So you think you’re lonely

Well my friend, I’m lonely too

I wanna get back to my city

– Journey

To grow the pie, or to recut the pie, that is the question. Whether ’tis nobler for China to suffer the slings and arrows of outrageous infrastructure construction, or to take arms against a sea of debt by redistribution and establishing a social safety net: to rebalance, to consume.

The consensus in the West is that rebalancing and redistribution is not only necessary but long overdue. It has been consensus for so long that it’s hard to remember if there was ever another view.

Western analysts have been harping about China’s unbalanced economy since before the 2007-08 Global Financial Crisis. The fingernail-on-chalkboard screech has just gotten louder over time.

To be fair, rebalancing will eventually happen and we are getting closer with every passing day. That’s how time and eventualities work – “not-to-be” catches up with Hamlet no matter what he chooses. However, the fact that Western consensus has been calling for rebalancing for at least 15 years should give us pause.

When the Global Financial Crisis threatened to take down China’s economy, the country was only 48% urbanized (versus 65% today). Did economists truly believe that China would have been better off building out a social safety net?

Or was it some sort of contrarian consensus that drew Western analysts like moths to flames – anything, as long as it’s contrary to whatever it is the Chinese Communist Party is doing. Even better if it’s wrapped in sanctimony and virtue signaling.

Who doesn’t favor giving households a greater share of economic output? Who doesn’t want better healthcare for the hardworking masses? Why are resources being diverted to corrupt and inefficient state-owned construction companies?

The proof, however, should be in the pudding. Over the past 15 years, China’s urban population increased by 17 percentage points, up to 238 million people. Household consumption increased over 204%, significantly outperforming all major economies (surpassed only by Uzbekistan’s 218%).

Over this period, household consumption’s share of GDP barely budged from a reported 35% in 2008 to an estimated 39% in 2023.

Of course, it should have been obvious that urbanization would achieve much more bang for the buck given just how rural China still was. Urban disposable income was over three times rural levels in 2008. No amount of redistribution could give households more spending power than turning rural workers into urban ones.

So where do we stand now? Simplistically, China’s 65% urbanization is where Japan, the EU and South Korea were in 1962, 1973 and 1985, respectively. Given that 92% of Japanese, 81% of South Koreans and 75% of the EU currently live in cities, China could have another 10-25 years of urbanization to go.

It is hard to know where urbanization finally peaks in China. We suspect it will be closer to the EU’s 75% than to Japan’s 92% if for no other reason than to maintain rural labor for food security. We can, however, be reasonably confident that we can expect another decade of investment-driven growth.

To be sure, the increase in debt over the last 15 years is somewhat worrisome. The powers-that-be evidently did not like the property sector taking on so much leverage, hence putting their foot down three years ago.

To the chagrin of the contrarian consensus, China diverted capital to manufacturing and infrastructure rather than welfare programs for the virtuous and long-suffering households.

The contrarian consensus often points out that China’s debt-to-GDP ratio is at developed economy levels, far above its emerging market peers. This is confused thinking.

Developing economies should have high debt – to build infrastructure, housing and industrial assets as quickly as possible – while developed economies should have low debt as years of cash flows pay off interest and principals. Young people should have mortgages while retirees should have nest eggs.

In practice, this is NOT what has happened as rich countries borrowed to fund welfare programs and poor countries could not access credit. As such, China is actually the only economy doing debt correctly.

Indeed, China’s reported GDP would be 25-40% higher if calculated using strict United Nations System of National Accounts (UNSNA) standards (see here). Restructuring property sector and local government debt should be more manageable with a debt-to-GDP ratio of 220-250% rather than the 308% reported by the Bureau of International Settlements (BIS).

As such, will likely continue to focus on investment and urbanization because the economy is not as unbalanced as the contrarian consensus believes. There is still more bang for the buck to be had by investing in urbanization and its attendant manufacturing industries. Doing just that has helped China around the inequality peak in 2010.

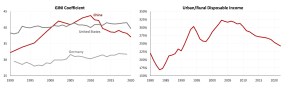

Inequality surged in the reform era as commercial opportunities exploded in urban China. The urban/rural income ratio was on a fast upward trend, with brief respites in the 1980s due to market reforms in agriculture and in the late 199’s due to the 1997-98 Asian financial crisis and mass layoffs from state-owned companies.

As urbanization passed the 50% mark, however, China suppressed continued population growth in first-tier cities, pushing growth into second-and third-tier cities, thus evening out economic discrepancies between provinces.

Since 2010, China’s Gini coefficient has been steadily falling. At around the same time, as the countryside emptied out, farm consolidation and mechanization resulted in rural incomes outgrowing urban incomes. The urban/rural disposable income ratio fell from 324% in 2003 to 243% in 2022.

Between 2003 and 2022, the number of Chinese cities with over two million people more than doubled, surging from 32 to 72, while total prefecture-level cities barely changed, increasing from 284 to 297.

Through sequenced hukou reform, China has been growing “medium-sized” cities – those with populations between 2 and 6 million – while keeping a lid on megacities with populations over 15 million. Hukous, granted by cities, are permits that allow urban residents to access social services like education, healthcare and retirement benefits.

In August, the Ministry of Public Security (MPS) accelerated hukou reform for all but 24 of China’s largest cities. The ministry ordered local governments to abolish hukou restrictions for cities with fewer than 3 million people and relax restrictions for cities with 3-5 million.

China is clearly trying to avoid population overconcentration. The top ten cities in China account for 11% of the population while the top 20 account for 17%. This compares favorably to the US at 26% and 38%, respectively and very favorably with Japan and Korea where 45-50% of the population is concentrated in one or two cities.

