Uttar Pradesh: Indian schoolgirlâs cycling death lays bare ugly face of âEve-teasingâ

shabby graphics

shabby graphicsThe tragic death of an Indian schoolgirl has exposed the negative effects of” Eve-teasing ,” a well-known South Asian euphemism that many claim minimizes the harassment and assault of women on the street.

The brief CCTV footage of two American women riding bicycles gets off to a good start.

The youth are riding side by side on a nearly deserted street while wearing their class uniforms, which include scarves and trouser bottom.

But the peace of the image is disturbed in a matter of seconds.

They are overtaken by two men riding motorcycles, and one of them removes the girl’s blanket. She soon loses control, her bike turns right, and a second motorcycle approaches from behind.

The 17-year-old is run over by a third motorcycles coming from the opposite direction as she and the riders fall onto the highway.

Her father Sabhajit Varma, who arrived at the scene shortly after receiving a call from his niece — the other girl in the CCTV footage— says,” The moment I saw my daughter, I knew she was dead.”

He told me on the phone from his house,” Some people had gathered, and we loaded her onto a tempo [ a small vehicle used to transport goods ] and rushed to the hospital.”

” Doctors claimed she was” brought dead ,” They claimed that her neck was broken and that she had passed away as a result of serious head injuries, he claimed. ” There were no condolences or parting words.”

After his two older girls were married, Mr. Varma’s wife passed away eight years ago, leaving the 17-year-old, the youngest of three, as the only person living with him. He tells me that she excelled in school and desired to become a physician.

He claimed that she had told him two days prior to her passing that some kids had been harassing her and different women outside of their college. Since then, police have also been informed by his daughter and other students that the young men used to hang out at their school in the morning and the night, occasionally racing their bikes.

The loss of his daughter has left Mr. Varma devastated and furious. ” My daughter was killed ,” she said. He declares that the people who killed her may be hanged.

In the northeastern state of Uttar Pradesh’s Ambedkar Nagar city, the incident happened last month.

Three suspects have been detained by police; according to reports, at least one of them is a slight, and they are still looking for another person. Mr. Varma claims that since the disaster, he has received visits from government representatives, including a secretary in the state, but has not been compensated.

As they attempted to grab our arms and flee while being taken for their health investigation, police claimed to have shot and injured two of the offenders in their arms within days. They continued by saying that the next man had broken his leg while attempting to flee.

The tragic death of the girl has brought attention to the problem of sexual abuse of women in public spaces, and some women’s rights activists have questioned why the local press used the term” Eve taunting” to describe the situation.

They claim that the word is” deeply difficult” and draw attention to the recent Supreme Court ruling that it should be replaced in courtrooms with” street physical harassment.”

The term, according to Kalpana Viswanath, co-founder of Safetipin, a social organization that works to create public spaces healthy and inclusive for women, sounds like it’s just teasing but is not innocuous.

” The idea that the warrior pursues the woman and she likes to get pursued” is a common one in Bollywood. However, it is a harsh crime, so let’s not downplay the severity of the crime by referring to it as Eve-teasing.

Eve tormenting is very common and frequently occurs while a person is walking down the street or riding in crowded public transportation, as most Indian women would attest. The majority of them have tales to tell about being groped, pinched, or elbowed in the breasts.

The majority of such abuse cases are listed in the Indian penal code’s Article 354, which deals with instances of” attempt to violate modesty of women.”

However, police have also brought up another serious charges in the Ambedkar Nagar suicide case.

Police reported nearly 90,000 such cases in 2021, the final year for which the Indian government’s crime data is available, or 13.4 % of the total 428, 278 crimes against women that year. According to the data, there were more than 500,000 of these cases pending in court as a result of the delay that had accrued over the years.

However, Ms. Viswanath claims that because most women don’t report sexual remarks or being touched or groped by somebody, street harassment is a crime that is rarely reported. Additionally, it can be challenging for yet a woman to discover her molester at times, especially in an area that is very crowded.

She claims that the tragic result of the event in Ambedkar Nagar is the only reason it has gained attention. No one would have discussed this event if she hadn’t passed away, gotten up after falling, cleaned herself off, and left.

Sex activists claim that the problem of abuse can only be solved by raising better boys. However, Ms. Viswanath notes that this is a long-term process and that” in the interim, there has to be better communication system in the media which, at the moment, is loaded against girls.”

The police need to be sensitized so they take complaints from women severely, and people must understand what constitutes acceptable behavior. Authorities didn’t be everywhere all the time, so the general public and onlookers must intervene.

” We may say that boys will be boys and look the other way.” Kids may remain boys, she continues.

Check out the BBC’s more India-related reports:

- Despite a dispute, Trudeau says he is severe about India’s relationships.

- News of an Air India 1985 attack follows a Canada column

- India controversy following the marriage of an LGBTQ partners in a Sikh temple

- American company’s copyright lawsuit is slammed by New Yorkers.

- Expectations are dwindling as India waits for a message from the Moon spacecraft.

