As the US ratchets up sanctions, China throws more money at its semiconductor industry. The sanctions have slowed but not stopped the advance of Chinese semiconductor manufacturing while sales of unsanctioned equipment to China have gone through the roof.

China is raising another US$27 billion from government institutions, state-owned enterprises and the private sector for its National Integrated Circuit Industry Investment Fund, according to recent reports. Also called the Big Fund, it currently has about $45 billion in capital, the reports said.

This will likely bring total financial support for the Chinese semiconductor industry in the five years to 2027 to roughly three times the $52.7 billion in government subsidies to be allocated for US-based chip production under the CHIPS Act.

China’s semiconductor industrial policy appears to be working reasonably well. Despite reports of financial mismanagement and setbacks in production schedules, China’s leading integrated circuit (IC) foundry, SMIC, is now making 7nm chips and is developing 5nm capability, according to reports.

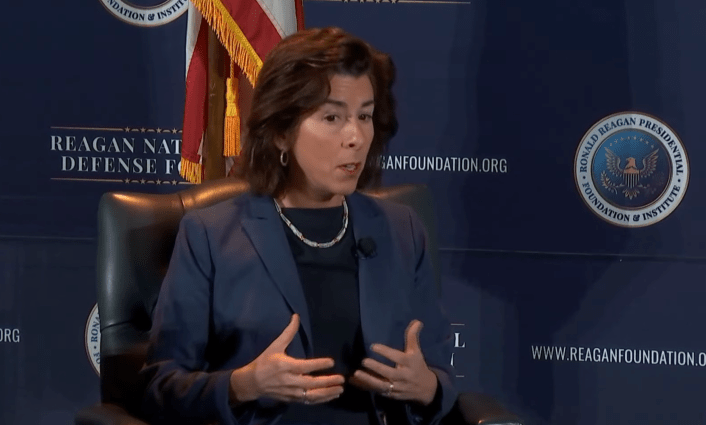

US Commerce Secretary Gina Raimondo and her staff initially designed their sanctions to stop China at 10nm, making the production of advanced smartphone chips impossible. But information publicly available from lithography system makers ASML and Nikon made clear that would not be the case.

The US has thus recently expanded its lithography sanctions from the extreme ultra-violet (EUV) systems made only by ASML of the Netherlands to the most sophisticated deep ultra-violet (DUV) systems made by ASML and Nikon of Japan.

These expanded sanctions took effect in the second half of 2023, too late to stop the launch of Huawei’s Mate 60 Pro 5G smartphones with 7nm processors made by SMIC.

Then, in February this year, the Commerce Department ordered Entegris and other US companies to stop shipping sophisticated components and materials to the factory where SMIC fabricates those processors.

Entegris produces gas and liquid filtration and purification systems, fluid chemical and component handling systems, specialty gases and other advanced materials. Finding alternatives will take time and cost money but it can likely be done.

Now the US is reported to be pressuring the Netherlands and Japan to force ASML and Nikon to stop servicing DUV lithography systems sold to China before the sanctions were tightened. The US is also said to be asking Japan to stop selling photoresists and other chemicals used in semiconductor production to China.

The Dutch and Japanese may or may not oblige. On March 8, Japan’s Minister of Economy, Trade and Industry Ken Saito told Nikkei Asia, “We have no plans to take new measures at this time.” The Dutch response has also been noncommittal, according to preliminary reports.

The US Commerce Department is also apparently considering adding Chinese DRAM maker CXMT and five other Chinese tech companies to its Entity List, which would cut them off from US technology. With the US in a heated election cycle where China is portrayed by all sides as the enemy, more such announcements are expected sooner rather than later.

While media reports have focused on the Netherlands and Japan, the new restrictions would of course also affect US suppliers of semiconductor production equipment and materials.

Last week, it was widely reported that Applied Materials and Lam Research supplied SMIC with equipment used to make Huawei’s 7nm processor, which should have been common knowledge months ago.

In fact, most leading makers of semiconductor equipment have become heavily dependent on the Chinese market. In the fourth quarter of 2023, the share of their sales going to customers in China was as follows:

US:

Applied Materials: 44%

Lam Research: 40%

KLA: 41%

Netherlands:

ASML: 39%

Japan:

Tokyo Electron: 47%

Screen Holdings: 41%

Disco: 38%

China was the largest regional market for every one of these companies.

Applied Materials, the world’s largest and most diversified maker of SPE, told investors “We believe equipment demand in China is likely to remain healthy for an extended period because China’s domestic manufacturing capacity remains significantly below its share of worldwide semiconductor demand. In addition, while nameplate fab capacity is growing in China, effective capacity is likely to remain below industry averages for some time until product and process yields gradually improve.”

Lam Research, one of the three leading makers of etch equipment (along with Applied Materials and Tokyo Electron), said that growth in sales to the foundry and logic segment was “led by leading-edge investments offset in part by mature node declines outside of China.” They also said that Chinese investment, which is almost all mature node, is stable at a high level.

KLA, the leading maker of semiconductor inspection equipment, reported “strong product success in legacy [mature node] foundry/logic optical inspection” – i.e., in China.

ASML, the dominant supplier of lithography equipment, reported 60% growth in shipments of DUV systems, compared with 30% growth in the more advanced EUV systems which could not be shipped to China.

Management told investors that, “While the export control regulations had an impact on our business, we continue to see strong demand for mid-critical and mature nodes in China.”

Tokyo Electron, the largest and most diversified SPE maker in Japan, raised its sales and profit guidance due to increased investment by Chinese semiconductor makers, one of its senior managers stating, “We expect strong demand from China to continue or grow stronger still.”

Industry sources estimate that China now makes about 20% of the semiconductor devices it consumes – up from 10% recently. With at least 20 new production lines under construction in China, the figure seems likely to rise at least to 30% and more likely to 50% by the end of the decade.

This is the “oversupply” that Raimondo and others in the US and Europe have said they are worried about: Chinese companies making semiconductors for sale in China.

Screen Holdings, the world’s top producer of cleaning equipment, said that “investment in China for mature nodes remains active.” This quarter, management expects more than half of the company’s semiconductor equipment sales to be made in China.

Disco, the dominant producer of wafer dicing, grinding and polishing equipment, sounded the only cautionary note in the group, with its director of investor relations telling the media that Chinese demand for some wafer fabrication processes might be leveling off. Nevertheless, Disco plans to increase production capacity by 40%.

Gregory Allen, director of the CSIS Wadhwani Center for AI and Advanced Technologies and former director of strategy and policy at the US Department of Defense’s Joint Artificial Intelligence Center, told Bloomberg:

“Nothing that Japan sells today is going to dissuade China from its goal of producing all of these machines domestically as soon as possible. However, if Japan exports machines, components and critical knowledge, it can significantly speed up China’s advanced node production in the short term and its indigenization goals in the medium and long term.”

The same is obviously true for the US and Europe. Justifiably concerned that sanctions will be tightened even more, China is loading up on the foreign equipment available now while doing everything possible to develop its own.

In the meantime, analysts on Wall Street and elsewhere have started to recommend Chinese makers of semiconductor production equipment including Advanced Micro-Fabrication Equipment Inc (AMEC) and Naura Technology, as long-term investments.

By shifting the focus of procurement from cost of ownership to security of supply, US sanctions have created an investment opportunity that otherwise would not be nearly as attractive.

The stock prices of those two companies, which compete with Applied Materials, Lam Research and Tokyo Electron, have risen by about a third since the beginning of February.

Follow this writer on X: @ScottFo83517667