Haryana: India start-ups eye rural markets to drive next leg of growth

Getty Images

Getty ImagesThe small towns of Haryana state in India’s remote north-western are now in an unlikely position in the spotlight.

Farmers ‘ homes in towns close to the industrial area of Rohtak are suddenly in demand and can now double as movie set.

Alongside the mooing of cows, it is n’t unusual to hear a director shouting “lights, camera, action” here.

A fresh start-up, called STAGE, has spawned a budding movie industry in this countryside.

” Batta”, a high-octane drama about power and injustice, is just the latest in half-a-dozen shows under production in the area, Vinay Singhal, founder of STAGE, told the BBC on the film’s models.

” Before we came in, there were just a few odd Haryanvi movies made in India’s story.” Since 2019, we’ve made more than 200″, says Mr Singhal.

STAGE makes information for generally under-served municipal audiences, keeping hyper-local tastes, philosophical quirks and the remote social grammar in mind.

There are 19 500 distinct languages in India, and STAGE has identified 18 that are spoken by a large enough population to justify their own independent movie industry.

Information is already available in Haryanvi and Rajasthani, respectively. It has three million paying clients and is planning to develop and include different languages like Maithili and Konkani, which are spoken in north-east and coastal-west India, both.

“We’re also on the verge of closing a funding round from an American venture capitalist firm to expand into these territories,” says Mr Singhal, who appeared along with his co-founders on the Indian version of Shark Tank, a business reality show, a year ago.

Saraskanth Lakh

Saraskanth LakhOne of the growing number of Indian start-ups is STAGE, which is betting heavily on the potential for growth in rural areas. People like DeHaat and Agrostar are among the people.

While a large of India’s 1.4 billion people still live in its 650, 000 villages, they’ve almost been a business for its flourishing software start-ups so much.

Asia’s third-largest economy has been a hotbed for innovation, birthing several dozen unicorns- or tech companies valued at over$ 1bn- but they’ve all largely built for the” top 10 %” of urban Indians, according to Anand Daniel, partner at Accel Ventures, which has funded some of the country’s most successful ventures, from Flipkart to Swiggy and Urban Company.

While there have been significant exceptions like online market Meesho, or a few land systems people, the start-up growth has mostly bypassed India’s villages.

As more owners succeed in reaching remote customers and receiving funding for their ideas, that is now changing.

” Investors do n’t show you the door anymore”, says Mr Singhal.

” Five years ago, I did n’t get any money at all. I had to genesis the business”.

Through its pre-seed accelerator program, Accel itself announced it will invest up to$ 1 million in rural start-ups, cutting more checks to entrepreneurs looking to solve problems for the rural market.

Unicorn India Ventures, another regional VC account, says 50 % of their assets are now in start-ups based in level 2 and tier 3 places. Suzuki, the auto industry’s biggest player, announced a$ 40 million India fund in July of this year to fund rural-market startups.

Saraskanth Lakh

Saraskanth LakhSo what’s driving this move?

The untapped market opportunity is large, says Mr Daniel, and there’s a growing realisation among investors and founders that rural does n’t necessarily mean poor.

Two-thirds of India’s population live in the countryside and spend about$ 500bn annually. In reality, the top 20 % of this demographic spends more money than half of those that live in the cities, according to Accel’s individual quotes.

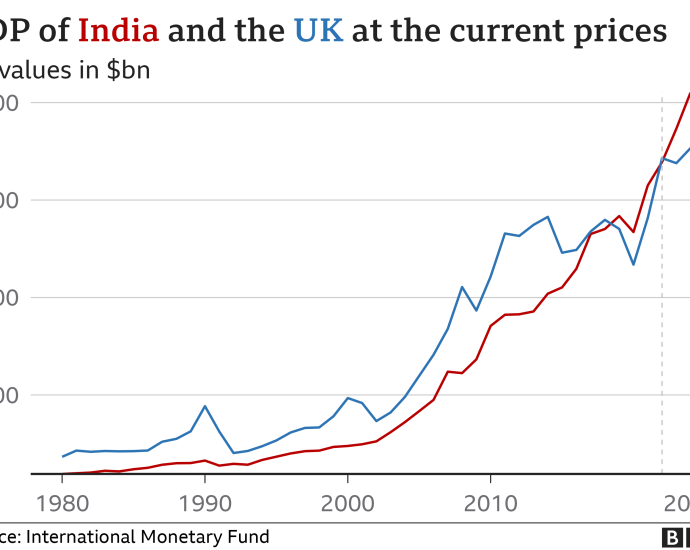

” As India adds$ 4tn to GDP over the next decade, at least 5 % of that will be online influenced, and coming from’ Bharat’ or remote India”, says Mr Daniel.

That’s a$ 200bn incremental opportunity.

The growing penetration of phones among middle-class remote communities is a contributing factor to this.

More than half of the population in the US currently uses one outside of its locations, or 450 million.

