Start-ups struggle to repay loans as interest rates rise, says association representing SMEs

GETTING OFF Money

Local start-up Igloo, which specializes in keyed smart digital hair for homes and businesses, is one company feeling the heat. & nbsp,

In order to survive the COVID-19 epidemic, the company took on two mortgages, but now it faces a new challenge: repaying them.

Anthony Chow, the CEO of the company, said,” We are fortunate that we are able to give up one of our money and we’re almost done with it.”

However, in order to get our shareholders’ support to expand its maturity date, we needed to refine the other one and placed in higher interest rates.

The company grew for approximately two years because it needed money to expand its operations.

Less Chance APPETITE FOR VENTURE CAPITALISTS

Startups typically require credit in order to survive, and one method is through funding from venture capitalists( VC ).

However, VCs are reluctant to take on more risks by investing in businesses that don’t clearly show evidence of revenue growth at a time when the recessionary bell is ringing.

In terms of the macro setting environment, rising interest rates, recessionary stress, etc., there is quite a bit of uncertainty. According to Mr. Patrick Lim, Director of the trade association Action Community for Entrepreneurship, which represents neighborhood start-ups.

The size and number of deals have decreased year over year as a dangerous resource, he continued.

” In truth, based on various market research, we have observed a more than 50 % decrease in overall deals completed for the first half of the season, as opposed to the same time last year.”

A FEW HARDER Reach Companies

Learning technology is one industry that has been particularly hard hit, according to observers.

In addition to dealing with higher prices, it is also experiencing a decrease in demand compared to the pandemic, when home-based teaching became the norm.

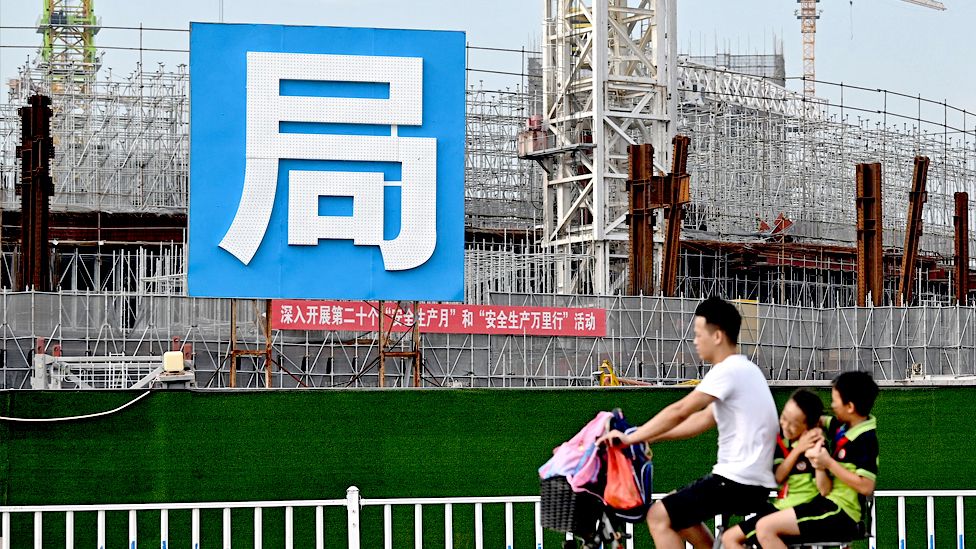

According to Mr. Jeff Ng, director of Asia Macro Strategy at Sumitomo Mitsui Banking Corporation( SMBC ) Asia Pacific, capital or resource-intensive industries will likely experience the greatest pressures because they require the heaviest debt financing. Real property and various investment-related industries fall under this category.

However, this might be advantageous for different industries, like economical services.

According to Mr. Ng, whenever there is a pattern, there are always some who gain from it and others who suffer. However, higher interest rates may ultimately cause economic growth to be below pattern for the time being.

Businesses running out of money, according to experts, will also have an effect on the supply chain, their enterprise partners, and their staff.

This is a disease or chain effect that could also have an impact on many other businesses and employees. On Wednesday, October 18, Mr. Ng told CNA’s Singapore Tonight that this can have an impact on usage and result in a general economic slump.

RESEARCHING FOR Styles

According to the industry association, in order to persuade owners of their impact, entrepreneurs must respond to styles more quickly.

It is doubling down on mentoring initiatives to help businesses swivel by assisting them in saving money and looking for opportunities to expand their operations in foreign markets.

At our ending, we look at how we can help the start-ups and see how they can evaluate their business model, assess their cost structure, and get through this trying time, according to Mr. Lim.

Igloo is addressing the cash shortage by cutting overhead costs, consolidating warehouses, and stretching every penny.

The company believes that streamlining supply chains will enable it to survive this challenging time and get back on track to achieve full-year success.

We want to prevent taking money as much as we may, Mr. Chow said,” as we think about our progress forth in 2024 and 2025.”

” In order for us as an organization to be in control of our own future, it is crucial that we enter a self-sustaining function, achieve positive cash flow, and achieve success.”

Following YEAR’S Good OUTLOOK

According to Mr. Lim, native start-ups can also prosper because Singapore receives a large portion of the funds now channeled into Southeast Asia, which means local businesses can prosper more successfully than competitors in nearby markets.

He continued by saying that investors are also more interested in industries like finance, agritechnology, ecology, and artificial intelligence, which encourages aspiring start-ups to consider cutting-edge trends and technologies.

Market participants think that while SMEs will need to continue tightening their belts in a challenging environment for the upcoming several months, the outlook for next year is better.

Overall, Singapore continues to experience extremely difficult and challenging development problems this year, so there are probably some ongoing problems. However, we anticipate some better circumstances next season than we did this month, Mr. Ng said.