SE Asia’s ‘China + 1’ payday shortchanged by Trump tariffs – Asia Times

Xi Jinping, the president of China, won’t just be talking about business deals and smiling for photo ops when he makes his first trip abroad in a year and his first journey to Southeast Asia since the crisis.

He’ll be bringing a long-term, clear monetary vision for Southeast Asia that the United States has struggled to sell.

As US wedding continues to veer between guarantees and pullbacks, President Xi’s stops in Malaysia, Vietnam, and Cambodia serve as corporate affirmations that China continues to be ASEAN’s most consistent and dedicated financial partner.

Beijing is doubling down on financial statesmanship as China-ASEAN industry is already on the verge of US$ 1 trillion and electronic yuan pilots are gaining local payment systems.

Washington’s strategy is still reactive, with no meaningful trade agreements with the region’s main economies, and obscure supply string “friend-shoring” rhetoric.

Nowhere is this discrepancy more obvious than in how the US handled the” China Plus One” ( C 1 ) outcome incompetently.

From China Plus One to China Through One

C 1 was originally conceived as a private sector reaction to political risk, but it has since evolved into a political tool.

British and related companies have shifted significant manufacturing capacity from China to Southeast Asia over the past ten years. Chinese companies started using it as a solution between 2018 and 2023 after first being thought of as a way for companies to expand production and lessen their reliance on China.

Chinese manufacturers reacted by rerouting supply chains through ASEAN to retain access to the American business as US tariffs over the years grew to over 2, 000 product lines.

Chinese FDI into ASEAN developing increased from$ 12.5 billion in 2017 to$ 37.3 billion in 2023. In Vietnam, companies like Luxshare and GoerTek, which manufacture devices for US companies like Apple, made 32 % of the new FDI in 2023.

A 2022 Rhodium Group report identified a significant “indirect trade substitution,” in which Chinese inputs are finished in ASEAN without paying US tariffs before being exported to the US with the label” Vietnami or Thai nature.”

C 1, in consequence, evolved into” China Through One.”

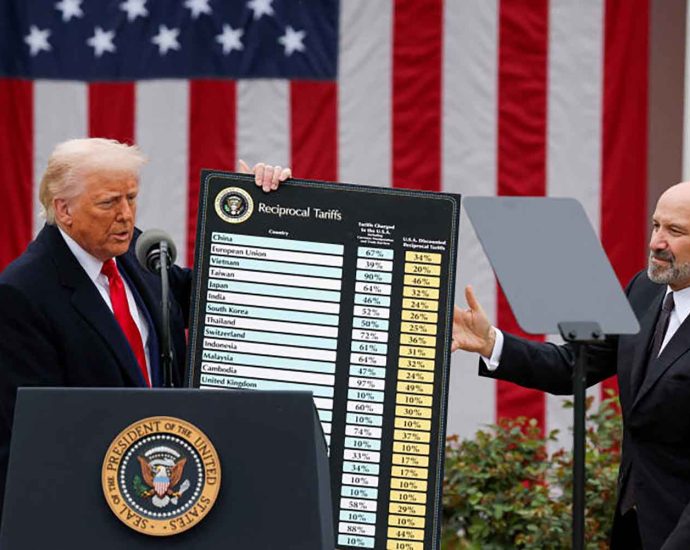

US taxes are higher than China’s in general taxes.

In April 2025, US President Donald Trump retaliated by imposing tariffs of up to 49 % on imports from ASEAN nations. Even Singapore, a long-standing US economic and security spouse, is subject to a benchmark price of 1 %.

The plan, which aims to stop US businesses from enforcing existing trade restrictions, will eventually cause the same harm to US businesses and consumers, causing disruption to supply chains and raising costs in key sectors.

Apple serves as an illustration. With over 95 % of its iPhones, iPads, and Macs manufactured in China or Vietnam, new tariffs could cause US retail prices to rise by 20 to 35 %, according to internal industry projections.

