China’s manufacturing powerhouse Guangdong eyes technological transformation

Using a PIN to Face Challenges

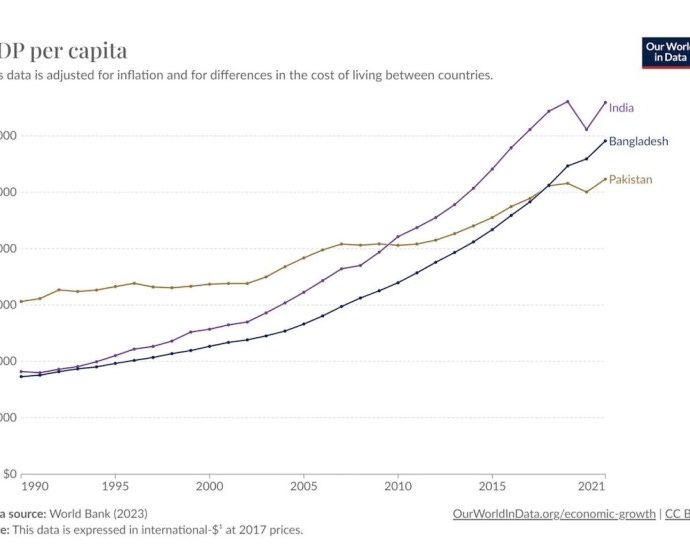

Local and foreign producers have been asked to reevaluate their supply chain methods by rising costs and rising costs. Some businesses have relocated some of their activities to different areas, such as South Asia and Southeast Asia.

Chinese electronic vehicle manufacturers, for instance, have just received government support to establish export-oriented supply chains in response to US and European trade restrictions.

Wang Weizhong, government of Guangdong, noted that despite the challenges still present, the region has also improved the law-based, market-oriented setting to draw significant foreign-funded projects.

He claimed that more than 1, 900 of these companies opened stores in Guangdong in January this year, an increase of 106 % over the previous month.

” We does actively promote the high-end, intelligent, and efficient business. According to Mr. Wang,” we will diligently apply the government’s new round of large-scale equipment regeneration and deployment, as well as major policy measures like reducing logistics costs and trade-in of consumer goods,” he told CNA.

He added that Guangdong’s local technology potential has been in the top spot for the past seven times.

” We will view the creation of new quality productivity as a strategic move and a long-term move,” he said,” and this shows ) strong confidence in the development of Guangdong’s manufacturing industry.”  ,  ,

ATTRACTING TALENT AND Assets

The place has been a key force behind China’s financial reform and expansion. It is located at the intersection of China’s Greater Bay Area ( GBA ), a hub for rapid high-tech advancements that attracts significant foreign investment.

” The GBA will enable the agility of a lot of skills, including those from mainland China, Hong Kong, Macao, and even those from other parts of the world,” said one analyst. Therefore, it is difficult for Guangdong to maintain its current talent while attracting more talent from other regions, according to political scientist Professor Sonny Lo.

He thinks Guangdong continues to be a hotbed for foreign buyers as a result of increasing investments in technical knowledge and better communication to Hong Kong and Macao.