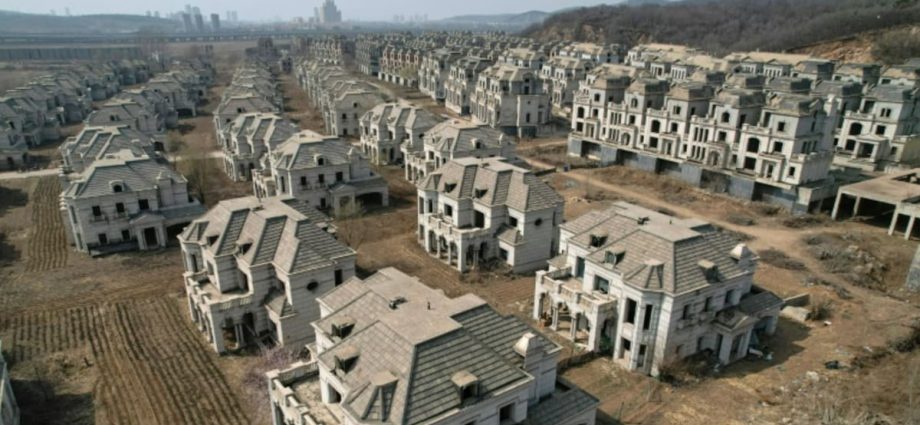

Three cities in China cities lift house buying curbs

BEIJING: Last month, at least three significant Chinese cities lifted restrictions on home purchases as the Asian powerhouse slowly retracted a crackdown on the real estate industry in an effort to boost its economy. Two of the most popular cities in the northern province of Liaoning, Dalian and Shenyang, individuallyContinue Reading