Gold opened in London January 31 at an all-time history of$ 2.845 an ounce. Platinum is a form of protection from political and financial disasters. More specifically, it has become a special insurance coverage against systemic risk, breaking apart from other resources it used to record – foreign assets and other metals, for instance, as well as inflation-linked Treasuries.

That may worry politicians in Washington.

Trump declared during his election plan,” I may end the war in Ukraine, I will stop the panic in the Middle East, and I will stop World War III from occurring,” adding,” You have no idea how near we are.” Trump vowed to put an end to the Ukraine War within a time of taking office, but peace is still not in view. The West didn’t accept Russia’s primary need for Ukrainian neutrality. Nevertheless, Russia continues to crush out regular gains.

What will the US would if Russia wins the military in a significant way over Ukraine? No single knows, and the price of end-of-the-world healthcare continues to rise.

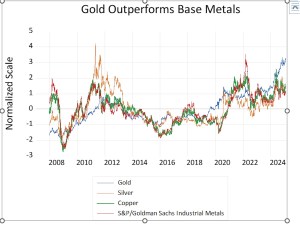

Gold’s document work is distinctive in three ways.

First, gold stopped trading with other metals, including gold, copper and various professional metal. That partnership lasted from 2007 until the close of 2023. Gold has increased significantly over the past year, while another metal have not.

Next – as we have noted usually – gold traded in combination with the supply of inflation-protected US Treasuries, or TIPS. Both are types of protection against sudden inflation and serious dollar depreciation. However, after the US and its allies seize$ 300 billion of Russian foreign exchange reserves in March 2022, gold became decoupled from TIPS provides. A plan of insurance that the insurer may seize at will is less appealing than gold in a central bank vault.

Third: Different currencies used to indicate a wall against the dollar. The Japanese renminbi, an alternative to the penny, was almost tracked by the silver price. However, in 2022, this marriage ended. For one thing, Japan’s government debt is now 250 % of GDP ( twice the US figure of 120 % ), and the central bank owns more than half of that debt. Japan’s inflation has crept up, eroding consumer purchasing power and weakening the region’s political organizations. The japanese is no longer a haven for foreign currency investors. The Euro, which has the bag of fragile and depressed markets like France and Italy, is not.

The United States must sell more than a trillion dollars of assets to the rest of the world annually with a trade deficit of$ 1.2 trillion and a net international investment position of negative$ 25 trillion. Five years ago, foreign investors stopped purchasing US bill, and since then, the country has been selling tech companies to foreigners to help it balance its trade deficit. A stock market selloff may have negative effects on the US dollar.

During his confirmation hearings, Treasury Secretary Scott Bessent pointed out that the US federal deficit, which ranges between 6 % and 7 %, is unprecedented for a time without war or recession. As I wrote December 20 in Asia Times, the gap may be Trump’s rival. American businesses now have the ability to cover the majority of the US government’s gap since 2020 as a result of foreign central banks ‘ reductions in their investments of US Treasuries. However, to get interest-sensitive personal investors, it will require either lower interest rates to help banks purchases of Treasuries, which are expansionary, or higher yields on government loan.

Both the global financial picture and the geopolitical balance are becoming more dangerous. Gold’s cost run provides a disturbing measure of risk perceptions, and it has evolved into a unique hedge against both types of risk.