Mumbai, Bengaluru, Delhi: Why it is so difficult to walk in Indian cities

Getty Images

Getty ImagesIn India, if you ask a commuter how many hurdles they’ve encountered on a road, they may not be able to count them- but they’ll definitely remind you that most roads are in bad condition.

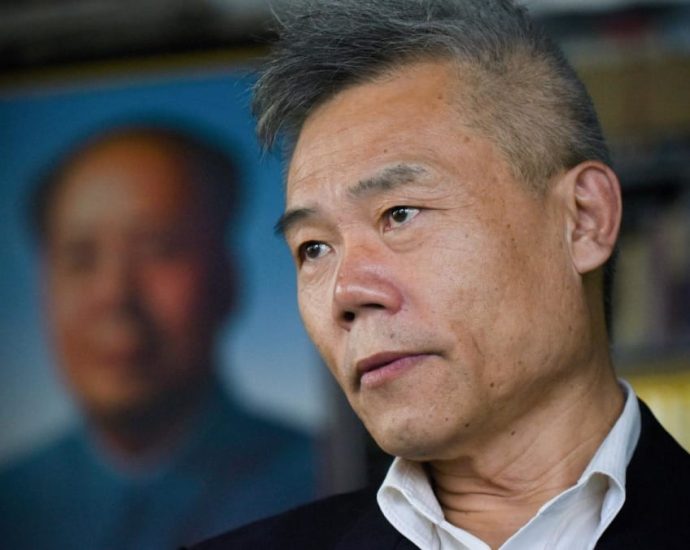

Arun Pai claims to have learned this when he began enquiring about people’s experiences while walking through Bengaluru ( formerly Bangalore ) in southern India.

This quarter he set up a “fun problem”- called the’ country’s longest road work ‘- which invited people to walk or run on an 11km ( 8 miles ) extend of footpath and make a note of all the obstacles they encountered, like hawkers, garbage or broken slabs of concrete. Then, they were asked to give a score of one to five to the road.

” When you have details, it gets easier to ask the authorities to take action. Instead of telling your local lawmaker” the trails are poor”, you can ask him or her” to correct certain places on a road,” Mr Pai says.

Mr Pai, who is the leader of Bangalore Walks, a non-profit that supports walking, is among many member protesters who are pushing to make the country’s streets more pedestrian-friendly.

In India’s money, a journey company called Delhi by Cycle has been advocating for making the city more cycle-friendly and accessible. These running enthusiasts are organizing consciousness marches, developing walking apps, and lobbying for change in the legislature.

Proper roads are rare even in India’s largest towns, and they frequently are overrun by stallholders, parked cars, and even cattle. In some places, they double up as homes for the weak.

Even today’s trails are frequently poorly maintained or built to a common. It can be difficult to navigate transportation and crowds on foot.

Getty Images

Getty ImagesLast month, Walking Project, a politician’s party in India’s financial capital, Mumbai, released a ‘ pedestrian statement ‘ ahead of Maharashtra state elections to identify the bad condition of the city’s roads and promote local politicians to take action.

In addition to reaffirming the manifesto’s demands for better parking, designated hawking areas, pedestrian-friendly corridors along arterial roads, and making footpaths more accessible for those with mobility challenges, the manifesto also included recommendations for better parking.

” Government statistics show that almost 50 % of the city’s population relies on walking, which is far greater than the 11 % that uses private transport and the combined 15 % that uses tuk-tuks and buses,” says Vendant Mhatre, convener of Walking Project.

” Pedestrians are the most underappreciated group of users when it comes to developing policies around transportation or road safety,” he continues.

According to the latest government estimates on road accidents, pedestrian fatalities were the second-highest after those of two-wheeler riders. In 2022, over 10, 000 pedestrians lost their lives on national highways across the country, with around 21, 000 more sustaining injuries in accidents.

Authorities frequently use band-aid techniques to stop road accidents, such as installing speed bumps or providing a signal. But what is really needed is inter-connected footpaths that can accommodate high footfall,” Mr Mhatre says.

According to research, addressing the issues of this forgotten group of road users can benefit a number of parties.

In 2019, researchers in the southern city of Chennai studied the impact the construction of new footpaths on 100km (62 miles) of the city’s streets had on the environment, economy and the health and safety of citizens.

They discovered that the new footpaths promoted walking among 9 % to 27 % of those surveyed, which reduced particulate matter and greenhouse gases. Additionally, they discovered that women and lower-income groups had new opportunities thanks to the footpaths, which also helped them save money.

The survey highlighted how accessibility and equity might be improved because people with disabilities and women might have nuanced requirements for footpaths.

Getty Images

Getty Images” Very often, people do n’t have a benchmark for footpath quality, especially if they have n’t travelled abroad or been exposed to places that have good facilities for pedestrians,” Mr Mhatre says. He argues that this is the cause of the country’s lack of footpath quality.

He adds that the majority of people view walking as an exercise or leisure activity. And so do they think about the infrastructure that comes with walking through parks or walking tracks. In reality, however, people walk to various destinations daily, so the scope of walking infrastructure is far broader.

It’s high time our leaders gave walking infrastructure as much thought as it does public transportation, according to Mr. Mhatre, because it’s the most economical and environmentally friendly way to navigate a city.

According to Geetam Tiwari, a professor of civil engineering, the main issue is that too much attention is paid to reducing road congestion caused by cars.

” To improve the flow of traffic, authorities often narrow down footpaths or eliminate them entirely,” she says. This approach, according to Ms. Tiwari, is problematic because it makes it difficult for pedestrians to use public transportation, such as buses and metros, which can relieve traffic pressure.

She claims that allowing the congestion to continue and concentrating on improving the infrastructure for pedestrians will ultimately help solve the traffic issue.

Ms. Tiwari also contends that the federal government should require states to adhere to the recommendations made by the Indian Road Congress, a national organization that establishes standards for road and highway design.

She says that cities can also implement their own Non-Motorised Transport Policy (NMTP) to create better infrastructure for cyclists and pedestrians.

It’s time more cities step up and experiment with a NMTP, she says, but only a small number of cities in India have done so so far.

Follow BBC News India on Instagram, YouTube, Twitter and Facebook.

The 2025 resources is full of opinions and observations. What else can I contribute to what has already been said, then?

The 2025 resources is full of opinions and observations. What else can I contribute to what has already been said, then?