Trump’s trade beef more with Global South than China – Asia Times

As Donald Trump gears up for his big trade battle with Xi Jinping’s China, is the US president fighting the wrong economic war?

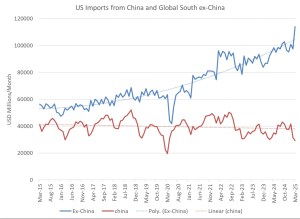

A perusal of Federal Reserve data shows, rather convincingly, that the US now imports roughly four times as much from Global South nations, ex-China, than from Asia’s biggest economy.

In March, for example, the US imported about US$29.3 billion worth of goods from China and $114 billion from the Global South.

This is no aberration, as the accompanying chart shows. US-bound shipments from Latin America, Africa, Turkey, India, Vietnam, Indonesia, Malaysia, Singapore, the Philippines, Thailand and elsewhere are, taken together, increasingly bigfooting those directly from the mainland.

Caveats abound, of course. The magnitude of indirect trade passing through third countries and re-exported to another is literally off the charts. The nature of modern-day supply chains is that economies like Mexico or Vietnam use Chinese components in their wares, which are then put on tankers to American shores.

Even so, the extreme bilateralization of trade as a foundational concept in the Trumpian mindset unravels, circa 2025, when you look at the biggest sources of US trade flows. It’s a reminder that Trump’s economic strategy is ripped from the pages of the mid-1980s.

The rationale behind Trump’s tariff policies dates back to a time when the five most industrialized nations held vast sway over economic dynamics. His obsession with a weaker dollar is inspired by a deal struck 40 years ago in New York’s Plaza Hotel, an iconic property Trump owned for a while. His tax priorities have critics linking them to the “trickle-down economics” era.

The problem with a US leader having his head stuck in 1985, aside from the obvious, is that “Made in China 2025” is upending the global economy now. And at a moment when China is investing in where it thinks the world will be in 2035. This goes, too, for a Global South that’s increasingly forging its own path – one that barely factors in where the US might fit in a decade from now.

“The world economy is splitting into competing groups instead of a single connected system of globalization of the 1990s,” says Gilles Moëc, chief economist at AXA Investment.

So, despite what Trump appears to believe, nothing he does with tariffs is going to shrink cross-border trade. What Trump World missed is that “instead of bringing production back to the countries where products are used, global companies have been reorganizing their supply chains around groups of countries or “clubs with similar values or security concerns.”

Moëc adds that “this rejig is a diluted version of globalization but can still keep the wheels moving. As long as clubs include both low-wage nations and high-spending economies, the adverse effects of fragmentation – such as inflation and lower efficiency – could be mitigated.”

Now that Trump seems to have segued from pushing tariffs to pushing Boeing planes and American semiconductors, the hope is that his assault on China Inc is losing momentum. But the reordering of global trade dynamics, evidenced by Fed data, suggests the Trump administration is firing tariffs at the wrong economic foe.

That is becoming even truer as traditional US allies like the European Union pivot to where the real future growth is.

“China is likely to double down on ties with the Global South and Europe, the latter now its most crucial market given its purchasing power and relatively restrained trade stance,” says Lauren Gloudeman, analyst at Eurasia Group.

Of course, China’s ability to reroute exports from the US to Europe will probably be quickly curtailed by forthcoming EU measures to prevent dumping by other countries,” Gloudeman notes. Still, this is trade that Trump is leaving on the table with policies that look backwards, not to the decade ahead.

Trump doesn’t have a monopoly on Panglossian views of the future. The Chinese side can also go too far with half-glass-full takes on the magnanimity of Beijing’s policy mix. Or the Chinese economy’s perceived invulnerability.

Take Yang Guangbin, international relations expert at Renmin University, who argues that “unlike the order brought to the world by the rise of the West, the new form of human civilization created by Chinese modernization will be shared development rather than beggar-thy-neighbor, common security rather than security dilemmas and civilization mutual learning rather than civilization conflicts.”

In Yang’s view, China’s policy priorities “set an example for Global South countries to independently and autonomously move towards modernization and will inevitably be emulated by some countries.”

Perhaps, but even BRICS nations — Brazil, Russia, India, China and South Africa — compete far more amongst each other than they cooperate. Yet, at the same time, the more Global South to Global South trade there is, the less there might be old-school trade with big roles for US companies.

As Fabian Zuleeg, chief economist at the European Policy Center, notes, multipolarity is often linked to countries aligning flexibly with other powers, rather than being forced into camps, or worse, becoming unwilling parties in a cold war or open conflict between superpowers.

“On one level,” Zuleeg says, “multipolarity is a description of the emerging global landscape. It also reflects the justified dissatisfaction with the global economic and governance system that was designed, and has been dominated by, the West, led by the US. This system is neither fair, nor is it underpinned any longer by the support of the US, let alone of the Global South.”

However, he stresses, “multipolarity is not an ordering principle, especially if it lacks a clear plan for reformed and inclusive international organizations able to define jointly acceptable rules, allowing for the peaceful mitigation of conflict.”

Yet Aparna Bharadwaj, managing partner at the Boston Consulting Group, adds that the US takes the Global South for granted at its own peril. She points out that global attention lately has fixated on the challenges and tensions fracturing the Western-led world order, such as “America First” policies, the fraying of decades-old alliances, dramatic US tariff increases on all its global trade partners, and Europe’s struggle to remain competitive.

“Less-noticed,” Bharadwaj says, “has been a development with perhaps even greater long-term implications for the global economy—the rise of a ‘third front’ on the world stage spanning more than 130 nations outside the orbits of the West and China and that accounts for more than three-fifths of global population. Nations in the Global South … are emerging from the shadows to craft their own paths in a multipolar world.”

And that world is now, collectively, becoming a bigger trading force for the US than the one over which Trump obsesses. This linear focus, of course, also dates back to the 1980s. Back then, it was Japan that Trump accused of exploiting US workers. Now it’s China in the role of economic bogeyman.

One could look at the destination of the first overseas trip of Trump’s second presidency — the Middle East — as a sign of situational awareness. But Trump family business seems to be the main objective of this Gulf tour, not spreading America’s economic wings.

The good news for the global economy is that Trump is retreating on tariffs, at least for now. “The transition from tariff rates, retaliation and ultimately to trade deals is an important sequence for the recovery in US equity markets,” says Adam Turnquist, chief technical strategist at LPL Financial.

And the recovery in global markets, too. But Trump can’t be happy about the dominant narrative that he blinked on his ballyhooed trade war. Nor is he likely to sit quietly as Xi’s government fails to offer loads of trade concessions in the days and weeks ahead. The odds are still high that “Tariff Man” returns, wreaking fresh havoc in stock, bond and currency markets around the globe.

The dollar is of particular concern as the US national debt races toward $37 trillion and Team Trump angles for more tax cuts. Markets worry, too, about Trump’s assault on the Federal Reserve’s independence.

And his musings over time about engineering a weaker dollar. As Trump continues to do his worst to trading partners and foes alike, the dollar’s future as the top reserve currency is becoming more and more wobbly.

The market is “re-assessing the structural attractiveness of the dollar as the world’s global reserve currency and is undergoing a process of rapid de-dollarization,” says Deutsche Bank economist George Saravelos. “Nowhere is this more evident than the continued and combined collapse in the currency and US bond market” in recent weeks.

What’s not collapsing, though, is US trade, thanks largely to the Global South, ex-China set. If Trump wants to boost US exports, he might want to start looking to the world that exists beyond China.

Follow William Pesek on X at @WilliamPesek