China to play starring role in coming US election chaos

Japan- US Republicans intensified their calls for President Joe Biden to maintain a strict stance on China in the final weeks of 2023.

Of course, Biden is far ahead of the group that Donald Trump, his father, hopes to win in November. Beijing’s access to technology essential to sharpening its financial and security activity has been constrained by Biden since January 2021.

However, the renewed attention on China serves as a sobering reminder of the crucial responsibility that Asia may play—and not in the best way—in the upcoming US elections.

The only issue that Biden’s Democratic Party and Trump-supporting Republicans can agree on is blaming China and Asia in general for the financial problems facing America.

As a result, the area will become the political focal point of choice for progressives, conservatism, and the dwindling number of reformers in Washington this time.

According to David Kelly, a worldwide planner at JP Morgan Asset Management, all of this raises significant economic difficulties. His “base case forecast” for the US in 2024 states that there will be” 2 % growth, 0 % recessions,” 2 % inflation, and 4 % unemployment.”

However, Kelly adds,” It should be acknowledged that there are numerous possible threats to this outlook.”

The “lagged effects of higher interest rates and very important political pressure” are among “many possible risks to this perspective,” Kelly adds, in addition to the US vote. Any of these problems, or something completely different, could lead to a US economy’s slow-growing crisis.

Before the November 5 vote, that something else might be social body sport.

With his Republican party’s fresh” axis of evil” tale, which has been expanded from the previous Iran, Iraq, and North Korea gathering to contain China and Russia, Trump threatens everything from trade restrictions to military activity to even the cancellation of US debt held by people of those countries.

Trump has stated that he will “enact extreme new restrictions on Chinese possession” of a wide range of US assets, prevent Americans from investing in China generally, and gradually phase in the importation of important Chinese-made goods, such as electronics, steel, or pharmaceuticals.

At a new campaign rally, Trump declared,” We will impose harsh sanctions on China and all other countries as they abuse us.” Additionally, he just vowed to enact” a daring series of measures to totally eradicate dependence on China in all crucial areas.”

When then-presidential candidate Trump said to CNBC in May 2016,” I would use, knowing that you could make a deal if the business crashed,” he shook the world’s debt markets. And it was fine if the business was strong. Therefore, you ca n’t lose.

Trump’s team hurried to clean up after claiming that the debt supporting the reserve currency was n’t something he was thinking about defaulting on. However, the Washington Post detailed in May 2020 how Trump’s inner group wanted to put pressure on the China trade conflict by using Treasury stocks.

After Japan, China holds the second-largest amount of US Treasury stocks worldwide. Critics point out that Biden himself crossed a fiscal red line by freezing some of Russia’s foreign exchange reserves in response to the so-called “weaponization” of the money, which was the invasion of Ukraine by Moscow.

However, Team Trump has already begun describing how chaotic his upcoming management might be in a second name that may start in January 2025. This might involve a power grab by the professional unit that strips Congress of control over American finances.

Additionally, a Trump 2.0 administration do make sure to scale back Biden’s work to limit Chinese access to US technologies, including high-end electronics, to 11. Additionally, Trump may try to make amends with businesses that resisted his first-term policies.

Economists at Union Bancaire Privée contend in a note to clients that “big tech could face heightened scrutiny, while industries like conventional power may benefit from swings in revenue and regulatory responsibilities.”

Biden, also, might stir up the anti-China sentiments to rekindle his depressing surveys figures and deflect criticism of his son Hunter.

Republicans are adamant about proving their claims that Biden’s home engaged in influence-peddling and shady dealings involving Chinese businesses in addition to conducting business in Ukraine. The US House Oversight Committee  held a number of sessions about Hunter Biden starting in February 2023.

According to this theory, Republicans are conducting an formal impeachment investigation. The Communist Party of President Xi Jinping is President Biden’s best line of defense against this China-profiteering conversation, according to experts in Washington.

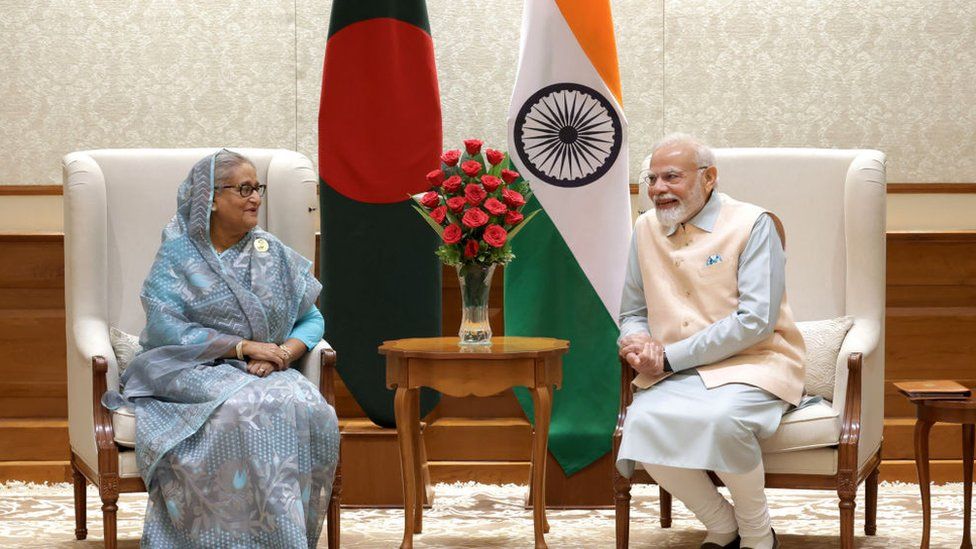

Following Biden’s much-anticipated conference with Xi in San Francisco in November, their first conference in a year, doing so would run any hope for an Sino-US detente. After the US allegedly shot down a Chinese detective bubble in February, relations soured.