Related Subjects

More information about this tale

-

-

16 December 2017

-

Aukus: UK defence giant BAE Systems wins £3.95bn submarine contract

BAE Systems

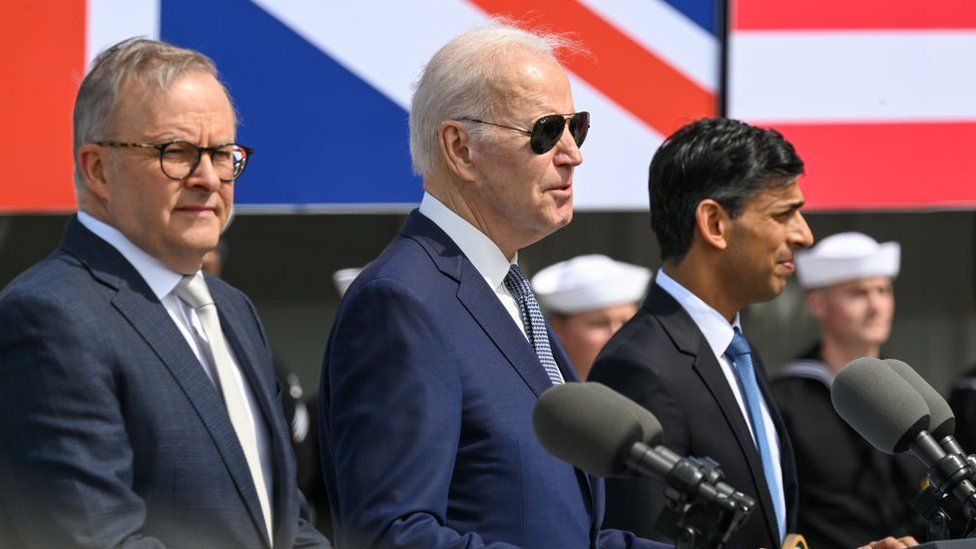

BAE SystemsBritain’s biggest defence firm, BAE Systems, has won a £3.95bn ($4.82bn) contract to build a new generation of submarines as the security pact between the US, UK and Australia moves ahead.

In March, the three countries announced details of the so-called Aukus pact to provide Australia with nuclear-powered attack submarines by the late 2030s.

The pact aims to counter China’s ambitions in the Indo-Pacific region.

Beijing has strongly criticised the three countries over the deal.

“We’re incredibly proud of our role in the delivery of this vitally important, tri-nation submarine programme,” BAE Systems Chief Executive Charles Woodburn said.

BAE said the funding will pay for development work to 2028, with manufacturing work on the vessels expected to start towards the end of this decade.

The first SSN-Aukus submarine is scheduled to be delivered in the late 2030s.

Both the UK and Australia will use the SSN-Aukus submarines, which will be based on a British design.

“This multi-billion-pound investment in the Aukus submarine programme will help deliver the long term hunter-killer submarine capabilities the UK needs to maintain our strategic advantage and secure our leading place in a contested global order,” UK defence minister Grant Shapps said as the Conservative party conference got underway in Manchester.

BAE said the SSN-Aukus will be the biggest, most powerful and advanced attack submarines ever operated by the Royal Navy and will eventually replace the Astute class, which its builds at its site in Barrow-in-Furness, Cumbria.

The agreement will provide decades of work at the Barrow-in-Furness shipyard, where it employs more than 10,000 people.

The company said the deal will also fund significant investment at the site, investment in its supply chain and recruitment of more than 5,000 workers.

BAE employs 39,600 people in the UK and has a global workforce totalling more than 93,000, according to the company’s website.

Other major UK defence contractors are also getting a boost from the Aukus deal.

In March, it was confirmed that Rolls-Royce Submarines would provide all the nuclear reactor plants that will power the SSN-Aukus vessels.

In June, Rolls-Royce said it would almost double the size of its Raynesway facility in Derby as a result of the deal. On Sunday, Babcock International, which maintains and supports the UK’s submarines, said it had signed a five-year deal with the Ministry of Defence to work on the SSN-Aukus design.

The Aukus security alliance – which was first announced in September 2021 – has repeatedly drawn criticism from China.

However, the three Western countries say the deal is aimed at shoring up stability in the Indo-Pacific.

Related Topics

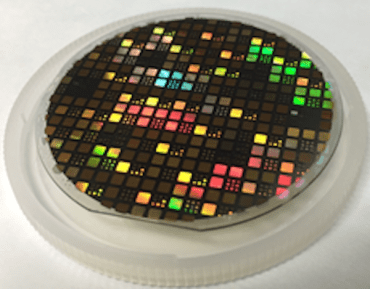

Intel upping chip game in market-leading ways

Intel has announced new chip technologies that promise to make it a more formidable future competitor of Taiwan’s TSMC and South Korea’s Samsung Electronics and that put the 7nm processor built by China’s SMIC for Huawei’s new 5G smartphone in a new perspective.

In a keynote address at the Intel Innovation 2023 event that opened in San Jose on September 19, CEO Pat Gelsinger said the company’s 2nm process (20A, or 20 angstroms, which equals 2 nanometers) will be production-ready in the first half of 2024 and its 18A process in the second half of the same year.

Intel’s 18A silicon should go into the fab in the first quarter of next year, leading to high-volume production in 2025.

If all goes according to plan, it would mark the success of Intel’s “5 Nodes in 4 Years” catch-up strategy announced by Gelsinger in 2021. TSMC and Samsung Electronics have 3nm processes in production now and plan to launch 2nm in 2025.

Intel’s “Beyond 5 Nodes in 4 Years” Roadmap:

Intel 7: Now in high-volume manufacturing

Intel 4: Now ramping up production

Intel 3: 2H 2023 – manufacturing ready, sampling

Intel 20A: 1H 2024 – on track for manufacturing

Intel 18A – 2H 2024 – on track for manufacturing

Intel has its own process roadmap terminology, which can be confusing. The XDA Developers tech news portal explains:

“For reference, Intel 7 is what the company names its 10nm process, and Intel 4 is what it names its 7nm process. Where the names come from (even though one could argue that they’re misleading) is that Intel 7 has a very similar transistor density to TSMC’s 7nm, despite Intel 7 being built on a 10nm process. The same goes for Intel 4… [which is] the first of Intel’s fabrication processes to make use of extreme ultraviolet [EUV] lithography… With that said, where things become very interesting is with 20A and 18A. 20A (the company’s 2nm process) is said to be where Intel will reach “process parity.”

Tom’s Hardware fills in the gap with this comment: “Intel 3 (previously known as 5nm)… uses extreme ultraviolet [EUV] lithography and is generally a refined Intel 4 production node (previously known as 7nm). Compared to Intel 4, Intel 3 promises an 18% higher performance per watt efficiency, denser high-performance library, reduced via resistance, and increased intrinsic drive current.”

