Central bank: Rate cuts not a quick fix for sluggish economy

Falling prices driven by government subsidies, not deflation

PUBLISHED : 15 Jan 2024 at 11:17

Thailand’s “uneven” economic recovery cannot be fixed only by adjusting interest rates, the central bank said on Monday, hitting back at the government’s calls to ease monetary policy to help revive sluggish activity.

Bank of Thailand (BoT) assistant governor Piti Disyatat said at a briefing its rates were already very low compared with global rates and that cutting them would not help an economy being battered by external factors like slowing global demand.

“The fact that the economy has not recovered comprehensively, these are all things that monetary policy cannot easily solve as a quick fix because many things require treatment that matches the root of the problem,” Mr Piti said.

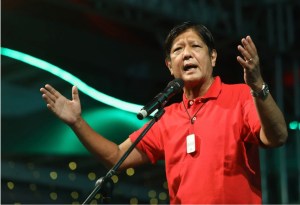

His comments came after Prime Minister Srettha Thavisin last week met with central bank officials to urge them to cut the policy rate, which is at a decade-high of 2.50%. The central bank left its policy rate unchanged in November after raising it by 200 basis points since August 2022 to curb inflation. It will next review policy on Feb 7.

Mr Srettha, who is aiming to kickstart the economy with a raft of stimulus measures, has said people and businesses were “suffering” from high rates, while his deputy has said the central bank’s rate increases were “a bit too fast, too aggressive”.

Headline inflation has been negative for three consecutive month through December, when it came in at -0.83%, making it the eighth straight month that it was below the central bank’s target of 1% to 3%. In November, the BoT forecast headline inflation of 2.0% this year and 1.9% in 2025.

On Monday, Mr Piti said falling prices do not indicate deflation and that negative inflation is being driven by government subsidies. Growth is expected to be more balanced in 2024, while inflation is seen being negative until February but should be within target this year, he added.

Prime Minister Srettha has said the Thai economy, driven in large parts by manufacturing, domestic consumption, exports and tourism, is in crisis. In response, his government has rolled out measures such as debt suspensions for farmers, a minimum wage hike, and a signature $14.3-billion handout scheme.

“Interest rates cannot give us more sophisticated, high-tech exports or the ability to increase the attractiveness of tourism,” Piti said on Monday The BoT wanted the key rate at a neutral level and is ready to adjust its monetary policy stance if the economy changes, he said.