A base iPhone might exceed the$ 1,000 mark. Tesla has previously warned of supply disruptions after exporting more than 92, 000 lorries from its Shanghai Gigafactory to the US in 2024. Similar risks exist for Walmart, HP, Dell, GoPro, Nike, and others.

Beijing has been promoting trade and investment while Washington controls taxes. Trade between China and ASEAN increased by almost 90 % to$ 998 billion in 2024. The largest trade bloc in the world, which accounts for 30 % of global GDP, ASEAN is now fully integrated into the Regional Comprehensive Economic Partnership (RCEP ).

Chinese technology companies are establishing themselves throughout ASEAN through the Belt and Road Initiative: Tencent, Tencent, and Ant Financial are the leaders in digital payments, and Alibaba is the mastermind behind e-commerce transportation.

China strengthened its cross-border online RMB pilots with Malaysia and Thailand in March 2025 and strengthened its free trade agreement with ASEAN.

Reclaiming the China Plus One

Beijing has a new opportunity to expand its economic appeal to the place as President Xi launches a new beauty offensive in ASEAN.

This may involve reform and renegotiating BRI-linked money, particularly in developing nations like Laos, Myanmar, and Indonesia, where the risk of default is rising.

Beyond the realm of network, China may expand its cooperation through mutual R&, D initiatives in key areas like clean energy, semiconductors, and agri-tech, which are both in line with ASEAN’s development priorities and China’s professional ambitions.

Education and skill mobility should also be considered. Expanding student exchanges and technical training would strengthen ASEAN’s people capital while strengthening interpersonal relationships.

Beijing may push for a formal ASEAN-China Digital Trade Protocol, which would complement and compete with the US-led Indo-Pacific Economic Framework ( IPEF ).

For a system would strengthen China’s financial presence in Southeast Asia and strengthen regional integration in e-commerce, transportation, and payments.

For its component, the US must move beyond speech and provide valuable contribution. If Washington is willing to make a strategic investment in China Plus One, it might form the foundation for a fresh US-led financial infrastructure in Southeast Asia.

That starts with providing genuine opportunities. In addition, production tax credits and green subsidies under the Inflation Reduction Act ( IRA ) could be expanded to the supply chains of solar and electric vehicles in Vietnam, Thailand, and Indonesia, if a$ 52.7 billion carveout is made from the CHIPS Act’s$ 52.7 billion is made.

Although comprehensive free trade agreements may be politically challenging, diplomatic or sector-specific agreements in digital industry, clean power, and cybersecurity, which are modeled after the US-Japan Digital Trade Agreement or the Singapore-led DEPA, could support regulatory positioning and provide the predictability ASEAN economies need in a sustainable economical alternative to China.

Countries, including ASEAN member-states, must not feel compelled to bandwagon against the US itself in order for China Plus One to work in America’s favor.

That could lead to what some are describing as a” World Minus One” scenario, where diversification strategies begin to view the US as a component of the problem as opposed to the solution.

Access, autonomy, and alternatives

C 1 is already changing global trade flows. Between 2017 and 2024, China’s share of US imports fell from 21.6 % to 13.3 %, while ASEAN’s rose from 6.8 % to 12.2 %. These shifts are structural rather than incidental.

The economic ministers of ASEAN reiterated their close ties to the US in a joint statement released in April 2025, but they expressed “deep concern” about the unilateral tariffs being imposed.

The fifth-largest trading partner of the world and the fifth-largest economic grouping of the US tries to avoid taking sides and acting as a pawn in great power conflict. The strategic goals of ASEAN are to secure autonomy, access, and meaningful alternatives.

The key is whether Washington can take advantage of it and deliver before Beijing does.

Marcus Loh serves as the director of Temus, a Singapore-based company that offers digital transformation services, and oversees strategic communications, marketing, and public affairs.

He previously served on the Institute of Public Relations of Singapore’s executive committee for digital transformation, the largest trade organization for Singapore’s technology sector.