Senate panel to study proposed casino project’s impacts

After the House examines the Casino and Entertainment Complex Bill, which is tentatively scheduled for next week, the Senate does establish a committee to examine the effects of the proposed casino-entertainment difficult task.

Two movements related to the job have been put on the plan for the April 8 meeting, according to Pisit Apiwattanapong, a legislator and official of the Senate committee on Senate matters. He claimed that as the House progresses with its deliberations, senators will be able to question these motions and establish a committee to examine the bill and its probable effects.

According to Mr. Pisit, the Senate is still divided on the subject, with the majority of legislators calling for a public hearing before a decision is made.

Due to rumors that the House investigation of the expenses will be moved up to Thursday rather than April 9, critics of the casino-entertainment difficult project are ramping up their campaign. On Thursday, some are anticipated to protest march outside parliament.

The costs would not be examined on Thursday, but it would otherwise be reviewed on April 9, according to general government whip Wisut Chainarun on Wednesday. He added that the new disaster would be the focus of Thursday’s meet.

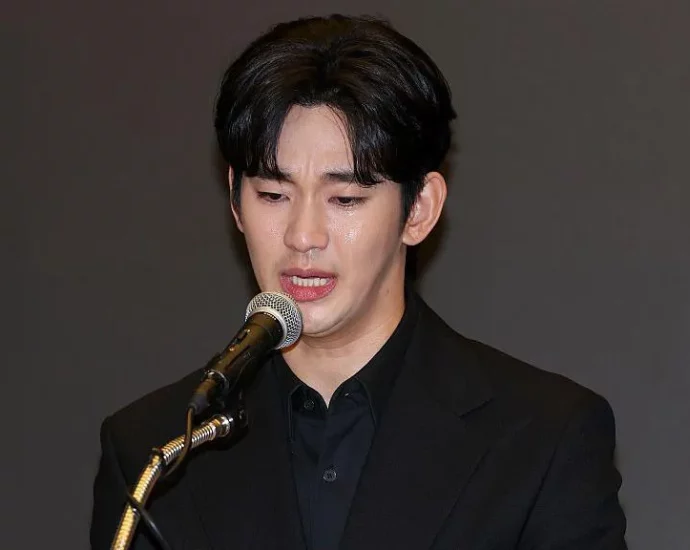

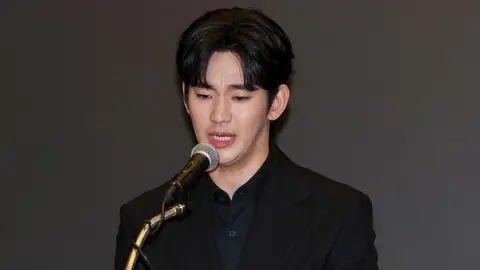

Along with criticism head Natthaphong Ruengpanyawut and House Speaker Wan Muhamad Noor Matha, the Stop Gambling Foundation’s secretary-general Thanakorn Kromkrit, the organization’s secretary-general, also submitted a petition opposing the bill on Wednesday. He demanded that the opposition make a referendum proposal and that all political parties reject the act.

Mr. Thanakorn criticized the game plan as careless, claiming that it lacked a thorough analysis and wasn’t a part of any election campaign. The drive to pass the bill could lead to further social divisions, he claimed, because it was gambling with society’s potential.

The PP leader urged the government to take into account people concerns while expressing concern that the bill does not address the issues it aims to address and might eventually benefit some groups.

On Thursday, former red-shirt chief Jatuporn Prompan demanded that critics gather outside parliament to rally in white shirts.

He criticized the government for passing the bill despite widespread concerns about the recent earthquake and those who are also encased beneath dust.

Chittawan Chanagul, a professor of economics at Kasetsart University, stated that her group intends to protest organizations to establish an ethics investigation into former prime minister Paetongtarn Shinawatra.