Joko Widodo: From promising democrat to Indonesia’s kingmaker

Getty Images

Getty ImagesMany had said it was Joko Widodo’s “man of the people” image that helped score his first presidential victory in July 2014.

The former furniture salesman was Indonesia’s first leader from outside the political and military elite. His decisive win was propelled by people’s frustrations with corruption and nepotism in the country’s young democracy, which is also the world’s third largest.

When he was first became president, Time magazine hailed him as “the new face of Indonesian democracy”.

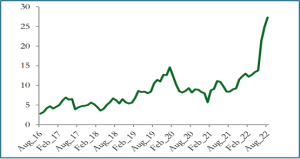

Under the 62-year-old, Indonesia’s GDP grew by a cumulative 43% since he entered office with the country also seeing a boost in infrastructure.

And even as he is about to step down he remains hugely popular, enjoying consistently high approval ratings of more than 70% – turning from a once fresh-faced figure to a powerful kingmaker.

But the enviable legacy he is leaving behind has been somewhat marred by a perceived attempt to build a political dynasty through his eldest son.

Rise to power

Mr Widodo was born in 1961 in the city of Solo to a family of wood sellers, who lived in a riverside shack until they were evicted by the local government.

He first entered politics with the Indonesian Democratic Party of Struggle (PDI-P) in 2005 when he was elected mayor of Solo, a city in central Java.

In 2012, he was elected the governor of Indonesia’s capital Jakarta with a resounding victory. He grew in popularity as a grassroots leader who was able to empathise with the poor.

Barely two years later, Mr Widodo was elected president. He made anti-corruption the mantra in his campaign and championed meritocracy.

This video can not be played

To play this video you need to enable JavaScript in your browser.

In a country marred by dynastic politics and corruption, many Indonesians saw him as a revolutionary.

“In 2014, there was a slogan, ‘Jokowi is one of us’. He was not a typical Indonesian politician,” said political analyst Firman Noor from Indonesia’s National Research and Innovation Agency.

“Everybody had high hopes for a better democracy,” he said.

Mr Widodo’s administration had a somewhat shaky start, rushing into some policies only to backtrack on them later.

Over the years, he built a strong track record on economic growth and infrastructure development. His infrastructure push produced 16 new airports, 18 new ports, 36 dams and over 2,000 kilometres of toll roads. Indonesia is expected to overtake Russia and the UK to become the world’s sixth largest economy by 2027, according to IMF forecasts.

All these while remaining close to the ground. One of his political trademarks, known in Indonesian as “blusukan”, involved impromptu visits to connect with the people and listen to their needs and grievances.

A controversial decision

But this one-of-us image lost some of its sheen.

Mr Widodo revived the death penalty for drug traffickers shortly after entering office. Fourteen people were executed within six months of his election amid international outcry.

For his re-election bid in 2019, Mr Widodo again raised eyebrows by picking Islamic cleric Ma’ruf Amin as his running mate.

His second stint in office saw him appointing controversial ex-general Prabowo Subianto as defence minister. Mr Prabowo, who was Mr Widodo’s bitter opponent in the past two elections, has faced allegations of human rights abuses. Rights groups said the appointment marked a “dark day” for the country.

Mr Prabowo is now the frontrunner for next Wednesday’s elections. His running mate is none other than Mr Widodo’s eldest son Gibran Rakabuming Raka.

Mr Widodo has not openly endorsed any candidate, but has appeared at Mr Prabowo’s campaign events. Analysts said this has widened tensions between Mr Widodo and his own party. The PDI-P’s candidate Ganjar Pranowo was previously seen as Mr Widodo’s shoo-in successor.

More recently, critics have accused Mr Widodo of bending rules to build his political dynasty – an irony for someone who once declared that “becoming a president does not mean channelling power to my children”.

A constitutional court, where Mr Widodo’s brother-in-law serves as chief justice, controversially cleared the way for 36-year-old Mr Gibran to run for vice-president – Indonesian law had initially required him to be older.

Critics believe Mr Gibran, if elected, would simply serve as a proxy for his father.

The president had earlier rubbished allegations that he was seeking to build a dynasty, telling the BBC in 2020: “If I directly appointed my family, or my son, as a minister, that’s a political dynasty. But if they participate in elections, it’s the people who decide. Not Jokowi.”

Foreign policy track record

Mr Widodo will also be remembered for his work to assert Indonesia’s presence on the global stage, despite early criticism that he had little experience in foreign policy.

It was on Indonesian soil that US President Joe Biden and his Chinese counterpart Xi Jinping met for the first time as leaders of their countries – during the G20 summit in Bali in November 2022.

Indonesia was the first country in Asean (or the Association of South East Asian Nations) to assume the G20 presidency.

During its tenure, Mr Widodo also offered to broker peace between Russia and Ukraine. His visits to both countries in June 2022 was the first by an Asian leader since Russia’s invasion of Ukraine in February.

Those efforts made little headway, but he managed to push the G20 member states to adopt a joint declaration condemning the invasion – a feat for someone who has maintained throughout his tenure that diplomacy is not his forte.

This was also an opportunity for Mr Widodo to show Indonesians that he was trying to tackle the country’s food crisis at its source. Indonesia is dependent on Ukraine for wheat and Russia for fertiliser.

Closer to home, Mr Widodo had sought to use Asean to push for peace amid Myanmar’s bloody civil war, although that too has achieved little so far.

Indonesia’s wealth of natural resources makes it valuable to global powers. Late last year, it strengthened ties with the US after Mr Widodo visited Mr Biden in the White House, despite the countries’ differing views on the war in Gaza.

Indonesia has also cultivated closer ties with China under Mr Widodo’s leadership. Large Chinese investments have created jobs and diversified Indonesia’s economy.

However an influx of Chinese money and workers – Beijing pledged $21.7bn in new investments last September to strengthen economic and political ties – have also stirred discontent among Indonesians. Many worry that their country will be caught in a debt trap.

Mr Widodo’s legacy may be tainted by his perceived failure to entrench the democratic values he first campaigned for, but his administration has strengthened Indonesian’s economy and its international profile.

Based on his current approval ratings, he will be stepping down as Indonesia’s most popular president.

With reporting from BBC Indonesian

Related Topics

-

-

20 October 2023

-

-

-

15 August 2023

-

-

-

14 August 2023

-

-

-

12 April 2019

-