Do you still use AXS kiosks? This is why some Singaporeans can’t do without them

In Singapore, an AXS shop is a well-known view. However, whether you’ve had a job since the mid-2000s or whether you were born before or after, or whether you’ve had to give your own expenses for the past 25 years or so, will determine how well you know how they operate.  ,

According to class CEO Jeffrey Goh, the latter class accounts for the majority of calls to Press whenever a system is removed.

” There is actually a great hoo-ha.” They’ll ask their MPs ( Members of Parliament ) to “do not remove,” he continued, comparing the situation to having a store they’ve frequented suddenly vanish.

How many Singaporeans believe that AXS shops are a public good that the government runs for their comfort, according to Mr. Goh, complicating issues.

Not everyone had a pc with internet access at home when the Singapore-based company was founded in 2000. The 57-year-old recalls that post offices remained empty until 8:30 p.m. on Wednesday to allow for working adults to pay their bills.  ,

How many times do you want to operate down to the post office, best?- Having multiple bills meant several due dates.

This idea served as the foundation for AXS’s key business model, which is both bill payments and payment aggregation. The business was even given a name to resemble how “access” is pronounced.

A longer list of items you can now pay for using AXS’ services includes utility bills, phone bills, credit card bills, medical bills, road tax, income taxes, membership membership fees, school fees, traffic fines, season parking fees, car loans, shipping costs, service and conservancy fees, and insurance premiums.

The government’s digital services were being provided for the people by this, but it’s being run by a secret company, not a government initiative, according to Mr. Goh.  ,

Today, there are still about 640 AXS restaurants or facilities in Singapore, making up about 35 % of all trades. The remainder are accomplished online.

There were almost 800 AXS facilities at one stage scattered throughout the area. Mr. Goh was open to the difficulties of keeping these physical shops about; together, they cost” a bunch” in book, that is, millions of dollars.  ,

Planning UPON THE Expenses

AXS made a brief appearance in the media earlier this year when dessert financing, a financial services company, removed its Visa debit card from the transaction platform in March, less than a fortnight after the collaboration began.

Users of Chocolate debit cards could immediately earn two miles per dollar on all purchases, including those that were typically exempted from the program like college expenses, bills, and AXS payments.

However, the relationship became “unsustainable” due to the surge in bill payment, particularly from AXS, according to Chocolate founder and CEO Walter de Oude.  ,

People typically turn into AXS clients when they begin working, homeownership, and bill payments, according to Mr. Goh.  ,

Paying energy, credit cards, and telco bills are AXS’s three most well-liked activities.

According to Mr. Goh, who gladly demonstrated paying his own expenses on his phone, almost all the features at a shop can also be accessed on AXS’ m-Station software.  ,

However, even those who use wireless internet finance apps to pay their bills might be using AXS solutions without realizing it.  ,

AXS processes the bills paid through the banks ‘ own internet banking functions for 11 banks in Singapore, including Standard Chartered, HSBC, and Maybank, according to Mr. Goh.  ,

” We are the ones who provide all of these links,” the statement goes. Due to the fact that they only connect with AXS, it’s even simple for the billers, right? If not, they must communicate with 11 businesses, he said, noting that doing so increases productivity overall.  ,

Essentially, AXS makes its money by charging bank and billers costs for sorting out all the necessary trades.

A twist has been added to the proliferation of online  scams as well: some customers are returning to natural AXS kiosks because they feel more secure entering their PIN numbers and receiving a notice right away.  ,

REQUIRED FOR RECORDING

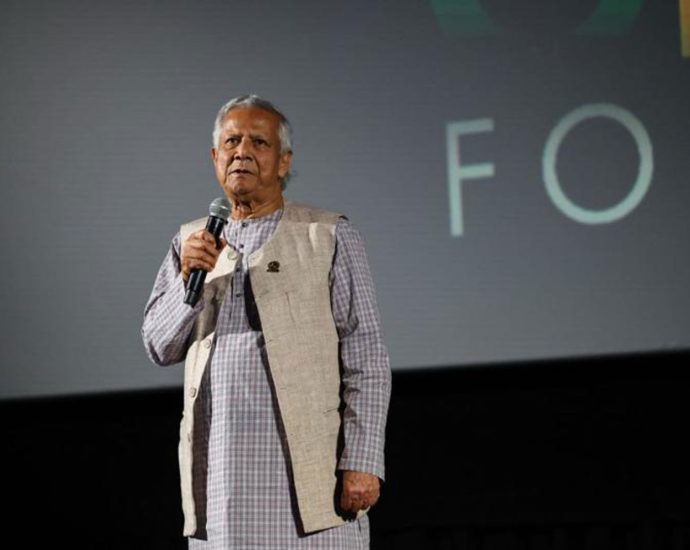

Mr. Goh was a member of the team that co-founded AXS 25 years earlier. Five years later, he left to lead the electronic payment service provider NETS, which was a DBS company.  ,

After working for Grab for eight countries on payment infrastructure, he returned to AXS as part of a deal that saw the private equity firm Tower Capital Asia seizing control of a 77.8 % stake in the business from DBS.  ,

” We need to reevaluate and completely change the business,” said Mr. Goh.  ,