Intel 3 process technology will be used in the volume production of the new data center and server processors at Granite Rapids and Sierra Forest scheduled for next year.

In comparison, the 7nm Kirin 9000 processor used in Huawei’s Mate 60 Pro smartphone was fabricated by SMIC, China’s leading foundry, using a 7nm process with DUV (deep ultraviolet) ArF immersion lithography.

The export of more advanced EUV lithography to China is banned under US sanctions, so this was the only solution available for the company.

US government officials and other commentators were surprised that this could be done, but industry specialists were not. With time, SMIC will probably be able to implement a 5nm process using the same equipment but that will be the limit.

On September 20, Intel announced the first use of EUV lithography systems in high-volume manufacturing in Europe at its new fab in Ireland. The machines will support Intel 4 starting this year and Intel 3 starting in 2024.

ASML’s next-generation High Numerical Aperture (High-NA) EUV systems will be used at the 18A process node. At Intel Innovation 2023, Gelsinger said the first of these machines will arrive at the company’s facility in Oregon in time for Christmas.

According to ASML, “That machine, the 0.55 numerical aperture (NA) Twinscan EXE:5000 pilot scanner, is being developed for chipmakers so that they may learn how to efficiently use High-NA EUV technology. Following those R&D efforts, high volume manufacturing of chips using High-NA scanners expected to commence in 2025, when ASML begins shipping the commercial-grade Twinscan EXE:5200 scanner.”

Compared with the 0.33 NA optics in current EUV systems, High-NA will greatly reduce the resolution limit, enabling “geometric chip scaling well into the next decade.” A critical technology for enabling nodes below 2nm/20A, it raises the bar for China’s lithography equipment developers.

Moreover, Intel announced on September 18 the successful development of its first glass substrates for the next-generation advanced packaging it plans to introduce in the second half of the decade. Intel explains the significance of this development as such:

“As the demand for more powerful computing increases and the semiconductor industry moves into the heterogeneous era that uses multiple ‘chiplets’ in a package, improvements in signaling speed, power delivery, design rules and stability of package substrates will be essential. Glass substrates possess superior mechanical, physical and optical properties that allow for more transistors to be connected in a package, providing better scaling and enabling assembly of larger chiplet complexes (called ‘system-in-package’) compared to organic substrates in use today. Chip architects will have the ability to pack more tiles – also called chiplets – in a smaller footprint on one package, while achieving performance and density gains with greater flexibility and lower overall cost and power usage.”

Compared with the organic packaging materials (epoxy resin, etc.) used today, “glass offers distinctive properties such as ultra-low flatness and better thermal and mechanical stability, resulting in much higher interconnect density in a substrate.”

“By the end of the decade, the semiconductor industry will likely reach its limits on being able to scale transistors on a silicon package using organic materials, which use more power and include limitations like shrinkage and warping. Scaling is crucial to the progress and evolution of the semiconductor industry, and glass substrates are a viable and essential next step for the next generation of semiconductors.”

They will be used first in data center, AI and graphics applications.

Meanwhile, Intel is working with the Universal Chiplet Interconnect Express (UCle), a diverse international consortium of which it was one of the founding members in March 2022.

The idea behind the UCle specification is to provide an open standard ubiquitous package level interconnect allowing system-on-chip (SoC) designers to combine chiplets from different suppliers, addressing “customer requests for more customizable package-level integration, connecting best-in-class die-to-die interconnect and protocols from an interoperable, multi-vendor ecosystem.”

The Merriam-Webster dictionary definition of “chiplet” is “a small modular integrated circuit component that is designed to provide a specific function.”

UCle now has more than 120 members, including founding board members AMD, Arm, ASE, Google Cloud, Intel, Meta, Microsoft, Qualcomm, Samsung and TSMC, additional board members Alibaba and Nvidia, and dozens of contributor members including Advantest, Applied Materials, Beijing Stream Computing, Bosch, Cadence, Ericsson, Global Foundries, IBM, imec, Keysight, Juniper Networks, Mercedes-Benz, Micron, MediaTek, Shanghai UniVista, Siemens, SK Hynix, Synopsis, Teradyne, Tongfu Microelectronics, Xi’an UniIC Semiconductors, UNISOC, VeriSilicon and Xspeedic.

The presence of IC designers and manufacturers, electronic design automation suppliers, semiconductor production and test equipment makers, a leading research institution, cloud service and software providers, telecom equipment makers and other manufacturing companies from around the world – including several Chinese companies – demonstrates the collaborative direction of what Intel calls the “Siliconomy.”

It is directly opposite to the fragmenting, supply chain-cutting, subsidizing and nationalistic bent of US politicians.

Follow this writer on Twitter: @ScottFo83517667

Could fear of embarrassment and Chinaâs domestic woes keep Xi Jinping away from APEC summit?

The wave of recent interactions, he said, indicated that the two countries hoped to repair ties, and there was an increased expectation for the two leaders to meet following the high-level visits. Wang Huiyao added that both China and the US stood to gain from a more stable relationship, andContinue Reading

Rina Sawayama: Therapy made me realise I was groomed at 17

BBC

BBC “I’ve never talked about this in any other interview,” Rina Sawayama says, her voice steady.

She keeps eye contact, ready to share the painful inspiration behind her second album, Hold the Girl, which she wrote after several sessions of sex and relationship therapy.

A few hours from now she will command the rooftop stage at New York’s Pier 17 venue, performing to a sold-out audience.

The crowd is not just made up of teenage girls, the usual staple that dominate audiences for pop starlets. Several same-sex couples are here, swaying and kissing to the more anthemic songs and a group of trans women mouth along to the LGBT-inclusive This Hell.

The team and tour crew that surround Sawayama are all just as diverse.

“The heads of the music industry are still a lot of straight white men,” she says, “so I work with people I want to see more of in the industry.”

Sawayama has been touring internationally for several months.

