New Japan-Philippine defense pact pushes back at China – Asia Times

Manila: To counteract China’s growing danger in the South China Sea, the Philippines is looking beyond the United States and toward Japan.

A high-stakes security agreement that will significantly improve diplomatic protection cooperation through joint military drills and gear transfers was eventually signed by Manila and Tokyo after years of negotiations.

President Ferdinand Marcos Jr. is promoting an “independent” foreign policy and is developing a large and well-diversified network of protection partnerships to counteract his nation’s dependence on US ally in the form of joint defense agreements.

Japan, which has recently established itself as a major regional and global surveillance person, is at the heart of the Philippines ‘ foreign policy growth strategy. Both parties have expressed concern about China’s assertive seafaring behavior, particularly along the so-called” First Island Chain” that runs from the East China Sea to the Taiwan Strait and South China Sea.

The Philippines is now only the third country, after Australia and the United Kingdom, to mark an RAA cope with Japan. The new defence pact falls far short of a comprehensive common defense agreement.

Similar to the Enhanced Defense Cooperation Agreement ( EDCA ), which Manila shares and has recently expanded to give US forces greater rotational access to its military installations, is there no such thing as a visiting forces agreement.

Rather, the new RAA specifies “procedures for joint activities that are carried out by troops of Japan and the Philippines while the power of one country is visiting the another country and establishes the legal standing of the visiting power”.

Additionally, the RAA will “improve interoperability between the causes of the two countries by facilitating the application of joint activities like joint exercises and hazard reduction between Japan and the Philippines.”

The two countries have stated that the new agreement is the result of a “increasingly extreme” security environment in the area and is a part of a wider combined effort to “promote security and defense cooperation between the two countries and strongly support peace and stability in the Indo-Pacific region.”

It’s widely expected that the Philippine Senate and the Japanese Diet, both under the sway of current administrations, will ratify the RAA soon, paving the way for large-scale joint exercises and defense equipment transfers. Shared concern about a potential Chinese invasion of Taiwan is a major driving force.

Near Taiwan’s shores, both the Philippines and Japan have military installations. Therefore, it is likely that the two parties ‘ future joint exercises will center on improving interoperability in the Taiwan Strait and Bashi Channel in order to respond to unexpected events.

Japan is also anticipated to increase its assistance to the Philippines in terms of maritime security in an effort to stop China’s actions on the water. In exchange, the Philippines will host more Japanese Self-Defense Forces for bilateral as well as multilateral drills involving like-minded nations like Australia, South Korea, Canada, and the US.

In the event that there is a significant Asian conflict to come up, the RAA could also serve as a springboard for a full-fledged alliance.

Perhaps Japan is the only country with such “bipartisan support” in the Philippines. Japan had the most favorable rating , ( 81 % ) among the Philippines ‘ Asian partners in one recent poll, well ahead of other key partners such as South Korea ( 68 % ) and India ( 48 % ).

Japan has served as a leading , export destination, development aid source and foreign investor, especially in public infrastructure, in the Philippines in recent decades.

All current Filipino presidents have pressed for greater strategic cooperation with Tokyo, from reformists like Fidel Ramos and Benigno Aquino to authoritarian populists like Rodrigo Duterte.

However, bilateral defense cooperation only began to gain momentum in the 2010s amid growing uncertainties over America’s commitment to the region and fears about China’s expanding military capabilities.

Tokyo and Manila have quickly increased their maritime security cooperation as Beijing has asserted its claims in both the South China Sea and the East China Sea. In particular, Shinzo Abe, the late prime minister, played a significant role in this regard by overseeing the transfer of coast guard ships and radar systems to the Philippines from the Aquino and Duterte administrations.

In exchange, the Philippines, especially under the Aquino administration, became the leading regional champion of a more proactive Japanese defense policy in the Indo-Pacific region.

Abe’s successors have doubled down on his legacy, with current prime minister Fumio Kishida calling for a new “golden age” of strategic cooperation just short of a full-fledged defense alliance in a historic speech before the joint congress of the Philippines last year.

Under Kishida, Japan has adopted a doctrine of “realism diplomacy”, vowing in the process to double Japan’s defense spending over five years. In addition to supporting like-minded countries like the Philippines in the area, Japan has recently launched a new Official Security Assistance ( OSA ) program.

Accordingly, the Philippine Coast Guard (PCG), which has already been a recipient of multiple Japanese-made patrol vessels in the past decade, is expected to acquire a new and modern multi-role ship.

The newly signed RAA is central to the fruition of Kishida ‘s , “new vision of cooperation”  ,. In their first” 2 2″ meeting in 2022, the Philippines and Japan flew to Tokyo to” strengthen defense cooperation in light of the increasingly harsh security environment” with then-Philippine Foreign Secretary Teodoro Locsin and then-Defense Secretary Delfin Lorenzana.

Despite Duterte’s generally warm ties with Beijing, his top diplomat and defense chief expressed ,” serious concern” over  , China’s increasingly assertive position in adjacent waters while broadly echoing the concern of Japan and major Western nations over Russia’s invasion of Ukraine. The two parties also discussed the transfer of new radar systems to the Philippine military in terms of a new defense pact.

Ferdinand Marcos Jr., who quickly strengthened defense ties with traditional partners following his unsuccessful visit to Beijing in January of last year, has strengthened Japan’s position as an “all-weather ally” to the Philippines.

More than nine out of ten Filipinos favor a tough and non-compromising stance in the disputed waters, which is anchored by Marcos ‘ defiance of China’s actions.

Crucially, the Filipino president has also pushed for closer trilateral security cooperation under the Japan-Philippine-US ( JAPHUS) framework. Foreign and defense ministers from both sides “understood the significance of each country’s respective treaty alliance with the United States and that of strengthening cooperation with regional partner countries” during their 2 2 meeting last year.

The RAA’s announcement comes as tensions in the South China Sea are rising, most recently as a result of Beijing’s deployment of one of its two “monster” coast guard ships in the disputed waters.

According to the most recent reports, China Coast Guard (CCG) ship 5901, which is a humongous ship three times bigger than the US Coast Guard’s National Security Cutters and five times bigger than the Philippines ‘ flagship vessel BRP Teresa Magbanua, is currently anchored at the Sabina Shoal in the disputed  , Spratly Islands, parts of which are located within the Philippines ‘ 200 nautical miles exclusive economic zone ( EEZ ).

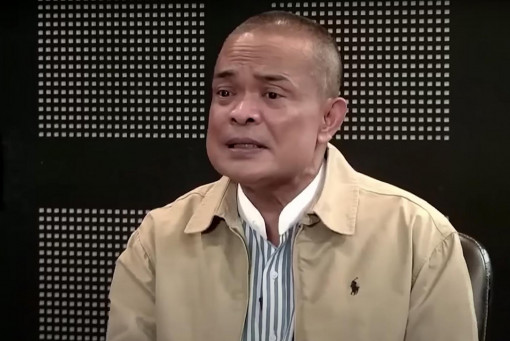

Philippine Coast Guard spokesperson Jay Tarriela , characterized the deployment as an “intimidation” tactic and insisted that” ]w ] e’re not going to pull out and we’re not going to be intimidated]by China ]”.

General Romeo Brawner, head of the Armed Forces of the Philippines ( AFP), asserts that the Philippines has rejected US requests for direct assistance for resupply and patrol missions in the disputed waters despite ongoing harassment and intimidation from China’s maritime forces. Knowing that it now has more tacit Japanese support, it is able to afford to do so.

Follow Richard Javad Heydarian on X at @Richeydarian