Big question: Can China or the US endure greater trade war pain? – Asia Times

China continues to fight back against US tariffs, challenging the US to start a complete trade war that was stagnate both of its economies. Which country may experience greater pain, in your opinion?

Contrary to the US, China does not face elections from the president or completely property markets. This enables Beijing to endure months or years of constant pressure, making socioeconomic difficulties the result of American hostility.

In contrast, President Donald Trump’s guidelines could receive probable local support.

China is making a strategic move to protect itself, putting a bet on the US’s unpreparedness for a serious business issue that threatens international commerce. Beijing anticipates that America will struggle to deal with a potential business collapse, rising prices, and recession, which will weaken Trump’s most important technique against China, which is financial decoupling.

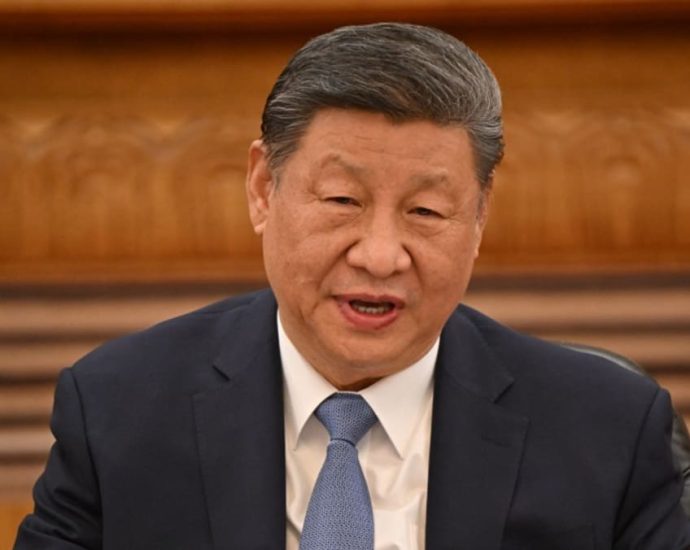

The Taiwanese economy is” an sea, not a lake,” according to President Xi Jinping. Premier Li Qiang also asserted that China is prepared to weather the trade war and won’t fall prey to US taxes during a conference with EU President Ursula von der Leyen.

China has been working on a subtle plan B for years that resembles North Korea’s self-sufficiency model. Stopping imports of US soybeans or maize, which are important creature supply, is a part of this strategy, which includes demonstrating willingness to avoid these commodities, at least partially, that some US strategists deemed crucial for China.

complicated web

Additionally, the political landscape is complex. Russia’s involvement in the Ukraine conflict is reportedly being strained by China’s sending of individuals, which could complicate any possible partnerships between President Vladimir Putin and the US.

Because its soldiers haven’t seen combat in 45 years, China’s role in Ukraine gives them valuable combat experience.

Because of political efforts, these tough decisions come with a variety of options. Trump could benefit from an Iranian nuclear deal, which would give him a diplomatic advantage, though one that might strain his ties with Israeli Prime Minister Netanyahu, who might reject any deal with Tehran.

China presents a défendable place on a global scale. Although tariffs are a response to the country’s trade surplus, Beijing has taken the lead in terms of international perceptions as a result of the US’s extreme tariff policies, which have changed that perception.

Given Putin’s reticence for peace, what are the crucial issues still to be resolved: Is the US willing to support Ukraine? Does China be resisted by an inflationary crisis? Does the US have a long-term plan for navigating this complex geopolitical landscape, which includes both economic and military conflicts, aside from business?

Without preparation, the US could suffer possible disgrace and unexpected consequences, necessitating a prompt reassessment of its position on China.

A chaotic outcome is good if Trump is never prepared. If he is, the ground will be set for a protracted and difficult deal cold war.

China has unwavering policies, but is the West prepared? What course of action does the US intend to take? Was Trump prepared for a shootout, simply carrying a carrot?

Home patterns

This political chess match features important home dynamics. My 30- to 40-year profession, if I had been an assistant to Xi Jinping, may have taught me two points: to defend my place and to second-guess my better.

Also, the group method essentially favors intellectual bias: supporting too far left with a traditional Leninist and anti-American strategy results in few or no penalties.

Leaning too far to the right, with democratic and pro-American perspectives, on the other hand, has risks because it conflicts with the party’s intellectual adversary, the Western capitalist system.

What guidance may I give the Chinese president regarding how to deal with a near-confrontation with the US? Suggesting gentle, right-leaning alternatives carries many risks. In contrast, putting forth difficult, left-leaning solutions may offer a number of advantages.

If my right-leaning plan were to be put to the test, it would be deemed a failure because it posed a threat to my job and was later adopted. In contrast, a left-leaning proposal could also show strength and tenacity for the nation if it were to fail.

An assistant is more likely to recommend robust measures and left-leaning suggestions in these circumstances as opposed to soft ones.

Additionally, if I were in the lower echelons and my communist guidance was successful, I may say credit. If it failed and Xi was in trouble as a result of internal criticism, it does offer the chance to reshape power dynamics.

Mafia economy

Trump has been accused of using a “mob manager” strategy in world markets, according to Gideon Rachman, according to Gideon Rachman. Trump, a bourgeois, was elected with the aid of tycoons who paraded at his opening, in contrast to the crowd manager, who lacks an unruly Congress, an independent press, an independent judiciary, and votes.

The royal mafia struggled to reintegrate into a bourgeois completely market system. Its main strategy involves dividing the place, levying taxes on firms, and imposing royal rules on a market-based program. When a business expands, place and taxes does become burdens rather than producing substantial profits. Capitalists are often tempted to cut corners, part the business, and become aristocratic lords, but capitalism works better than feudalism.

America’s problem lies in having much held the reins of the capitalist system and been in charge of all financial activities. Without adequate tenacity and perseverance in an attempt to cut corners and reform the market, one could lose widespread power and have it transferred to another fingers, like China’s.

As an alternative to SWIFT, China recently introduced a new economic transfer system with nations in Southeast Asia and the Middle East. Re-industrialization and managing loan are the genuine problems facing America. Although some taxes does have a purpose, a general requirement that nations negotiate with the US is misplaced because businesses operate autonomously of any bourgeois world’s power.

The strength of Wall Street is good for the US unless a would-be expert misinterprets the industry. The US has the authority to impose a significant financial and commercial reform, but it also needs a strategy to avoid going through discomfort for a while. Without it, we might be in the dark when the ancient order is no longer in effect but the novel is also possible.

Francesco Sisci, an Italian researcher and political commentator with over 30 years of practice in China and Asia, is the director of the Appia Institute, which was the source of this article’s original publication. With agreement, it can be republished.