A Singaporean court has begun issuing sentences in a shocking case in which 10 Chinese nationals were accused of laundering money earned abroad for$ 2.2 billion ( £1.8 billion ).

Earlier this month, Su Wenqiang and Su Haijin, became the first to remain jailed in the case. Su Haijin, authorities said, jumped off the next- ground rooftop of a home trying to flee arrest. Both men did spend a little over a time in prison before being deported and prohibited from moving back to Singapore. Eight others are still awaiting the judge’s decision.

The event, which is the largest of its kind in Singapore, continues to raise unavoidable questions as it draws to a nearby. The income that paid for their comfortable lives in the country, prosecutors said, came from improper resources elsewhere, for as scams and online gaming.

How did these men, some of whom had several documents from Cambodia, Vanuatu, Cyprus and Dominica, life and banks in Singapore for ages without drawing attention? It has sparked a review of policies, with banks tightening rules, especially around clients who hold multiple passports.

Most important, the case has spotlighted the country’s struggle with welcoming the super wealthy, without also becoming a destination for ill- gotten gains.

Show me the money

In the 1990s, Singapore began to woo banks and wealth managers, and is frequently referred to as the Switzerland of Asia. After the economic reforms in China and India had begun to pay off, wealth increased as well in a once-stabilized Indonesia in the 2000s. Soon, Singapore became a haven for foreign businesses, with investor- friendly laws, tax exemptions and other incentives.

They include those of Google co- founder Sergey Brin, British billionaire James Dyson and Chinese- Singaporean Shu Ping, boss of the world’s biggest chain of hotpot restaurants, Haidilao.

Some of the defendants in the money-laundering case, according to authorities, may have been connected to family offices that received tax incentives.

There is an inherent contradiction between a place like Singapore, which prides itself on having low taxes and having good governance while also offering advantages like banking secrecy, according to Chong Ja- Ian, a non-resident scholar at Carnegie China.

” There is a greater risk of becoming a banker for people who made their money through nefarious or illegal means.”

