Frugal innovation upside in a high-spend, high-tech age – Asia Times

The US and China’s high-stakes conflict or their desire to dominate artificial intelligence are two topics that are currently at the forefront of the global conversation on tech: one, the significant offers announced during US President Donald Trump’s explore to the Gulf, and two.

The wave and spread of reduced- and mid-tech technology that is improving everyday life in Asia, Africa, and Latin America is a quieter collection of evolving technology innovations and relationships that are overlooked in this narrative.  ,

The Global South currently accounts for 40 % of the nation’s economic production, and it is anticipated to account for the majority of development in the coming years. This economic development is being fueled by useful, robust solutions to pressing public needs, including financial inclusion, digital ID, and low-carbon energy supplies. Additionally, they promote unheard social participation and assistance between the South and the South.  ,

More than 40 million kilograms of greenhouse gas emissions have already been reduced in India by blending alcohol into gasoline. Mobile wealth and SMS-based services are driving financial participation in all of Africa, while online resources are modernizing fish and disease prevention.

One of the inventions competing for the Africa  Prize for Engineering Innovation is clean cooking gasoline made from recycled plastic and electricity-free consumable goods cold storage.

Unified Payments Interface ( UPI), which was introduced in 2016, accounts for nearly 80 % of India’s digital payments and facilitates billions of instant transactions. 140 million people use Pix, the Portuguese equal. According to the Atlantic Council, one in every eleven people worldwide uses Pix or UPI to send or receive payments right away.

Partner in the Global North have been a significant source of the funding for many of these advances, a feat that has decreased in recent months as a result of USAID closing and wider challenges to development finance.

China also plays a significant function, with a rumored three out of every four money going to countries participating in the Belt and Road Initiative, which includes both physical and digital equipment.

However, the funding environment is changing. Between 2020 and 2022, Masdar, the United Arab Emirates, signed agreements across Uzbekistan, Azerbaijan, Egypt, and Tanzania, almost double its renewable energy capacity.

The UAE invested US$ 110 billion in Africa from 2019 to 2023, surpassing China, the UK, and France, and it only invested$ 72 billion in solar power. By the year 2024, it had surpassed all other investors in new American firm ventures.  ,

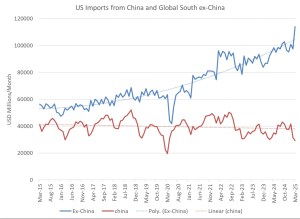

Countries in the Global South are expected to suffer from US tariffs that range from 48 % for Laos to 49 % for Cambodia, and shock figures are being assigned to South East Asian solar panel producers.

By reshaping supply chains, promoting economic restructuring, and incentivizing regional partnerships, it may unintentionally contribute to this surge in new technical partnerships across the Global South.

For instance, India has assisted Zambia in turning fabric byproducts into low-carbon electricity, focusing on affordable, low-tech solutions that help rural communities.

Numerous American nations have collaborated to create disaster risk management systems, utilizing local information and frequently using low-tech techniques like community-based early warning systems. These “frugal innovation” projects had encourage inclusive growth by addressing issues that arise in traditionally underrepresented markets.  ,

Tech participation in the Global South extends beyond capital flows; it also provides models for how nations can hatch and trade indigenous technologies that address issues that are shared across borders.

Regional relationships are expanding, placing a premium on shared technical standards and electronic equipment on which real improvements can be built, like ASEAN’s Digital Masterplan 2025 and Africa’s AfCFTA.  ,

Policymakers and company directors must pay attention to both technologies and management in order to promote this engagement. The best way forward is in split innovation strategies, which combine robust low-tech, high-impact innovations with areas of competitive edge in more innovative technologies, on the technical level.

Aadhar, whose implementation is being evaluated by other nations, is based on fairly “low tech,” but it now has an AI layer to facilitate citizen-state interactions.

Nandan Nilekani, a co-founder and president of Infosys, has argued that India should concentrate on becoming a worldwide “use case money” for AI, avoiding a target on foundation models. With this method, India’s innovators could create practical solutions that both meet local needs and are sellable to nations with similar challenges.  ,

Diversification should be proper on the policy-related front, avoiding the possibility of getting lost in an alliance that is overabundant.

The ability to choose, coordinate, and participate in forums may become more important as diplomatic technology agreements and minilaterals grow in the Global South. They ought to pay attention to the safeguards that ensure that electronic equipment and systems advance the common good.

Minilateral organizations in the Global South with an emphasis on technology business and management may be uniquely positioned to help assistance on a range of global issues, from preventing terrorist financing to promoting food security to supporting communities on the frontlines of climate change through simple cellular communications strategies. The objectives should be clearly stated.  ,

Public-interest innovation that can be cultivated through cooperative blocs has the potential to promote economic growth and support local economies. It could also increase the Global South’s geopolitical influence by positioning its nations as adept at resolving issues at the forefront of global changes.

StateUp was founded by Dr. Tanya Filer, the founder and CEO of the University of Cambridge’s Bennett Institute for Public Policy.

Dr. N. Janardhan is the research director at the Abu Dhabi-based Anwar Gargash Diplomatic Academy.