DisruptInvest 2024:Chua Kee Lock of Vertex Holdings on the 3 key trends emerging, and the exit of momentum investors

With only three days until the DisruptInvest Summit on May 23rd in Kuala Lumpur, keynote speaker and one of the most successful venture capital firms in Asia, Chua Kee Lock ( pic ), CEO of Vertex Holdings, who leads a network of seven funds ( with Japan being the most recent ), with around 90 VC professionals, shares his quick thoughts with DNA on the tech trends he sees. We even questioned whether he thought Penang or Singapore had the tastier city food. ( Spoiler alert, his answer is not spicy. )

With only three days until the DisruptInvest Summit on May 23rd in Kuala Lumpur, keynote speaker and one of the most successful venture capital firms in Asia, Chua Kee Lock ( pic ), CEO of Vertex Holdings, who leads a network of seven funds ( with Japan being the most recent ), with around 90 VC professionals, shares his quick thoughts with DNA on the tech trends he sees. We even questioned whether he thought Penang or Singapore had the tastier city food. ( Spoiler alert, his answer is not spicy. )

Can you introduce Vertex Holdings and its seven resources to us first?

, Vertex Holdings,  , is a Singapore- based venture capital investment holding organization. A custom worldwide system of venture capital funds receives anchor funding and functional support.

, At provide, we have seven community partnerships, each with different focus sections. Our Vertex community of cash invests in early stage technology prospects through Vertex Ventures, especially – , Vertex Ventures China,  , Vertex Ventures Israel, Vertex Ventures Southeast Asia &, India,  , Vertex Ventures US.

We recently welcomed , Vertex Ventures Japan into our Vertex global network which launched its inaugural ¥10 billion ( RM299.7 million ) fund with Vertex Holdings as its anchor investor. The account will concentrate on investing in leading Chinese startups with strong growth potentials in Deeptech, DX, AI, and the creator economy.

For our international funds, we have  , Vertex Ventures HC, which specialises in first- level medical opportunities and , Vertex Growth, which targets development- stage opportunities across technology and healthcare sectors.  ,

Each Vertex portfolio is run by its own General Partners, who manage each of its own local and regional partners. Collaboration and information sharing are promoted among the money through the Vertex international community.  ,

Can you provide your opinion on the current funding landscape ( based on the sites and investment elements of the 7 Vertex money ) and the top 3 disruptive changes emerging from the network?  ,  ,

We do see pockets of prospects emerging throughout our community, given the breadth and scope of our global community. The flood of international technological disruption is underway, and the cost of developing new products is decreasing as a result. This results in exponential growth in computer power and a corresponding decrease in technology costs over time. In the last 20 years, many nations have established and maintained their modern facilities, facilitating the adoption of new technologies.  ,

With the fast adoption of technology, we are witnessing some important changes emerging:

- Generative AI programs are changing the future of business, from boosting productivity to developing novel business models.

- The rise of” As- a- service” ( XaaS ) model – With a subscription basis model, businesses are transforming how they utilize technology.

- With the rapid progress in AI, we think these industries will use AI to strengthen their current software and choices.  ,  ,

Beyond AI as the current and future pattern, it is difficult to see beyond internet protection and the latest buzz. What are the changes Vertex sees, however, from your point of view?

,  ,  , With the general AI industry forecasted to reach around  , US$ 2.5 trillion by 2032 , and the relational AI industry poised to become at , at , US$ 1.3 trillion by 2032 it is no question why AI is changing the prospect. We believe AI have the potential to disrupt industries ,  ,  ,  , much like the internet revolution did as startups develop AI- enabled applications to transform industries.

Beyond AI, we also witnessed significant changes in the cloud computing space where the industry is moving towards specialized and intelligent cloud solutions. We see a rise in adopting hybrid and multi- cloud strategies, to leverage the strengths of ,  ,  ,  , different providers. The integration of AI and machine learning into cloud services will enable automation, optimisation, and deeper data analysis. Coupled with the growing focus on edge computing for real- time processing, the cloud landscape ,  ,  ,  ,  , is , becoming increasingly intelligent and distributed.  ,

,  , Secondly, the” as- a- service” model, often referred to as XaaS, is also experiencing remarkable growth. This model includes everything from infrastructure ( IaaS ) and platforms ( PaaaS ) to software ( SaaS ) and platforms ( PaaaS ) available on a subscription basis. Its ,  ,  , appeal , lies in the on- demand access companies have to cutting- edge technology at a cost- effective rate.