Biden and Xi vowed to resume military-to-military connections in the midst of rising conflicts over Taiwan and China’s reassuring of Russia.

To prevent “vital miscalculations on either side” that could result in accidents, Biden stated that “open, clear, strong communications” should be the top priority. Xi pledged to maintain” secure, healthy, and green” ties with Washington at the time.

As the island holds presidential and parliamentary elections andnbsp on January 13, democratic elections that are putting Beijing’s compassion with talk of freedom to the test, the Taiwan issue may take center stage.

According to Rick Waters, an scientist at the Eurasia Group,” US-China relations remain necessarily competitive, and stabilizing work will continue to be vulnerable to both near and unexpected stresses in the year forward, including presidential , election&ndspp, elections in Taiwan and the US.”

Perhaps the last thing China wants is more industry tension. Foreign direct investment in China soared for the first time in years in 2023. Some of the unfavorable sentiment stems from worries about the ability of investors and international companies to respect audits and other fundamental due diligence.

Xi and Premier Li Qiang have increased their efforts to reform the private business as a result of the flows. However, as 2024 approaches and Beijing announces a new crackdown on China’s digital economy, foreign investors are unsure of how to feel about the rise of Asia.

This also applies to Washington. No world president, according to Biden, may enjoy switching areas with Xi. After all, the president of China must deal with a weakening economy, an intensifying housing crisis, high rates of adolescent poverty, and difficult Taiwanese policy. Additionally, Biden questions whether these competing pressure may produce Xi’s gathering more dangerous.

Others believe that a more intense monetary policy is possible. Kelvin Wong, an analyst at OANDA, advises keeping an eye out for potentially more generous fiscal and monetary policy trigger actions that may lift good creature ghosts in the small to medium term for nbsp, China&nBSP, and Hong Kong stock markets.

If China is given an even bigger composite position prior to the November elections, that becomes more difficult. Eastern exchange costs will undoubtedly take the lead in this situation. And this also applies to Japan.

The japanese performed the worst among the 10 wealthy countries in 2023, falling 9 % for the next year in a row.

The Treasury Department of Biden came to the conclusion that no significant buying companions were influencing exchange rates in November. That was true even though China, Vietnam, Malaysia, Singapore, Taiwan, and Vietnam were added to the Treasury’s waitlist.

The loss of Treasury Secretary Janet Yellen to criticize China’s monetary system infuriated some Republicans. Of course, one may counter that a weaker renminbi is entirely consistent with economic underpinnings given China’s problems. Maybe Yellen was concerned about the implications of attacking China without specifically targeting US supporter Japan.

However, if Biden wants to support his anti-China bella credentials, all bets might be off here as well. Particularly as Trump, the presumed Republican candidate, changes his strategy to more directly challenge Biden’s Asian history.

The worst problem of Japanese Prime Minister Fumio Kishida might be this. Shinzo Abe’s international minister at the time the later Japanese head bowed to Trump was Kishida. Abe was the first earth president to rush to Trump Tower in New York in November 2016 to speak with the incoming US leader.

Trump imposed onerous taxes on steel and other essential commodities, giving Abe nothing in return—not perhaps a pass for Japan. Socially, Abe was hurt by the imbalance in their “bromance.” The fact that the erratic US president essentially had three friends in international management lines: Vladimir Putin, Kim Jong Un, and Abe infuriated the Tokyo creation. Speak about a poor appearance.

In fact, Kishida has courted Biden, endorsing Washington’s strict stance on China and Russia and providing support to Ukraine, including traveling to Kiev to join with President Volodymyr Zelensky.

The possibility of a Trump lost in November has Kishida’s group somewhat hedging its wagers. As a result, Kishida took time out of his busy schedule in April to match with Florida governor Ron DeSantis, who was trying to out-Trump Trump.

The Tokyo creation, however, has little interest in a Trump 2.0 White House after witnessing the panic of his first name and how it strengthened Pyongyang’s nuclear ambitions.

Yet, both Biden and the Republicans may be careful not to overextend themselves. The US federal debt reached a record high of$ 34 trillion in 2023.

That dubious breakthrough occurred just weeks before Congress’s deadlines to approve new federal funding plans and 51 times after Moodys ‘ Buyers Service threatened to remove Washington from its final AAA credit rating.

Whatever the outcome, experts at Goldman Sachs predict that” US votes could result in a more financially expansionary results,” another possible catalyst for higher bond yields.

Unchecked governmental spending, as well as more deficit growth, could” cause a rise of inflation, challenging the Fed’s control over the economy,” according to analysts at UBP.

A judgement on the Trump tax cuts is “one option Congress may encounter at the end of 2025,” according to Bank of America academics. Congress did not stretch the Trump tax cuts if it is sincere about reversing the exceedingly unsettling path of debt to gross domestic product.

BofA claims that while this “would n’t get enough fiscal adjustment to correct the current trajectory,” it” will likely be the first real test of Congress ‘ handle around the increasingly untenable fiscal path.”

All of this is reaching a nose as concerns about the US dollars continue to rise. It might not get much to enrage Xi’s people in Beijing into selling their holdings in the US Treasury.

Chaos would ensue if industry learned that China was selling sizable chunks of its$ 860 billion in debt to the United States. Markets could be destroyed by even word that Tokyo is refusing to increase its$ 1.1 trillion in Treasuries.

But, as the next 306 days go on, Asia will undoubtedly be dragged more and more into the most contentious US election in history, critically and uncomfortably at a time of greatest worry for the world economy.

Following William Pesek on X, previously Twitter, at @WilliamPess