This has been a significant year for the artist. She performed her own set at Glastonbury 2023, followed by an appearance alongside Sir Elton John on the Pyramid Stage. She featured on the cover of British Vogue’s LGBT-pioneers issue. And she starred in her first Hollywood feature film, John Wick 4, alongside Keanu Reeves. It’s all been part of her steady rise to fame.

In 2021 the Japanese-passport holder, who has lived in the UK most of her life, successfully spearheaded a movement to change eligibility rules for the Mercury Music Prize and Brit Awards. Now, non-British UK residents can qualify for the big prizes.

Since then she has released two studio albums and has been performing continuously ever since coronavirus restrictions were lifted.

New York Pier 17 is her final performance before a break in the tour.

A few hours before her show, inside a chic hotel, with the intrusive noise of New York’s East Village whirring outside, Sawayama is about to share something for the first time publicly – the inspiration behind her album, which NME music magazine describes as a “total triumph”.

It is about a relationship with an older man, she says.

“I was groomed,” she tells the BBC: “It was by a school teacher.”

The legal age of consent in the UK is 16. Sawayama was 17. But she says that’s a time when a girl often making choices she isn’t ready for.

Now, aged 33, Sawayama says she looks back on that period of her life with defensiveness for her younger self.

“Seventeen to me is a child. You’re in school. If a school teacher is coming onto you, that’s an abuse of power,” she says. “But I didn’t realise until I was his age.”

If you have been affected by the issues raised in this article, help and support is available via BBC Action Line.

Sawayama admits that felt “slut-shamed” by her peers for the relationship, and its aftermath led to a long period of self-loathing.

“I completely lost my sense of self,” she says. “I dissociated from my body. I just felt so afraid.”

She says sex and relationship therapy allowed her to rethink what happened from an adult perspective.

“I would revisit my 17-year-old self, hold her close, and tell her that it wasn’t her fault.”

It was the inspiration of the album title Hold the Girl and her other songs went even further.

Your Age, the seventh song on the album, is about reaching the same age her teacher was at the time and realising how wrong it was.

When it was released, critics described the industrial, nu-metal inspired track as “angry”, with Paste magazine saying it was like “a long-dormant volcano exploding”. Lyrics such as: ‘Why did you do it? What the hell were you thinking?’ speak to a visceral pain that still exists within her today, over a decade later. But some critics incorrectly guessed the inspiration for the song was about a lack of connection with her immigrant family.

Born in Japan in 1990, Sawayama and her family moved to London when she was five years old. The initial plan was to return to Japan, but when they were eligible for a permanent visa, Sawayama’s mother decided that her creative and expressive daughter may be better suited to a city like London.

Sawayama entered the music industry relatively late, in her mid-twenties, years after completing a politics and psychology degree at Cambridge University. She was 27 when she signed to a record label, and she felt uncomfortable about her age.

“When I was growing up, especially in the 1990s and 2000s, you signed to a label when you were 13, 17 at the oldest,” she says, referencing female pop stars she looks up to, like Britney Spears who was just 15 when Jive Records gave her a contract.

“I was 29 when my first album came out, so I felt old.”

But she was embraced by a young and diverse fanbase. Sawayama, who says she is attracted to people regardless of their gender, came out as pansexual in 2018. Her videos rack up millions of views and attract comments praising her for singing about social issues.

The video to Sawayama’s first single STFU! is an outcry against microaggressions many East Asian women experience in western countries. It shows Sawayama on a date with a white man, who makes a series of racially inappropriate comments, and at one point narrows his eyes using chopsticks to pull them apart. The song, she says, was inspired by personal experience.

“I felt people saw me as a map of Japan, not as a person,” she says. “I think a lot of immigrants, or first generation immigrants, can relate to that.”

STFU! went on to be named as one of the best songs of 2020 by Rolling Stone magazine and while Sawayama still remains a refreshing addition to mainstream pop, she’s not shy about pointing out its failings.

“There’s a lot of people outside of the music industry, who don’t know about the music industry,” she says. “Recording artists don’t have exit clauses between albums, for example.”

“There needs to be some sort of overhaul, because currently it’s very much benefiting music labels and record labels, and not artists.”

So is it a worry to speak so honestly about the industry she is still navigating?

“I have always wanted to lead with the truth, always,” she stresses, “being transparent is important to me”.

It’s in that spirit she says, that she now wants to share with fans her story and the trauma that inspired so much of her recent music.

“Writing that album was one of the hardest things,” she says, “but it was also one of the most incredible experiences”.

Incredible, because of its impact.

Back at Sawayama’s rooftop concert in New York, you can see how the song Hold the Girl, in particular, clearly shakes the audience. At the front row, where the most hardcore fans stand, several are in tears during her energetic performance. Although they may not know yet the full meaning behind the song, it evidently moves them.

“When I look out to the audience and I see women or femmes connecting to it, I think maybe you know,” Sawayama says. “Maybe you have experienced this too.”

When it comes to her future work, Sawayama admits she’s not sure what kind of songs will make up her third album: “I hope that I don’t have to write autobiographically all the time!”

“I don’t want any more traumas to come out,” she acknowledges, as she smiles wryly.

“I would love a day where I can write a song that’s just about love or sex,” she says, adding: “I’m getting there. I am getting there.”

In Conversation is a collaboration between the BBC World Service and BBC Three.

Higher for longer US rates ringing Asia alarm bells

The broadside Moody’s Investors Service just fired at the US dollar and interest rates dramatizes why the next few months could be uniquely chaotic for global markets.

It stands to reason that the one major credit rating company still holding Washington in AAA esteem is anxious to announce a downgrade.

Twelve years after S&P Global downgraded the US, Fitch Ratings last month followed suit. Fitch’s move was about more than America’s national debt careening toward US$33 trillion.

It was also a response to the “steady deterioration in standards of governance” as politicians play games with raising Washington’s statutory debt limit.

Now, Moody’s warns that the dysfunction surrounding a government shutdown on October 1, the latest manifestation of extreme polarization, may be the reason to cut Washington’s rating to Aa1.