Cybersecurity is another area where we see significant advancements. The development of AI-powered attacks and specialized language models highlights the evolving nature of cyber threats. Both cyberthreat actors and cybersecurity teams ( including ,  ,  , Information Technology and Operational Technology ) can leverage on AI to enhance cyberattacking tactics or respond against cyberattacks to prevent disruption. Lastly, big data and datafication are moving beyond mere volume to become ,  , actionable assets by leveraging on the power of data and AI to drive real- time decision- making. Datafication, the process of turning various information types into data, will continue to expand incorporating sources like the Internet of Things ( IoT )  ,  , and sensor networks.  ,

Do you agree with the frequently stated claim that Southeast Asia is a market of 600 million or that it is much more geographically concentrated than that? Why do you say this?

Southeast Asia ( SEA ) is one of the world’s fastest- growing markets, and home to more than 600 million people. However, it is made up of a number of different nations, making it not a monolithic market. Investors should be aware of local preferences and cultural sensibilities, and they should n’t use a one-size-fits-all approach to all markets.  ,

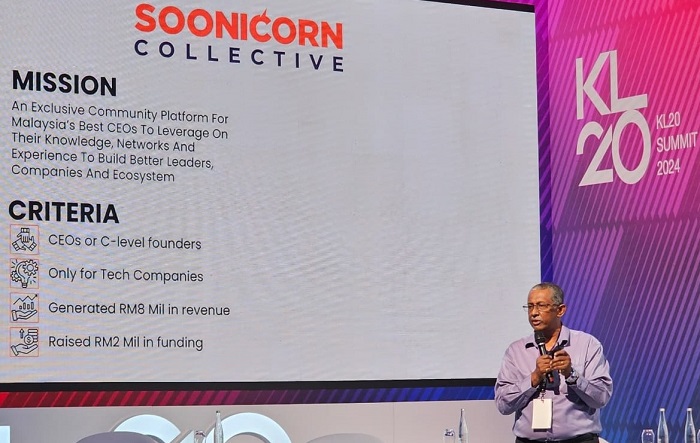

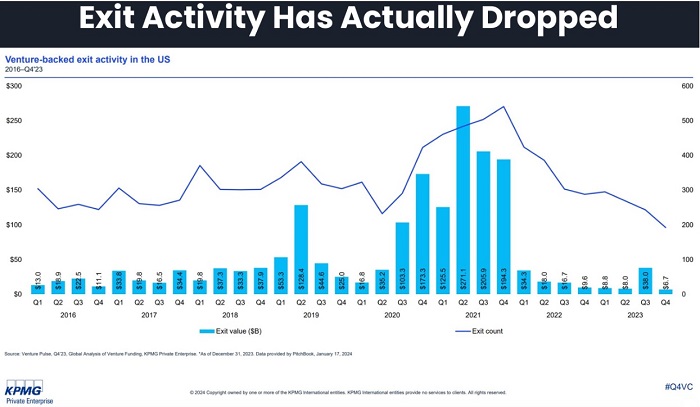

Despite recent decline, we think SEA continues to be a desirable investment destination and that Venture Capital (VC ) activities are still going strong. For instance, during COVID- 19, we witnessed a hyper investment pace between 2021- 2022 especially in Indonesia and Singapore startups. Since then, the investment pace has moderated. As concerns about the performance of existing investments arise, venture capital firms that have overinvested may instead devote capital to existing portfolios. While the overall funding has dipped, competition for high- calibre deals remain.  ,

With “momentum” investors leaving the ecosystem, companies are focusing on fundamentals such as Product Market Fit, Scalability and Path to Profitability. In early-stage companies, we continue to see the development of novel and disruptive business models or technology applications, while growth stage companies are increasingly becoming more realistic about valuations by raising money at normalized valuations.  ,

Which island do you feel has the more delicious street food, Penang or Singapore?

Both islands offer great options, each with its own unique flavours. Penang is renowned for its rich culinary heritage, which includes dishes like Penang char kway teow, assam laksa, and others that reflect the island’s diverse cultural influences.

Singapore, on the other hand, is famous for its hawker centres, where you can enjoy a variety of local favourites such as Hainanese chicken rice, laksa, and chili crab.  ,

Personally, while I have a deep appreciation for Penang’s authentic and traditional street food, my personal preference, although slightly biased, leans towards Singapore. It is a favorite for me because of the variety and consistency of quality. Both locations are culinary have ns, so foodies from all over the world would enjoy what each has to offer.

The company’s current residents include numerous multi-billion-dollar corporations as well as numerous promising startups that have achieved significant success. The startup residents have already established hundreds of jobs and successfully raised nearly US$ 400 million ( RM1.9 billion ) in funding.  ,

The company’s current residents include numerous multi-billion-dollar corporations as well as numerous promising startups that have achieved significant success. The startup residents have already established hundreds of jobs and successfully raised nearly US$ 400 million ( RM1.9 billion ) in funding.  ,