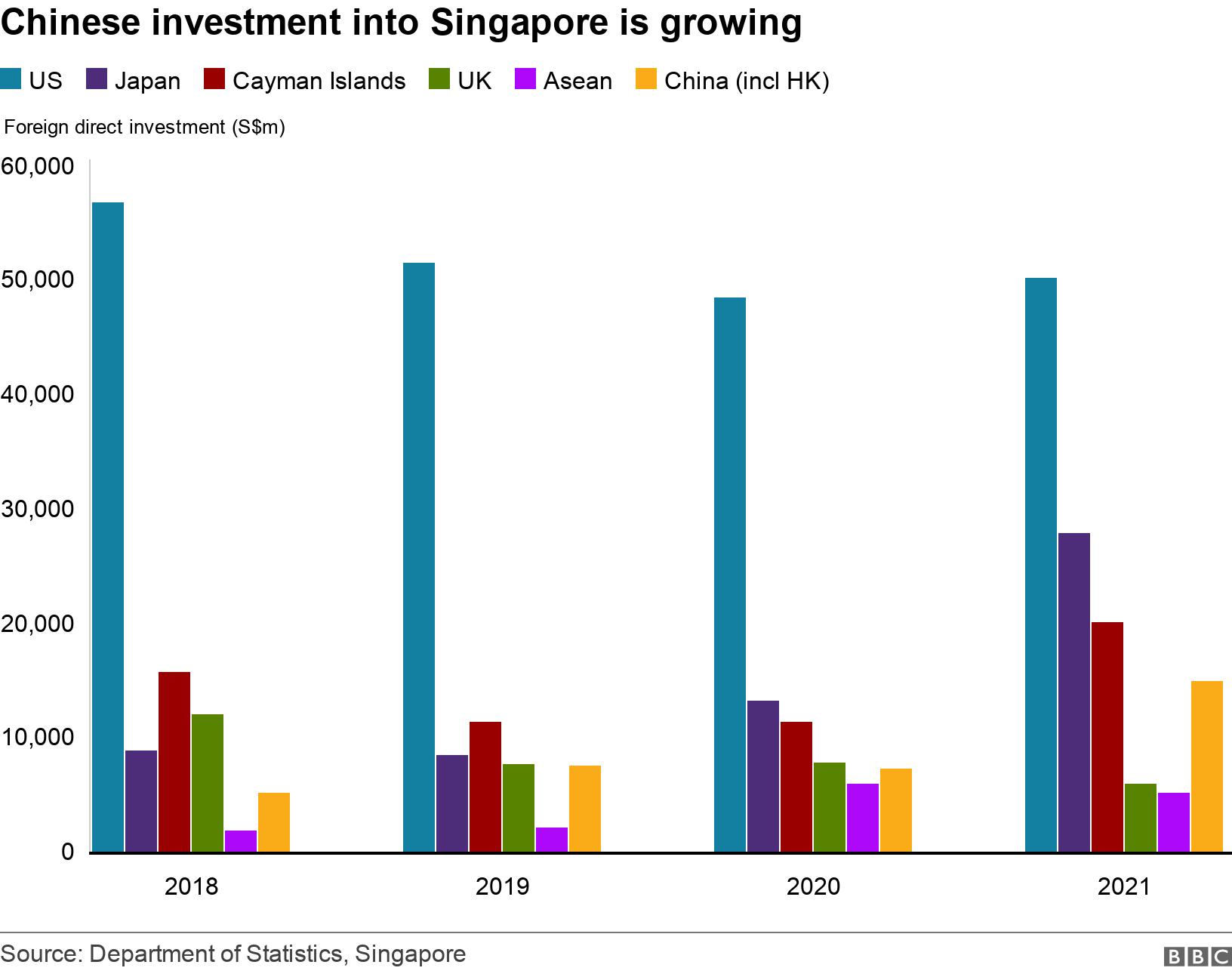

For rich Chinese, Singapore is a top choice because of its reputed governance and stability, as well as its cultural links to China. Additionally, more Chinese currency has recently poured into Singapore.

One of the ten suspects in this case has been wanted in China since 2017 because of his alleged involvement in online illegal gambling. According to the prosecution, he allegedly settled in Singapore because he “wanted a safe place to hide from the Chinese authorities.”

Hiding in plain sight

The nation is active members of the Financial Action Task Force, a global organization that investigates money laundering and financing for terrorism networks. It has strict laws aimed at white collar crimes. Over the years, banks have invested heavily to strengthen compliance, to screen prospective customers and to urge regulators to report suspicious transactions. But none of this is foolproof.

For one, it is difficult for regulators to spot suspicious cases in a sea of high- value transactions.

” It’s not just one needle in a haystack, but one needle in several haystacks”, Singapore’s second minister for home affairs, Josephine Teo, told parliament in October last year.

Singapore’s buoyant property market is a popular means to” clean” dirty money, some experts pointed out. And there are the casinos, nightclubs and luxury stores.

” Massive amounts of money pass through Singapore’s banking system every day. Criminals can use this feature to conceal their money-laundering activities among legitimate ones, according to accounting professor Kelvin Law of Nanyang Technological University in Singapore.

Singapore also does not have a declaration requirement for cash transfers, but it does if the amount is greater than S$ 20 000, and it does not. And that is an advantage, says Christopher Leahy, the founder of Singapore- based investigative research and risk advisory firm Blackpeak.

Singapore is a great place to hide a lot of money, and that’s how you go about doing that. There is no point putting it in the Cayman Islands or the British Virgin Islands, where there is nothing]to spend money on ]”, he said.

” We ca n’t close the window, because if we did that, then legitimate funds will also not be able to come. Additionally, legitimate business cannot be conducted or becomes challenging to do. So we have to be sensible”, K Shanmugam said.

” When you are successful, you are a major financial centre, a lot of money comes in, some’ flies ‘ will also come in”, he added, referring to an oft- repeated quote of the late Chinese leader, Deng Xiaoping.

According to Dr. Chong of Carnegie China, Singapore must decide how far it will accept “money with varying shades of grey.”

He claims that more regulation will help, but that transparency poses a greater challenge because it “violates the very model of discretion that many wealth management hubs thrive.”

According to some analysts, this might be the price Singapore will have to pay to maintain its position as a financial hub.

” The vast majority of the funds are legitimate, after all”, Mr Leahy says. However, there is an inevitable cost to operating a major financial hub.

Related Topics

-

-

17 August 2023

-

-

-

20 July 2023

-