Investors seem way ahead of credit rates as US yields move higher. Rates on 10-year Treasury bonds are at a 16-year high this week, a dubious milestone that’s slamming European and Asian markets. Benchmarks from Japan to South Korea to Australia plunged.

On Tuesday alone, MSCI’s gauge of global stocks plunged 1.24%, an outsized move for the benchmark. By Wednesday, the index was falling for a ninth day as it approaches its longest losing streak in more than a decade.

The Cboe Volatility Index, Wall Street’s so-called fear gauge, flashed its most intense warnings since May, when US inflation hit a 41-year high.

Adding to the disorientation is the dollar’s curious durability. The more investors fret about the state of global finance, the more the dollar rises. The yen’s move toward 150 to the dollar, a psychologically important level, has markets bracing for currency intervention by Japanese authorities.

The US Federal Reserve, meanwhile, is making it clear it’s not done hiking rates. When Minneapolis Fed President Neel Kashkari on Tuesday assigned 40% odds that rates will still go “meaningfully” higher, traders figure policymakers are telegraphing more austerity to come.

Already, 11 Fed tightening moves in 18 months are working their way through global markets. The specter of more hikes could wreak havoc in debt markets, equity bourses and property sectors everywhere.

Europe is uniquely poorly positioned to withstand the coming financial storm. Rising yields will hit real estate values from Tokyo to Seoul to Bangkok.

A major challenge for Asia is figuring out which financial shoes might drop next as well as how and where the tremors will be felt.

The US government shutdown for which Republican lawmakers are agitating would furlough hundreds of thousands of federal workers and suspend vast swaths of public services, crimping US economic growth.

“A shutdown would be credit negative for the US sovereign,” Moody’s analysts wrote in a note this week. They argue that “it would underscore the weakness of US institutional and governance strength relative to other AAA-rated sovereigns that we have highlighted in recent years.”

In particular, Moody’s adds, “it would demonstrate the significant constraints that intensifying political polarization put on fiscal policymaking at a time of declining fiscal strength, driven by widening fiscal deficits and deteriorating debt affordability.”

Economists at Wells Fargo write that “should a shutdown transpire, there could be a negative impact of the US dollar, albeit one that is likely to be modest and short-lived.”

Gita Gopinath, first deputy managing director at the International Monetary Fund, warns of “tougher global financial conditions.” As the “fight to bring inflation back to target continues,” Gopinath says, “we expect global interest rates to remain high for quite some time,”

Furthermore, she notes, “there are reasons to think that rates may never return to the era of ‘low for long.’ This possibility is reflected in US 10-year Treasury bond yields, which have surged” to the “highest level since the global financial crisis.” In this environment, Gopinath says, “financing conditions for emerging markets can be expected to remain challenging.”

Analyst Gennadiy Goldberg at TD Securities says “overall, we view the shutdown as one of the many headwinds the economy faces this fall.” Analyst Michael Pond at Barclays tells Bloomberg that a government shutdown “will likely lead to some heightened uncertainty,” given how vulnerable Asia’s export-led economies are to “hot money” flows.

Shutdown risks are coinciding with surging oil prices and a massive strike by Detroit auto workers, both of which are exacerbating inflation risks. As such odds are Fed Chairman Jerome Powell’s team will hit the monetary brakes even harder.

Count Jamie Dimon, CEO of JPMorgan Chase, among those who believe Fed rates – in the 5.25%-5.5% range now – could go significantly higher as inflation remains elevated.

“I am not sure if the world is prepared for 7%,” Dimon told the Times of India. “I ask people in business, ‘Are you prepared for something like 7%?’ The worst case is 7% with stagflation. If they are going to have lower volumes and higher rates, there will be stress in the system. We urge our clients to be prepared for that kind of stress.”

What’s more, Dimon referenced Warren Buffett’s famous observation that “only when the tide goes out do you discover who’s been swimming naked.” As Dimon notes of more assertive Fed tightening moves, “that will be the tide going out.”

“Investors,” says analyst Paul Nolte at Murphy & Sylvest Wealth Management, “are beginning to realize that a higher for longer interest rate environment is a likely outcome and are slowly adjusting to the new normal. Higher-for-longer has been the mantra of the Fed for a few months. It is only recently that the markets have been taking them at their word.”

The irony, of course, is that the worse things get for the US fiscal outlook, the more investors flock to the dollar. That’s luring capital away from China, Japan, South Korea and other top Asian economies at the worst possible moment for Beijing, Tokyo, Seoul and beyond. Counterintuitively, big losses in US sovereign securities are increasing the dollar’s appeal.

Even before Moody’s stumbled onto the scene, global investors faced the specter of a third straight year of losses in the $25.5 trillion Treasury debt market. All the red ink reflects investor concerns about liquidity amid the most aggressive Fed tightening cycle since the mid-1990s and extreme volatility as inflation flares up across the globe.

Yet from an interest rate differential standpoint, says Nomura Inc strategist Andrew Ticehurst, the dollar’s legacy safe-haven status, America’s steady growth and high yields make for an “unusual and powerful combination” at a moment when the potential for sudden risk-off pivots abound in markets.

Another reason this appears to fly in the face of both political and financial reality: US President Joe Biden’s dismal approval ratings. As Congressional Republicans and Democrats lock horns, Biden’s low-40s support rate leaves the White House little hope of cajoling lawmakers not to shut down the government, gamble with Washington’s credit rating or pursue reforms to increase US innovation and productivity to tame inflation.

The same goes for Biden’s latitude to protect the roughly $3.2 trillion of US Treasury securities held by top Asian authorities. Those foreign exchange reserves could find themselves in harm’s way as Moody’s joins S&P and Fitch in closing the books on America’s AAA era.

Japan would be the biggest loser with its more than $1.1 trillion of US government debt. China holds $821 billion and Korea has $116 billion. Along with losses on state savings, surging US rates could devastate Asia’s biggest trade-reliant economies, each of which is navigating their own domestic debt troubles.

