by the US investment firm.

The Adani Group has terminated the report as malicious, but the reaction has failed to come the uproar.

India’s main opposition celebration has demanded a study.

The business publicly listed companies have lost about $50bn in market value.

Shares in the firm’s flagship Adani Enterprises decreased by nearly 20% on Friday, while some of the group’s additional publicly listed companies tumbled even further, triggering automatic halts in trading in Mumbai .

Mr Adani has dropped from the third richest individual in the world to the seventh on Forbes’ rich listing , maintaining approximately net worth of more than $96bn, according to the publication.

The fallout arrives just days right after Hindenburg Research, a strong that specialises within “short-selling”, or gambling against a carrier’s share price in the expectation that it will fall, published a report accusing the Adani Group of engaging in decades of “brazen” share manipulation and information systems fraud.

Its survey came ahead of the planned share selling for Adani Businesses, which is now viewing little demand.

Mr Adani is really a self-made tycoon that has built a fortune along with investments in slots, airports, renewable energy and other industries. His wealth has soared previously three years, as the associated with shares in his firms skyrocketed.

His firm said it was considering legal action towards Hindenburg.

An ally associated with Indian Prime Ressortchef (umgangssprachlich) Narendra Modi, Mr Adani has lengthy faced claims through opposition politicians alleging that he has benefited from his political ties, which he refuses.

Many Native indian banks and state-owned insurance companies have possibly invested in or borrowed billions of dollars to companies linked to the Adani Group.

In interviews with Reuters, some of India’s top public sector banking institutions said they were not really worried about risks coming from their exposure to the particular firm.

However the wider stock market has been hit by the episode, helping to send India’s benchmark Nifty 50 stock index straight down more than 1% upon Friday.

-

-

22 hours ago

-

-

-

2 December 2022

-