All major exporting nations showed steep year-on-year declines in shipments during June and July led by South Korea and India, which both fell by 16% during July and June, respectively. China and Taiwan registered year-on-year declines of 9.2% and 10.4% in July. Singapore’s July exports, moreover, fell 19.3% year over year, while Vietnam’s fell by 15%.

China’s July pullback drew attention from major media because of the tense political atmosphere surrounding its trade, but the Chinese data are unremarkable. As the above chart shows, China’s export performance was in line with the rest of East Asia and South Asia. The most prominent “re-shoring” venues – countries that supposedly offer an alternative to China’s enormous export machines fell even farther than China itself.

The shrinkage in exports occurred across all major markets. China publishes detailed export data earlier than most countries, and these show a downturn in all major destinations.

According to US data for June, the latest month available, total American imports fell by 9.9% year over year. The fall in China’s exports to the US is exactly in line with the overall shrinkage of US exports.

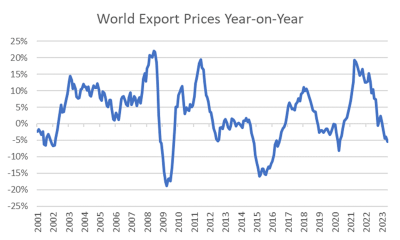

Part of the world export slump is due to lower prices. After the 2021-2022 burst of inflation, which peaked at a 19% year-on-year rise in export prices in May 2021, world export prices fell into deflation during the past three months. Overall, export prices showed a 5% decline as of May, according to the Netherlands Central Planning Bureau.

Consumer electronics, which boomed during the COVID lockdowns, were one of the most affected sectors. The semiconductor shortage of 2021-2022 has turned into a global glut, with substantial price discounting for computer chips.