In China, it’s property markets and a titanically large shadow-banking sector. In Japan, it’s the most crushing debt load in the developed world made worse by a fast-aging population. In Korea, it’s record household debt undermining broader consumption dynamics.

Here, the dollar’s trajectory – and how its rally defies gravity as bonds sell off – is adding to Asia’s headaches.

Economist Jeongmin Seong at the McKinsey Global Institute says that “many Asian countries accumulated substantial foreign exchange reserves after the Asian financial crisis of the late 1990s.” In 2022, he notes, Asia accounted for 40% of global capital flows, four times the level in 2000.

“But there may be pockets of vulnerability to any sudden outflow of capital,” he explains. “In Indonesia and Vietnam, for instance, foreign direct investment accounts for 20% and 14% of total investment, respectively.”

Episodes of runaway dollar strength tend to end badly for Asia. Look no further than the region’s 1997-98 financial crisis, which was precipitated by the US Fed’s aggressive 1994-1995 rate hike cycle.

Episodes of yen volatility pose their own threat. Worries about surging Japanese government bond yields are rippling through global credit markets as the Bank of Japan hints at an exit from quantitative easing. That poses outsized risks because 24 years or zero-to-negative rates morphed Japan into the globe’s premier creditor nation.

These funds are then invested in higher-yielding assets from Brazil to South Africa to Indonesia. This giant “yen-carry trade” often explains why sharp yen moves often slam markets everywhere.

IMF economist Thomas Helbling says Asia is highly exposed on account of debt levels. “Asia’s increased borrowing in recent decades has augmented the region’s exposure to rising interest rates and heightened market volatility,” Helbling explains. “Borrowing by the region’s governments, companies, consumers and financial firms is well above levels prior to the global financial crisis.”

Trouble is, Helbling says, “highly leveraged companies face greater risk of default as monetary policies and financial conditions remain tight. Even with resilient economic growth, interest payments may exceed earnings as borrowing costs rise, reducing firms’ ability to service their debts.” Generally speaking, he adds, “corporate debt in Asia is concentrated in firms with low-interest coverage ratios.”

McKinsey economist Seong says that “some Asian economies, government, household, and corporate debt has risen by even more than the Organization for Economic Cooperation and Development average.”

Seong points out that nonfinancial corporate debt in China is 150% and in Japan, South Korea and Vietnam it is more than 120%. In 2021, Korea’s household debt reached 106% and Australia’s was 119%, against an OECD average of 60%. “Carrying this amount of leverage will be costly if interest rates continue to rise,” Seong notes.

Photo: CNBC Screengrab / Zhang Peng / LightRocket / Getty Images

On the property side, “there’s is a risk of a fall in asset prices, including real estate,” Seong says. Between 2015 and 2021, the average nominal housing price rose by 50% in China, 34% in Australia, and 17% in South Korea. Price inflation in cities is even higher. In Seoul, for example, the price-to-rent ratio increased 2.5 times in the 2015-2021 period.

At home, Biden also must ensure the stability of banks as Fed rate hikes continue. Mohamed El-Erian, advisor at Allianz, worries higher borrowing costs may cause havoc in real estate markets. “We’ve got to be really careful,” El-Erian warns. “The housing market is central to the economy.”

At the same time, the fallout from the collapse of Silicon Valley Bank in March “is casting doubt on America’s ability to maintain its leadership of the global monetary system,” notes economist Diana Choyleva at Enodo Economics. It’s up to Washington “to take decisive steps to shore up confidence, including extending dollar credit lines to a clutch of Asian countries.”

As Choyleva stresses, “it is in Asia that the United States’ global financial hegemony is being most keenly contested – by China.”

It’s hard not to think Washington’s shutdown showdown is doing Beijing’s work for it.

Follow William Pesek on X, formerly known as Twitter, at @WilliamPesek

Mazars in Singapore appoints new leaders | FinanceAsia

Paris-headquartered audit, tax and advisory firm, Mazars, announced earlier this month the appointment of new leaders across its capital markets, risk management, and outsourcing businesses in Singapore.

Chee Keong Ooi, Shireen Tan and Justin Lim have each been appointed as head of capital markets, head of risk management and head of outsourcing respectively, effective September 1.

“Effective leadership involves making timely strategic decisions that align with both the current macro challenges and our long-term vision,” Rick Chan, managing partner in Singapore and head of audit and assurance in Apac, told FinanceAsia.

The new leaders will provide regular updates on the progress and development of their respective teams to the Mazars’ executive committee, he added.

With over 20 years of experience in accounting, Ooi brings to his new role significant experience advising clients seeking initial public offerings (IPOs) and reverse takeovers via the Singapore and Hong Kong exchanges. Having been with Mazars for over 11 years, he most recently served as audit partner based in Singapore, according to his LinkedIn profile.

Chan explained that Ooi’s senior role is newly created. Among his priorities will be solidifying Mazar’s reputation and shaping the firm’s strategic direction in the capital markets sector.

“Ooi’s responsibilities span vital areas, including business development, client relationship management, team growth and development within Mazars’ capital market sector, and overseeing risk assessments for capital market projects,” Chan noted.

Mazars was the second most active firm in IPO audit services in Singapore last year, supporting two out of nine offerings and representing 36% of the S$17.9 million ($13.1 million) in funds raised in the market.

“Listing on the international market continues to hold strong appeal for investors and companies alike,” Ooi told FA, citing recent IPOs from Arm and Instacart in the US, both of which bolstered market sentiment and investor confidence.

Meanwhile, he identified market volatility and regulatory hurdles as some of the greatest challenges for Asia’s current IPO market.

“Factors like uncertainty, geopolitical tensions, and economic instability can affect market volatility,” he explained.

“Navigating regulations, compliance, and reporting standards can also be complex for companies seeking to go public.”

He added that concerns around valuation, liquidity, and exit strategies can also affect capital raising and share prices.

