Commentary: South Korea is facing a deepfake porn crisis

ENTRENCHED GENDER BIASES

Yoon is best. The effects of this kind of digital sexual abuse can be devastating for victims because this is n’t just a prank.

Given that the incident is raging while Pavel Durov, the product’s CEO, has been arrested and charged in France for allegedly colluding with children, is the subject of a lot of blame, particularly given how well the platform is being held accountable, especially now that the platform’s CEO has been charged with child pornography. Korean officials claimed that Telegram is cooperating with the research and that it has received requests to delete articles.

However, Yoon’s words may seem dull to some given that he came to power in 2022 to win over young female voters and proposed to abolish the female equality ministry, which he claimed treated men like “potential sex criminals.”

He added that South Korea does not practice structural sex discrimination and that he made the claim that feminist was to blame for the government’s low birth rate. However, women earn some 30 per cent less than their adult counterparts, marking the highest gender wage gap in the developed world. Yet in dual-income families, people bear the brunt of housekeeping and childcare responsibilities.

Prior to the development of AI tools, advocacy organizations had been highlighting a rash of modern sex crimes, with the majority involving secret cameras or intimate photos.

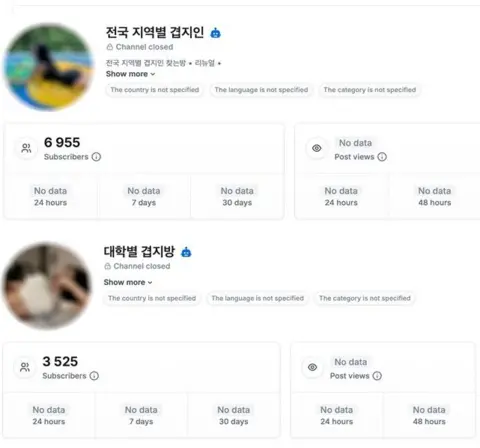

There are a number of reasons why North Korean women choose not to have children, including rising child labor force participation and the uneven burden of raising children, like their counterparts in other developed nations. This hill of incredibly disturbing data might be more important to examine than to blame feminism. Surprisingly, there were 227, 000 people of one of the main Letter groups that distributed these images, which is roughly on par with the number of babies born next year.