Hukou reform, or lack thereof, is a favorite hobbyhorse of the contrarian consensus, providing nearly limitless opportunity for virtue signaling and sanctimony. Of course, the costs of unregulated population concentration are rarely addressed. The hukou system has helped China avoid the slums and shanty towns that plague cities across the Global South.

Population concentration in the US has contributed to political estrangement between coastal elites and the forgotten masses in “flyover” country. Economists have blamed even more intense population concentration in Japan and South Korea for falling birthrates and diminishing economic vitality.

Keeping China’s population spread out by growing small and medium-sized cities complements the “rural rejuvenation” policy that aims to prevent decay and poverty in the countryside. If rural residents move to cities closer to home, links to the rural economy can be better maintained.

A dense web of high-speed rail (HSR) is key to this urbanization plan. China currently has 42,000 kilometers of HSR accessing all first-, second-and third-tier cities in a 4×4 grid.

The plan is to increase HSR density to an 8×8 grid, 70,000 kilometers in length, extending coverage to fourth- and fifth-tier cities by 2035. This has drawn the ire of the contrarian consensus which refuses to fathom how this can possibly make economic sense as China already has two-thirds of the world’s HSR.

For inexplicable reasons, very smart people suddenly become innumerate when analyzing China. On a per capita basis, Finland, Spain, Sweden, Greece and France have multiple times the HSR length of China. On a land area basis, China’s HSR network covers a fraction of country compared to systems in South Korea, Germany and Spain.

While most of China’s HSR lines are not profitable – hardly unique among mass transit systems – the World Bank calculated in 2017, including externalities, that China’s system achieved a return of 8%.

According to analyst Glenn Luk, network effects of further HSR expansion should result in increasing rather than diminishing returns. As HSR lines were added, the World Bank reported that:

Many opportunities have developed to connect cities through services over a combination of lines, with, for example, direct trains between Beijing and Xi’an via Zhengzhou. Networking is an important feature of Chinese HSR. North–south vertical lines and east–west horizontal lines provide the basic network skeleton, supplemented with regional and intercity railway lines.

Each HSR line thus creates flows for other lines. For example, 24% of the passengers traveling on the Beijing–Shanghai line in 2016 were traveling to and from stations that were not on the line itself but on connecting lines.

Another example is the Zhengzhou–Xi’an line, which until 2012 was an isolated line, serving only passengers between Zhengzhou and Xi’an. After it was connected to the Beijing–Guangzhou HSR in 2013, passenger volume increased by 43% and passenger-km by 72%.

Distributed urbanization through HSR buildout is nothing less than a complete re-engineering of physical China, overturning millennia of political dogma. The mountains may be high, but they are now shot through with tunnels and the Emperor is a 350-kilometer-per-hour HSR ride away.

If this all goes sideways, it will be because China is again attempting something unrealistically ambitious – like the Great Leap Forward or the Cultural Revolution. Perhaps many parts of rural China cannot and should not be rejuvenated and abandonment is the best policy.

The same may apply to many provinces and cities. Maybe it would be more efficient if everyone crowded into 20 coastal cities and turned mountainous provinces like Guizhou into nature preserves.

At this level, it becomes philosophical. Economic arguments are pointless when China is undergoing social engineering at the level being attempted.

Left to develop organically, we would expect Beijing, Shanghai, Guangzhou and Shenzhen to have become even larger megalopolises, teaming with slums like Sao Paulo and/or sucking the vitality from the rest of the country into Bladerunner-like techno dystopias like Seoul (or lack thereof).

Some would say Beijing, Shanghai and Shenzhen are already there. Perhaps. But the direction is clearly to prevent this trend from developing any further. Over the past two decades, investment as a percentage of GDP has been far higher in inland provinces. Only one of the top ten fastest-growing provinces in the past decade (Fujian) has been coastal and none in the past two decades.

Much of the debt China has accumulated has been from local government infrastructure spending with the most impoverished provinces racking up the largest deficits. Tibet’s local government budget deficit was an astonishing 113% of its GDP in 2022 versus 9.7% for local governments as a whole.

Sparsely populated western provinces like Qinghai, Gansu and Xinjiang all racked up large deficits as they invested in infrastructure projects like Tibet’s Ya’an–Nyingchi HSR line currently under construction.

China has chosen to leave no province behind in its infrastructure buildout. While many of these projects do not make commercial sense (e.g. Tibet’s population is only 3.5 million people), the Communist Party evidently believes that investment in lagging provinces is important for political integrity and national unity.

While these investments have dubious financial returns, they almost certainly kept many residents from migrating to coastal provinces. Ultimately, this is a massive transfer payment from rich coastal provinces to the poor interior. The return is political cohesion and, to the horror of the contrarian consensus, social justice.

When Hamlet questioned his existential drudgery in Act III, he was a sorry young man beset by the weight of the world. Clinically depressed, the young prince could only imagine a future of suffering or suicide.

However, according to literary scholar Harold Bloom, at every moment, Hamlet was overhearing his own words and reconceiving himself. By Act V, our sulking nepo baby’s metamorphosis culminated in incandescent transcendence (no spoilers).

Similarly, “To grow the pie, or to recut the pie” is such an Act III question. Only the clinically narrow-minded would obsess over it. Like Hamlet, China has been reconceiving itself as it “overhears” its own reforms. And we are all audience to the metamorphosis which still has multiple acts to go.

‘Han Feizi‘ is a Beijing-based financial industry veteran.