“For venture-backed companies, the ability to offer exit opportunities to early-stage investors and founders through IPOs is crucial,” he explained.

Risk awareness

Shireen Tan joins Mazars from PricewaterhouseCoopers (PwC), where her most recent role involved serving as senior manager, according to her LinkedIn profile.

In her new capacity, Tan will aim to foster a risk-aware culture, enhance risk identification, and implement robust risk mitigation strategies, Chan outlined.

“Effective risk management is not just about minimising potential risks or losses but also about seizing opportunities in an ever-evolving business landscape,” Tan shared in the press release.

“I’m committed to working closely with cross-functional teams to align risk management strategies with the firm’s objectives, enabling us to make informed decisions that drive sustainable growth.”

Also forming one of the key changes is Justin Lim’s appointment to lead Mazars Singapore’s outsourcing team. In his new role, Lim will be responsible for further strengthening the outsourcing capability, which is the firm’s third largest service line after audit and assurance services. Alongside his new remit, he will continue to lead the Asia-based Corporate Secretarial segment.

Additionally, Tan Shen Way and Victor Ouyang were promoted as local partner in audit and assurance, effective September 7.

¬ Haymarket Media Limited. All rights reserved.

Mazars in Singapore appoints new Southeast Asian leaders | FinanceAsia

Paris-headquartered audit, tax and advisory firm, Mazars, announced earlier this month the appointment of new leaders across its regional capital markets, risk management, and outsourcing businesses.

Chee Keong Ooi, Shireen Tan and Justin Lim have each been appointed as head of capital markets, head of risk management and head of outsourcing respectively, effective September 1.

“Effective leadership involves making timely strategic decisions that align with both the current macro challenges and our long-term vision,” Rick Chan, managing partner in Singapore and head of audit and assurance in Apac, told FinanceAsia.

The new leaders will provide regular updates on the progress and development of their respective teams to the Mazars’ executive committee, he added.

With over 20 years of experience in accounting, Ooi brings to his new role significant experience advising clients seeking initial public offerings (IPOs) and reverse takeovers via the Singapore and Hong Kong exchanges. Having been with Mazars for over 11 years, he most recently served as audit partner based in Singapore, according to his LinkedIn profile.

Chan explained that Ooi’s senior role is newly created. Among his priorities will be solidifying Mazar’s regional reputation and shaping the firm’s strategic direction in the capital markets sector.

“Ooi’s responsibilities span vital areas, including business development, client relationship management, team growth and development within Mazars’ capital market sector, and overseeing risk assessments for capital market projects,” Chan noted.

Mazars was the second most active firm in IPO audit services in Singapore last year, supporting two out of nine offerings and representing 36% of the S$17.9 million ($13.1 million) in funds raised in the market.

“Listing on the international market continues to hold strong appeal for investors and companies alike,” Ooi told FA, citing recent IPOs from Arm and Instacart in the US, both of which bolstered market sentiment and investor confidence.

Meanwhile, he identified market volatility and regulatory hurdles as some of the greatest challenges for Asia’s current IPO market.

“Factors like uncertainty, geopolitical tensions, and economic instability can affect market volatility,” he explained.

“Navigating regulations, compliance, and reporting standards can also be complex for companies seeking to go public.”

He added that concerns around valuation, liquidity, and exit strategies can also affect capital raising and share prices.

“For venture-backed companies, the ability to offer exit opportunities to early-stage investors and founders through IPOs is crucial,” he explained.

Risk awareness

Shireen Tan joins Mazars from PricewaterhouseCoopers (PwC), where her most recent role involved serving as senior manager, according to her LinkedIn profile.

In her new capacity, Tan will aim to foster a risk-aware culture, enhance risk identification, and implement robust risk mitigation strategies, Chan outlined.

“Effective risk management is not just about minimising potential risks or losses but also about seizing opportunities in an ever-evolving business landscape,” Tan shared in the press release.

“I’m committed to working closely with cross-functional teams to align risk management strategies with the firm’s objectives, enabling us to make informed decisions that drive sustainable growth.”

Also forming one of the key changes is Justin Lim’s appointment to lead Mazars Singapore’s outsourcing team. In his new role, Lim will be responsible for further strengthening the outsourcing capability, which is the firm’s third largest service line after audit and assurance services. Alongside his new remit, he will continue to lead the Asia-based Corporate Secretarial segment.

Additionally, Tan Shen Way and Victor Ouyang were promoted as local partner in audit and assurance, effective September 7.

¬ Haymarket Media Limited. All rights reserved.

DBS, UOB become latest banks to restrict app access if sideloaded apps detected on customersâ phones

NO MONITORING OF PHONE ACTIVITIES

OCBC was the first to roll out new anti-malware security measures last month, followed by Citibank on Sep 15.

The new moves aimed at nullifying the threat of malware scams have received mixed responses from banking users here, with OCBC customers taking to the local bank’s social media to express their concerns about privacy.

Asked why DBS is pursuing this security measure despite customer concerns, Mr Lam stressed that the latest security features do not monitor phone activities, collect or store any personal data.

“We are detecting the signatures of known malware or the signatures of sideloaded applications.”

DBS has done “a lot of testing” to strike a balance between security and user experience “as well as possible”, he added in an interview with CNA ahead of the announcement.

“For now, it appears (that) scam vulnerability by malware is a major issue and therefore, it is appropriate to strike the balance in favour of protection for now. If this changes over time, then we may be willing to revisit the situation,” he said.

In a press release, DBS Singapore Country Head Han Kwee Juan said: “We recognise that certain measures may add some friction to the customer journey and seek their understanding that they are necessary to ensure that they can perform digital transactions on a secured platform with peace of mind.”

UOB also sought to assure customers that its new security features do not monitor phone activities, nor collect or store any personal data.

“These features are necessary for enhanced security to mitigate the risks and protect customers’ exposure to malware scams,” said Mr Ng.

“We also seek our customers’ understanding that deployment of the features may lead to some inconvenience.”

