Moody’s downgrades outlook on China credit rating over debt fears

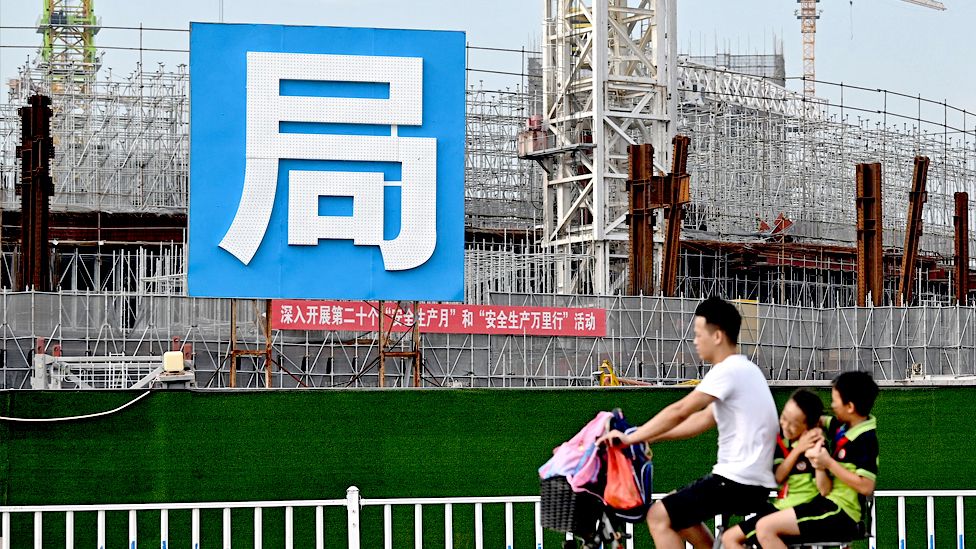

BEIJING: The outlook on China’s credit rating in the second-largest economy was downgraded from” stable” to “negative” on Tuesday ( Dec 5 ) by Ratings agency Moody. China’s post-pandemic treatment has been hampered by a persistent housing crisis, high rates of adolescent unemployment, low consumer and business trust, as wellContinue Reading