US-China: ‘Cold War 2’ or something worse – Asia Times

Most of Washington finally realizes – even if grudgingly– that the People’s Republic of China ( PRC ) is a threat.  , However, President Trump’s problem resembles that of Ronald Reagan taking over in 1981 from a foolish leadership that allowed America’s primary opponent to get the advantage.

It appears to be another Cold War, similar to the one that the US and the Soviet Union experienced between 1945 and 1991.

If we refer to it as” Cold War 2″?

Often speech matters, and sometimes it doesn’t matter.  , In this case, it doesn’t.  ,

For example, a big part of the American population , wasn’t also born when the Cold War ended in 1989.  , The manifestation didn’t appeal.

Even more, the Chinese don’t distinguish between” cold” war or any other type of war. To the Chinese Communist Party (CCP), war is war. The absence of shooting ( going “kinetic” ) doesn’t mean it’s not a life-or-death fight. Whatever goes.

The Soviets doesn’t had dared to use fentanyl to shoot well over half a million Americans during the Cold War, as the PRC has done for the past ten years.

When confronted with the proof of their “drug battle” against America, the Taiwanese hardly shrug.

Unlike the Cold War

The US and the USSR battled each other during the Cold War, but this time around, the PRC was at odds with them.  ,

China, unlike Russia, had probably dominate and beat the United States. Probably never tomorrow, but wait a decade or two.

Given the nature of the regime that underlies it and the PRC’s economic clout, the People’s Liberation Army ( PLA ) poses a greater military threat than the Soviet military.  ,

The US did small business with the Soviet Union because it was not a powerful financial strength in any way.  ,

China, on the other hand, is a world power thanks to the US funding and development invested in over the past four decades and the poor PRC’s inclusion in the World Trade Organization.

And, worse, the United States is extremely if not dangerously dependent on Chinese production, proper nutrients, components, pharmaceuticals and much more.  ,

Yet the supply chains of the US military are firmly anchored in the PRC. With the Russians, that would have been impossible, and there was a strict COCOM trade control system to prevent the Soviets from obtaining US and Western technology.

And the US record of the Chinese aristocracy is far worse than something the Russians have always accomplished. How effective?  , Regard the preceding Chinese-origin fentanyl.

What retribution has Beijing received from Congress or any other government for this widespread death?  , Nothing.  , Such is the strength of America’s “donor” group over Capitol Hill.

And then there are Russia’s and China’s regional targets. Russians never truly believed they could fight the US until around the 1970s. China considers it capable.

However, Xi Jinping regards America as the primary barrier to the Chinese’s ascendancy abroad, and as a barrier that needs to be eliminated.

Russia and its supporters are another distinguishing factor between the 1990s and the present. The Eastern Bloc was able to wreak havoc, especially through usurpation and by supporting extremist and rebel parties. However, as long as the US kept its muscle, it never really threatened America or its place in the world.  ,

China, on the other hand, has ties with Russia, Iran, North Korea, Venezuela, Cuba and several other states that taken together can cause significant problems for the US and its companions.

Their corporate goals then coexist, while the United States allowed its economic might and threats to fall after it “won” the second Cold War in 1991.

America’s lovers are in even worse condition.

Regarding the” plane of chaos,” Russia would not have been able to pursue its assault on Ukraine without the assistance of China, Iran, and North Korea as much or as successfully as it has.

And there is a legitimate worry that as North Korea and Russia support the United States ‘ exit from East Asia, they will seize Taiwan.

America’s answer

Trump is aware of the dangers the PRC poses to us, despite his frequent use of constrained language.

His major national security officers, Mike Waltz, Marco Rubio, Pete Hegseth and another, recognize the PRC risk.  , They believe in “peace through strength” . ,  ,

Whether another officials – especially so-called “restrainers” and promoters of  ,” cooperation spirals” with China who are strangely showing up in the administration – will gum up the works is vague and troubling.

The Cold War is now worse than what we currently face.  , One almost waxes nostalgic.

Instead of pondering the current struggle, it’s more crucial to comprehend and articulate the PRC’s threat and the need to vehemently defend the United States and its interests.  ,

No one has done that, or at least no one has persuaded most Americans to do it well.

And don’t just talk about the problem. Find senior officers who can fight and win wars and strengthen the US military ( including eradicating DEI ).  ,

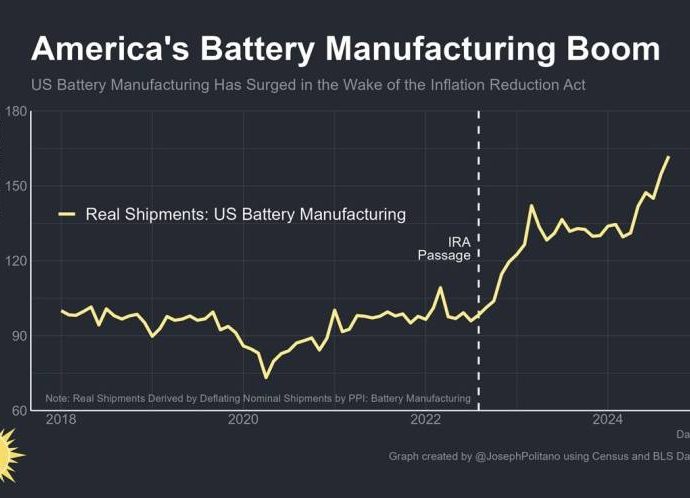

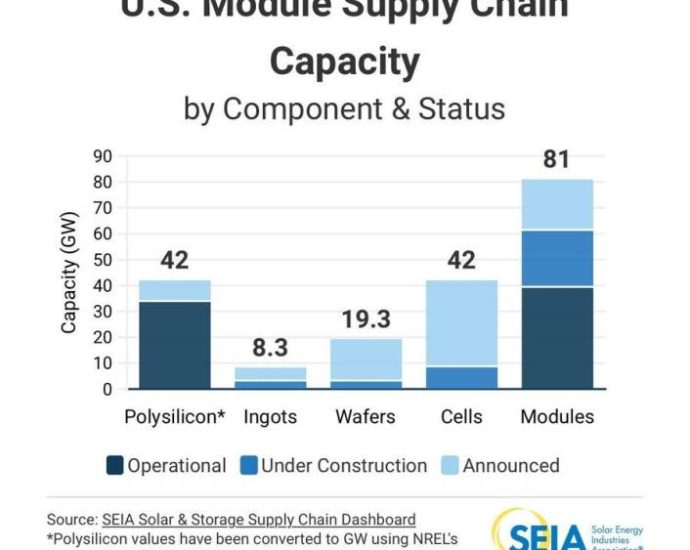

Instead of spending like drunken sailors and debasing the US currency and global trust in it, restore America’s industrial and manufacturing base, and get America’s finances in order.  ,

Pressure China where it is vulnerable. Xi tells us:  , Trade, technology, human rights, regime legitimacy, a currency that few people want and high-level corruption – Xi’s included.

Stop providing the technology and convertible currency that have developed the Chinese military and economy.  ,

Wean ourselves away from the China market quickly and without delay.  ,

” Decoupling” is essential.  , Let the world develop into a “free world” trading bloc alongside another bloc for the’ unfree’ countries.

China is the main enemy.  , Defang it, and then Russia, Iran and North Korea are relatively easier to handle.  , In the meantime, apply comprehensive pressure on all of them and don’t let up.

There is no tentative agreement to be reached with the Chinese Communist Party.

What matters is to triumph in the conflict we are currently in.  ,

Lose it, and it will not matter what its name is.