Meanwhile, DBS also rolled out a new security check-up dashboard, which hopes to get customers into “the habit of regularly reviewing” their security settings on the banking app.

Users can already access the new feature via the app’s homepage, based on a check by CNA.

Currently, the dashboard will focus on “getting customers to strengthen their core security accesses” before being expanded to include more security features in the coming months, DBS said.

With an increasing number of customers becoming more informed and looking to safeguard their own online security, the bank has been rolling out more of such self-managed security controls.

For example, the payment control features launched in 2021 allow customers to set monthly card spending limits, and indicate their preferences for cash advances and overseas in-store transactions.

Nearly half a million DBS and POSB customers have used these payment control features.

DBS said it has been continuously sharpening its security measures in line with evolving scam and fraud typologies. Together, the new measures announced on Tuesday will add to existing safeguards, including surveillance and monitoring systems.

China, US deescalate with talks, metals concession

The newly-announced establishment of two economic and financial working groups between China and the United States is expected to help push forward a possible meeting between the two nations’ leaders in November.

The US Treasury Department said on September 22 that it will set up an economic working group with the Chinese Ministry of Finance and a financial working group with the People’s Bank of China (PBoC). It said the two groups will meet at the vice-minister level at regular intervals and report to US Treasury Secretary Yellen and Chinese Vice Premier He Lifeng.

This came after the two economic officials met in Beijing on July 8 and agreed to boost communication on economic matters.

Beijing also showed friendly gestures to the US by issuing export licenses to the China-based units of AXT, a California-based semiconductor manufacturing company, so they can export their products that contain China’s gallium and germanium, Reuters reported.

The why

“Why did the two countries set up working groups? It’s simple – they felt the pain caused by their fight, and now they are trying to ease their pain,” a Shanghai-based columnist says in an article published on Monday.

“After several years of conflicts, both sides feel that they cannot win against one another in the short run while they are facing huge risks in their own economy,” he says. “If both sides insist on challenging each other, they will be severely injured.”

He says that, although some compromises can ease pain, the hostile Sino-US relations won’t be changed easily. He says the US will continue to try to suppress China’s high technology sectors but China refuses to remain a low-end manufacturing country forever.

Compromising with each other is necessary in the short term while “beating each other is a final goal,” he says.

Not easy to change course

“Both China and the US hope to push forward a meeting between their leaders during the APEC Summit” to be held November 12-18 in San Francisco, Wang Yong, a professor with the School of International Studies at Peking University, told Chinareports, a media unit of the state-owned CICG Asia-Pacific. “The establishment of the two working groups increased the expectation that top leaders of both sides will meet again after the last meeting a year ago.”

“It’s not easy to turn around the strategic competition between China and the US in the short run. But having dialogues is better than nothing as it can help both sides to understand each other’s policy direction,” Wang said. “This also shows that rational and pragmatic voices are now on higher ground.”

“Since the US-China trade war broke out in 2018, both sides have lagged in developing a mechanism to resolve problems,” said Zhou Mi, a senior research fellow at the Chinese Academy of International Trade and Economic Cooperation. Reducing damage caused by US sanctions to the global economy “will be one of the most important tasks of the economic working group.”

Zhou also said it is necessary for both countries to discuss their macro and fiscal policies, which have been inconsistent for some time.

CHIPS Act guardrails final rule

Meanwhile, the US Commerce Department on September 22 released the final rule implementing the national security “guardrails” of the bipartisan CHIPS and Science Act, which was passed by the Congress in August last year.

The rule prohibits CHIPS funds recipients from expanding material chip-making capacity in foreign countries of concern – mainly China and Russia – for ten years, and from entering into certain sorts of joint research or technology licensing efforts with foreign entities of concern.

In August last year, the US announced a subsidy package of US$52.7 billion to boost its chip sector. South Korean and Taiwanese firms can apply for the subsidies but in exchange they would have to limit their expansion in China.

Xi-Biden meeting

Last November, Chinese President Xi Jinping and US President Joe Biden met on the sidelines of the G20 summit in Bali, Indonesia. The two countries agreed to improve their bilateral relations but their political tensions then increased in early 2023 after a Chinese spy balloon was seen flying across North American airspace.

The chip war also escalated as the US on August 9 this year unveiled new rules to restrict American funds and firms from investing in China’s high-technology sectors from 2024. Beijing also started requiring companies to apply for licenses to export gallium and germanium, raw materials of high-end semiconductors, from August 1.

In a meeting in Malta on September 16-17, China’s Foreign Minister Wang Yi and US National Security Advisor Jake Sullivan discussed key issues in the US-China bilateral relationship, global and regional security issues, Russia’s war against Ukraine and cross-Strait issues, among other topics.

The meeting was followed by the establishment of the two new working groups between China and the US last Friday.

US hawks

After a four-hour meeting between Raimondo and Chinese Commerce Minister Wang Wentao on August 28, the US and China agreed to set up working groups to handle their trade and investment disputes. It appears that Beijing wanted to set aside the chip war and focus on resolving other economic issues with the US.

This came after the US compromised on several things in August: unveiling softer-than-expected investment curbs against China’s high-technology sector; agreeing that the Netherlands can continue to ship high-end DUV lithography to China until the end of this year; and removing 27 Chinese entities from its “unverified list.”

But Washington refused to make more compromises, especially after the sanctioned Huawei Technologies launched its flagship smartphone Mate60 Pro on August 29 to show off its chip-making ability.

Representative Michael McCaul, the chairman of the House Foreign Affairs Committee, last Friday said that the requirement that US firms notify the government about their investments in China’s high-technology sectors is not sufficient.

“I’m tired of seeing our technology ripped off and being used in their weapons,” McCaul told Bloomberg News in an interview, adding that sale of high-end chips, AI and quantum computing products from US to China should be banned.

Read: China sets aside chip war, moves on with US

Follow Jeff Pao on Twitter at @jeffpao3