Insuring US Treasury notes against default now costs more than insuring Mexican debt, as House Republicans threaten to push the US into technical default rather than give the Biden administration more room for deficit spending.

If April tax receipts turn out to have been weaker than expected, default could hit as early as mid-June. US Treasury Secretary Janet Yellen has warned of “catastrophe.”

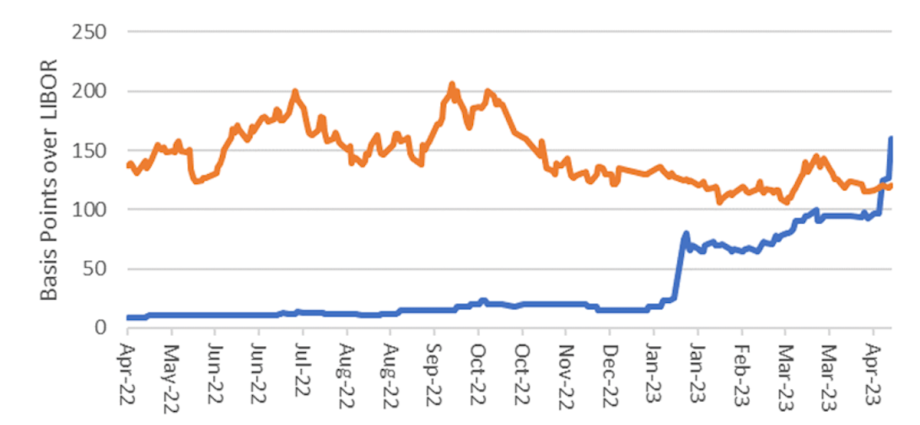

The cost of five-year credit default swaps (insurance against US default) now exceeds the cost of similar protection against Mexican foreign debt – something that hasn’t happened previously in financial history.

Barring an actual default six to eight weeks from now, the jump in US credit default swap spreads is a technical bad in a small and illiquid market. Gold remains stuck in a trading range around $2,000 an ounce. If the world really thought America’s credit had turned bad, gold would break out to higher levels.

The wrangle over Treasury default, though, adds to uncertainty about the US economy and financial markets. Those markets took a body blow in mid-March when depositors fled regional banks, forcing the Fed and Treasury to provide emergency liquidity and guarantee bank deposits.

Tightening financial conditions are pushing the US into recession.

UPS stock plunged by nearly 10% on April 25 after the delivery company reported much lower-than-expected volume for the first quarter. Revenue fell to US$22.9 billion compared with $24.4 billion in the first quarter of 2022. The company blamed lower retail sales and falling consumer demand.

The Conference Board meanwhile reported on April 25 that consumer expectations fell to the lowest level in more than a year.

US commercial banks tightened lending standards and reduced new lending after the March run on regional banks. First Republic Bank, one of the banks that suffered March deposit runs, lost another 10% on April 25 after its first-quarter results revealed a bigger deposit loss than anticipated.

Survey data from regional Federal Reserve banks meanwhile showed that the US is on the edge of recession. The Philadelphia Fed’s index of nonmanufacturing business activity (shown in green on the chart below) fell to its lowest level since the 2020 Covid lockdowns.

The Philly Fed index is widely considered one of the best leading indicators of general business activity.

$6 trillion of consumer stimulus in response to Covid kept the US economy growing for the past two years, but retail sales have been falling for two years after deducting inflation.

Follow David P Goldman on Twitter at @davidpgoldman