Volatility expected as debt ceiling negotiations intensify

Investment strategy: How to trade the 14th Amendment?

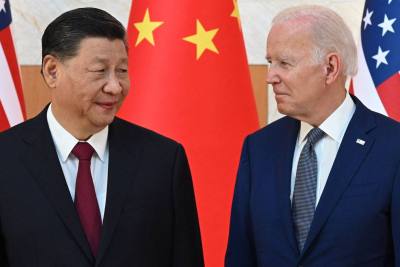

David Woo writes that markets have largely disregarded the debt ceiling negotiation as a major risk due to the growth of passive investing and a lack of urgency from negotiators. However, concerns are rising over whether the positive talk is a mere show, and there is speculation that President Biden may invoke the 14th amendment if a deal cannot be reached.

Global Uncertainty Index Remains at Zero Line

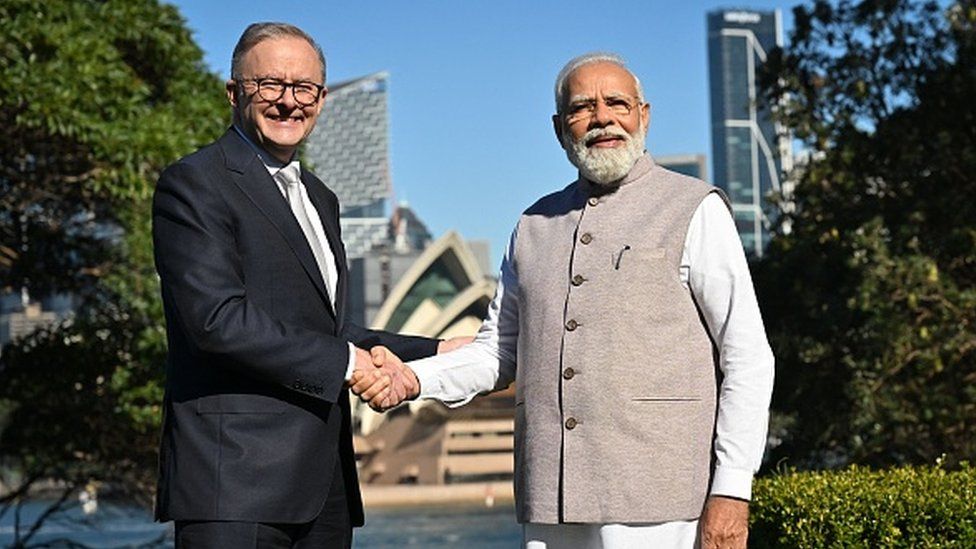

David Goldman assesses how declining foreign deposits at US banks, signalling a global squeeze on dollar credit, could potentially lead to increased volatility and a shift towards alternative currencies in international trade, further impacting America’s economic position.

Russians strategize offensive options after the fall of Bakhmut

James Davis details how the war in Ukraine has entered a phase of increased uncertainty as neither side has a defined strategy. Both sides are regrouping after the Wagner group’s capture of Bakhmut, where Ukrainian troops suffered significant losses in morale and resources, with Russia now considering various offensive options.

China declares Micron a cyber threat while the long-term outlook favors Korean chipmakers

Scott Foster delves into China’s move to ban the use of Micron’s memory chips due to concerns over national security, which is seen as retaliation against US sanctions and is expected to lead to tougher sanctions on the Chinese semiconductor industry, favoring Korean competitors like Samsung and SK Hynix.