AC Ventures and PwC unveil corporate governance playbook for tech startups

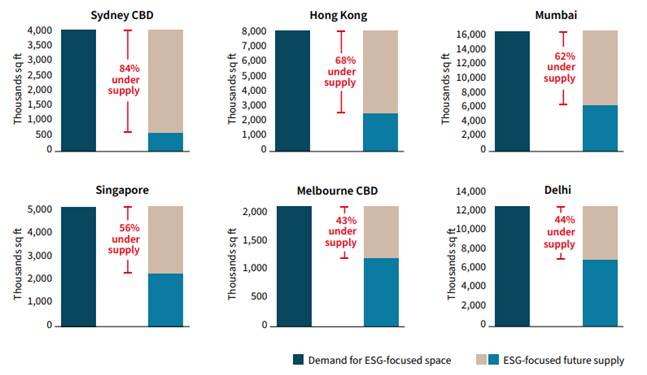

79% of investors view ESG as central to their investment calculus

Playbook offers practical advice on foundational governance principles

AC Ventures, in collaboration with PricewaterhouseCoopers (PwC) Indonesia, has released a playbook on corporate governance tailored for tech startups. Anchored in the Indonesian General Guidelines for Corporate Governance, the playbook offers actional advice on…Continue Reading