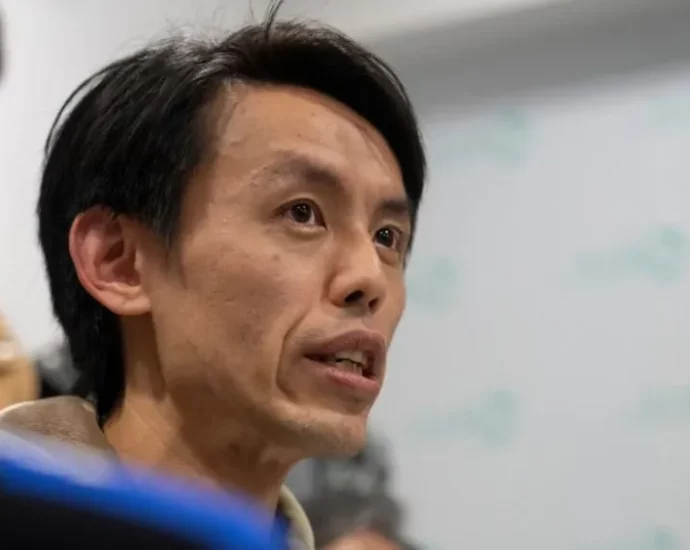

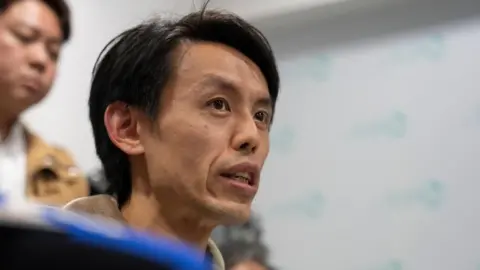

PM commits to eliminating scam gangs preying on Thais

Nearby states cooperating, problem may be taken seriously, she says

Prime Minister Paetongtarn Shinawatra stated on Tuesday that the government would continue to fight against fraud groups operating in neighboring nations that are ripping off Thai citizens until the issue is resolved.

” As long as this difficulty exists, we will not stop our work. It must be taken seriously”, she said after the regular government meet.

The prime minister also stated that she would go to Sa Kaeo county, near to Poipet, on Friday, to see the issue.  ,  ,

Ms Paetongtarn said Tuesday’s government appointment was briefed on the president’s latest goes against call-centre fraud criminals preying on Thai citizens.

Numerous people were arrested as a result of the government’s total cooperation with China and Myanmar, which had sealed the borders of 14 counties.

The Defense Ministry was collaborating closely with nations where people who had been detained while conducting raids on gangs in Myawaddy wanted to return them fast.

Thailand, China and Myanmar had even set up a mutual board for bilateral deals on dealing with cross-border violence, Ms Paetongtarn said.

The Ministry of Digital Economy and Society, which was working with the National Broadcasting and Telecommunications Commission ( NBTC ), Central Investigation Bureau ( CIB ), and state-owned National Telecom (NT ), briefed her on the removal of signal towers close to border areas, lowering the height and signal strength of others, and ensuring transmissions were only directed into Thailand.  ,

Communications from authorized SIM containers had also been checked for networking scams. Exceptionally high usage was more examined to see if it was from fraudulent sales.

The prime minister said the administrations of Thailand, China, Myanmar and Cambodia were taking the hoax problem seriously.  ,

She will travel to the border checkpoint in tambon Klong Luek, which is located directly contrary Poipet in Banteay Meanchey territory in Cambodia, close to Rong Kluea business.

She did closely examine the issue and make more aggressive efforts to eradicate the problem of scamming as soon as possible.

” As long as this difficulty exists, we will not stop our work. It must be taken seriously. We have received good responses to our efforts to solve the problem at this point, the primary minister said.

We can safely state that Thailand is taking the problem seriously and that its neighbors are also benefiting from it, Paetongtarn said.  ,