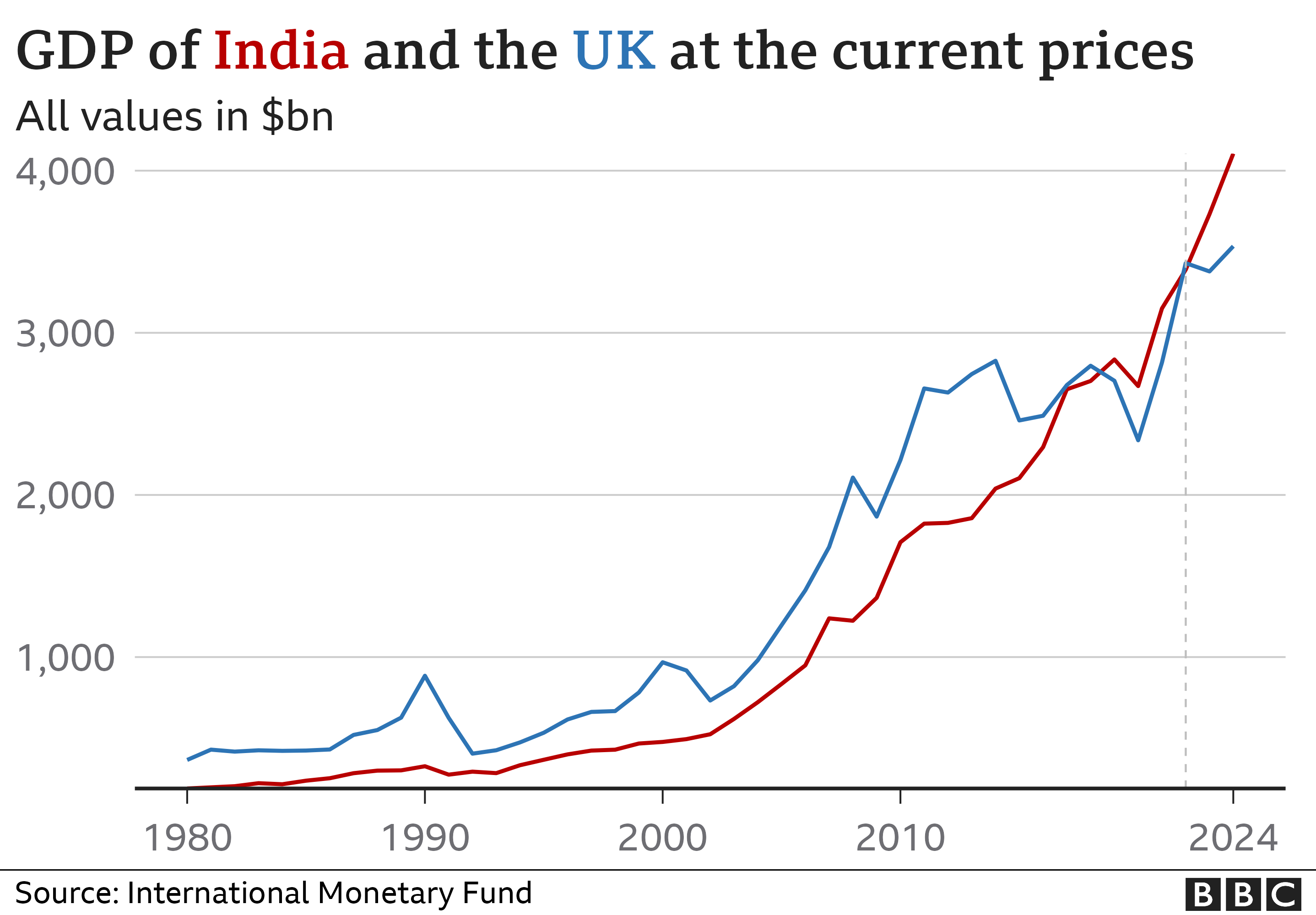

And for businesses looking to expand their offerings beyond the towns, the highly praised UPI program has changed the way they do business.

” Five or seven years ago, the ability to reach this goal group- get it online, economically or in terms of getting obligations- was n’t simple. However, the right time is also much better for this era of start-ups trying to enter this industry,” says Mr. Daniel.

In addition, a decade ago, the majority of development occurred in cities like Mumbai and Bengaluru, but a growing number of businesses are now emigrating from smaller towns, fueled by factors like lower operating costs, native talent presence, and state initiatives aimed at promoting innovation in less-metropolitan regions, according to a statement from Primus Ventures.

Being close to the ground may have also contributed to exposing members to the potential of the enormous non-metro business.

Saraskanth Lakh

Saraskanth LakhBut it’s simpler to crack remote India.

The little town customer is price-conscious and regionally dispersed. In any given location, there are much less addresses for buyers than in cities.

Infrastructure also continues to lag, so “distribution is n’t easy, and operating costs are high”, says Gautam Malik, chief revenue officer at Frontier Markets, a rural e-commerce start-up that does last-mile deliveries to villages with populations below 5, 000.

Besides, those using industrial designs and force-fitting them to the village environment may fail, says Mr Malik.

His business quickly realized why traditional e-commerce could n’t get to the very last mile. The customer in the village genuinely did n’t trust her money with a business that did n’t have a local presence.

To increase that level of trust, Mr. Malik and his team needed to collaborate with village-level women entrepreneurs to operate as their sales and distribution representatives.

