Chinese electronic parts opportunity Viiyong has raised 2 billion yuan (US$295 million) in the Series B (second round) share concern intended to finance r and d, and mass manufacturing of multilayer ceramic capacitors (MLCCs) with regard to automotive applications with two new factories. Viiyong already offers the Chinese auto, mobile phone and other industries.

Chinese expense banks CITIC Investments and GF Securities investment companies SDIC Venture Capital and Technologies Financial Group were reported to have backed the underwriting.

Viiyong’s founder and chairman Chen Weirong has been working on MLCCs for more than two decades. Viiyong, originally called Guangdong Viiyong Electronic Technology, was founded in 2017. Chen seeks to make it one of the world’s top suppliers associated with MLCCs.

Virtually the whole MLCC industry is focusing on the auto market, which is emerging as the largest demand car owner. In May, TDK announced plans to build a brand new factory dedicated to automotive MLCCs in Japan.

Last December, Taiyo Yuden announced plans to develop one in Cina. Murata is building new MLCC industrial facilities in Japan and Thailand. Samsung Electro-Mechanics opened a new factory in China a year ago.

It is a packed and competitive marketplace, but China is promoting its own companies to facilitate its changeover from a low-wage set up economy to a highly-automated advanced industrial economic climate.

As existing, Murata and the various other top-ranked companies prospect in terms of materials and manufacturing technologies, where miniaturization and other improvements in quality rely. These technologies are usually proprietary.

But the smaller companies have never disappeared and Chinese companies are growing – an impressive feat considering the technical hurdles. Chen and Viiyong appear to have a reasonable chance of catching up with the particular Taiwanese.

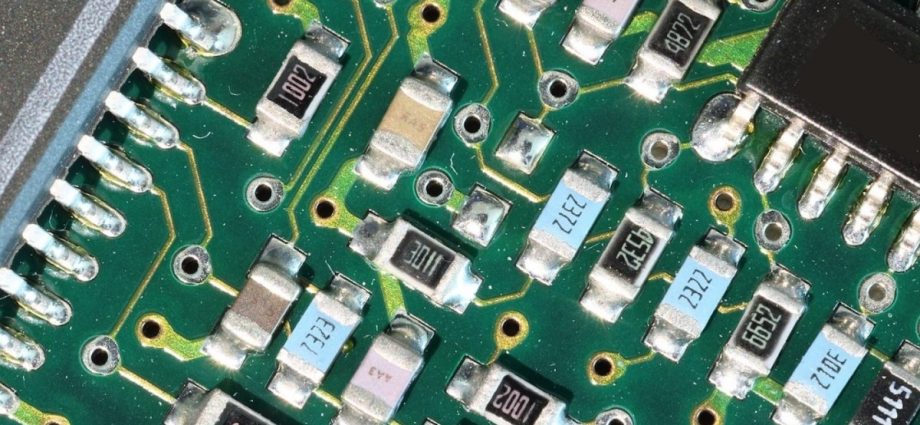

As explained by market leader Murata of Japan, “A capacitor is an digital component that shops and releases electricity in a circuit. The capacitor is an essential part of electronic apparatus and is thus nearly invariably used in an electric circuit. ”

“The structure of the very basic type of capacitor for storing electricity consists of a dielectric placed between two electrodes. A multilayer ceramic capacitor consists of several layers of this framework to enable storage of a greater charge. ”

A few MLCCs have more compared to 500 layers.

MLCCs are used within smartphones and other electronics, automotive, industrial and military electronics, as well as other electronic products. Several trillion of them are manufactured each year. Up to 1, 100 are utilized in a high-end mobile phones.

Murata proceeds: “The key to creating a high-performance, multifunctional, and user-friendly 5G-enabled smartphone of the correct size will depend on the particular miniaturization of MLCCs. ” Murata’s and the world’s smallest MLCCs are smaller than the usual grain of fine sand (0. 4 by 0. 2 by 0. 2 mm).

Within automotive electronics, however, components must work reliably for a long time in a harsh atmosphere characterized by high temperature ranges, high humidity and high voltage. But miniaturization counts here, too.

According to analysis organization MarketsandMarkets:

The boosting deployment of electronic devices in automobiles, such as engines, powertrains plus infotainment systems, is usually accelerating the demand for multilayer ceramic capacitors. Constant improvements in the automotive industry demand component miniaturization, increase in capacitance and improvements in safety features. Furthermore, self-driving vehicles, hybrid electric vehicles (HEVs), plug-in hybrid electrical vehicles (PHEVs), and advanced driver assistance systems (ADAS) used in cars inherently require MLCCs… As vehicles transition from inner combustion engines (ICEs) to battery electric vehicles (BEVs), the amount of MLCCs employed boosts, frequently by greater than five times. BEVs are projected to make use of more than ~10, 500 MLCCs.

This, plus China’s position as the world’s largest producer associated with electric vehicles, explains Viiyong’s focus on the particular auto industry.

Data from market research organizations and the companies themselves indicate the top makers associated with MLCCs – Murata, Taiyo Yuden plus TDK of Japan, Samsung Electro-Mechanics of South Korea, plus Yageo and Walsin of Taiwan – control at least 85% of the market.

Estimates vary yet Murata appears to convey more than 30%, Samsung Electro-Mechanics more than twenty percent, Taiyo Yuden and Yageo around 10% each, Walsin almost 10% and TDK close to 5%.

The rest will be shared by greater than a dozen companies, which includes Kyocera of Japan and its American part AVX; Johanson Dielectrics of the United States; Samwha Capacitor, Amotech and Avatec of South Korea; and Chinese companies Eyang, Fenghua, Fujian Torch and Viiyong.

Eyang, Fenghua and Fujian Torch serve China’s smart phone, telecom equipment, electronic devices, automotive, medical electronic devices, factory automation, aerospace and defense industries. For its connection with the Chinese military, Fujian Torch has been put on the US government’s organizations list.

Follow this author on Twitter: @ScottFo83517667