Issuing limits for Singapore government securities, Treasury bills raised to S$1.5 trillion

FISCAL POSITION IS NOT APPLICABLE RAISING LIMIT.

Additionally, he claimed that government expenses are not funded by the proceeds from these assets ‘ release.

According to him,” the government does not use for systemic spending needs, so as not to burden our upcoming generations who will have to pay the debt incurred by current and former generations.”

The president’s fiscal location is not affected by the increase in the spending cap.

Under the Significant Infrastructure Government Loan Act ( SINGA ), Singapore only borrows money to finance nationally significant infrastructure projects, unlike other nations do so for recurring spending.

Less than 2 % of the total amount borrowed by SINGA is actually made up by the state, and SINGA has a different loans cap.  ,

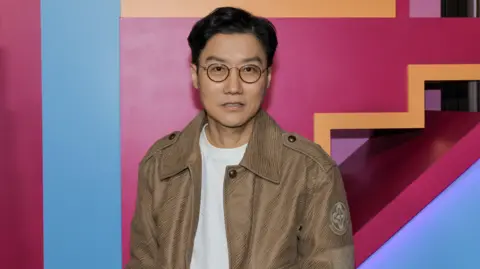

Mr Chee added that Singapore’s total debt-to-GDP amount may seem large, but it does not fully reveal the country’s economic position as it does not regard Singapore’s assets, which outweigh its debts.

The 2025 resources is full of opinions and observations. What else can I contribute to what has already been said, then?

The 2025 resources is full of opinions and observations. What else can I contribute to what has already been said, then?