Such diversity and a responsibility for the long haul will be important, he says, to winning rural India and cracking that iterative$ 200bn business prospect.

Follow BBC News India on Instagram, YouTube, Twitter and Facebook.

.jpg)

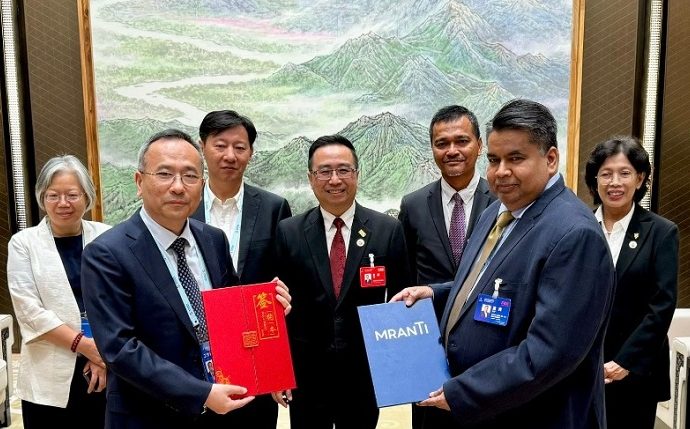

( pic ), head of Digital Exports, MDEC. We are hoping to galvanise more businesses outside the country by using our efforts to help our FOX businesses become international businesses and finally to encourage unicorns to stay in Malaysia after they become extremely successful.

( pic ), head of Digital Exports, MDEC. We are hoping to galvanise more businesses outside the country by using our efforts to help our FOX businesses become international businesses and finally to encourage unicorns to stay in Malaysia after they become extremely successful.

.jpg)

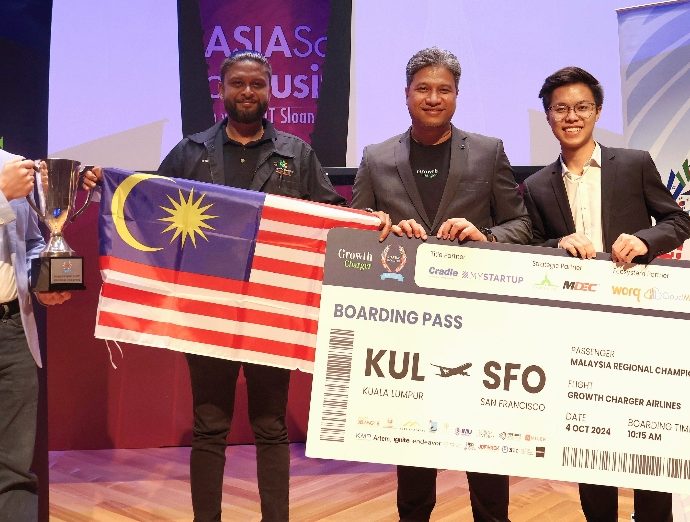

.jpg) His back was against the wall by that point, so the timing could n’t have been better. It was not an easy time, he admits. There was little to no money being made, and the statement” We were running out of money then” was true.

His back was against the wall by that point, so the timing could n’t have been better. It was not an easy time, he admits. There was little to no money being made, and the statement” We were running out of money then” was true.

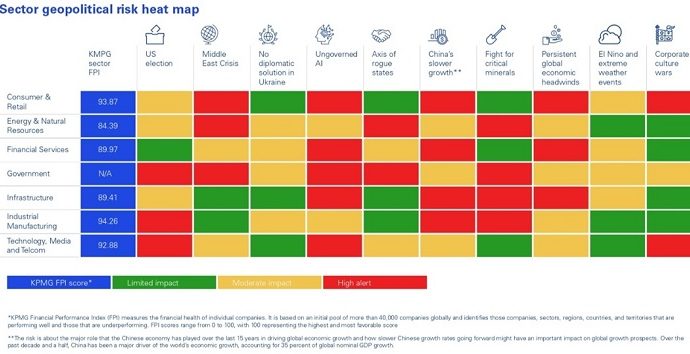

The rise of trade protectionionism, according to Johan Idris ( pic ), Managing Partner of KPMG in Malaysia, could have an impact on the export-oriented nation’s export-oriented economy, which accounts for 66.1 % of Malaysia’s GDP in 2023. He added that “recent global events have revealed the fragility of the global trade ecosystem and disruptions will continue to impact organizations unable to shore up ample defenses. Business leaders should develop adaptive capacity to increase operational resilience as a strategy. This can be accomplished by using a top-down policy mandate and bottom-up corporate capabilities approach.

The rise of trade protectionionism, according to Johan Idris ( pic ), Managing Partner of KPMG in Malaysia, could have an impact on the export-oriented nation’s export-oriented economy, which accounts for 66.1 % of Malaysia’s GDP in 2023. He added that “recent global events have revealed the fragility of the global trade ecosystem and disruptions will continue to impact organizations unable to shore up ample defenses. Business leaders should develop adaptive capacity to increase operational resilience as a strategy. This can be accomplished by using a top-down policy mandate and bottom-up corporate capabilities approach.