South Korea poised to crash and burn in 2025 – Asia Times

It’s difficult to imagine any Eastern country more appreciative of South Korea’s accomplishments in 2024.

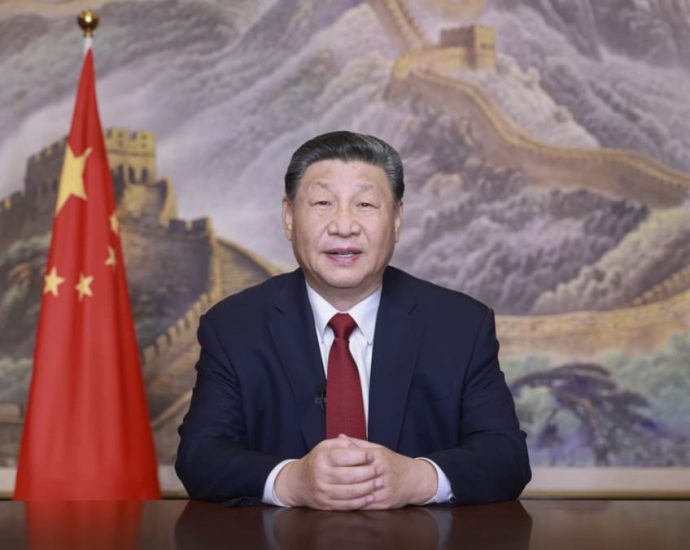

President Yoon Suk Yeol declared martial law just the last fortnight, reversed six hours later, was impeached in parliament amid large street protests, and is now facing a historic arrest permit.

As if that weren’t enough conflict and woe, Korea experienced its worst local aircraft disaster in more than 20 years, killing over 181 people and invoking grave fresh concerns about the safety of Asian skies.  ,

Korea’s really nasty December deepened what was already anything of a midlife crisis time for Asia’s fourth-biggest business. This may be as good as it gets as a madly uncertain 2025: Seoul’s very destructive elections are about to meet with the Trumpian wind to occur.

Even if, best-case scenario, “increased US protectionist measures imply lower , taxes on , Korean , imports than on various trading lovers”, says analyst Brian Coulton at Fitch Ratings, “declining demand from China and the US, which , collectively accounted for around 40 % of , Korean , commodities exports in , 2023, may adversely affect exports”.

Korea will be directly at the heart of the potential weaker Chinese demand-related collateral damage, despite the president-elect’s threats of 60 % tariffs against China. Japan, too, but then Tokyo isn’t embroiled in a political imbroglio the likes of which Seoul hasn’t seen in decades.

Something that Japan and Korea have in common, though, is being snubbed by Trump. Trump has rebuffed repeated requests from Yoon and Japanese Prime Minister Shigeru Ishiba for a Mar-a-Lago tee time since his re-election on November 5.

Both Yoon and Ishiba have watched as Trump met with a parade of world leaders, including Canada’s Justin Trudeau, France’s Emmanuel Macron, Ukraine’s Volodymyr Zelensky, Hungary’s Viktor Orban, Argentina’s Javier Milei and even the UK’s Prince William. But so far, he’s had no time for Washington’s top North Asian allies.

Anyone’s guesses whether Trump intends to impose tariffs on Seoul and Tokyo. Or that Trump’s hopes of a “grand bargain” trade deal with China take precedence.

Seoul’s distracted legislators won’t be doing much to improve Korea’s competitive game as Yoon awaits a possible arrest and his fate in the courts in the months to come.

Even before Yoon’s bizarre martial law decree on December 3, his People Power Party wasn’t getting much done to level economic playing fields, address near-record household debt, increase productivity, empower women or improve corporate governance.

Yoon’s first 966 days in office were anything but a reformist whirlwind. In other words, his party has a slim chance of coming up with a solid policy response to the Trump 2.0 shock.

The Bank of Korea will become even more dependent on that. The BOK has taken the lead in managing one of the world’s most open major economies since Yoon took office in May 2022. Governor Rhee Chang-yong is now in the hot seat as never before due to the political vacuum in Seoul.

Before Yoon’s short-lived martial law stunt, Seoul was planning to shore up key sectors as headwinds from Washington intensify. A package of support measures is included for the crucial semiconductor industry.

Korea, which is home to the world’s leading memory chip manufacturers Samsung Electronics and SK Hynix, is more unsure than most other nations about Trump’s tariff plans. Finance Minister Choi Sang-mok stated on December 2 that” the next six months will be the golden time that will decide the fate of our industries.”

Choi continued,” The role of the government must shift from a supporter to a player working alongside businesses, given the current challenges, including global economic shifts under the incoming US administration, competition from emerging countries, and the rapid reorganization of global supply chains.”

Since then, though, Choi has been elevated to acting president, the third to serve as president this month. ” So South Korea’s most bizarre and explosive political crisis in decades just got even weirder”, says Ian Bremmer, president of Eurasia Group.

That leaves his successor with the responsibility to spearhead support for semiconductor companies, from tax incentives to fiscal assistance, to advance the tech ecosystem. And to do so in the midst of growing political slurs.

These initiatives range from top-down initiatives to subsidizing the costs of burying transmission cables for semiconductor clusters in cities like Yongin and Pyeongtaek.

Already, Choi is doing his best to reassure the public. We are confident that our robust and resilient economic system will ensure quick stabilization, Choi said on December 27.” Although we are facing unexpected challenges once again, we are confident that we are facing unexpected challenges.”

Yet Choi inherits a 2025 budget that’s US$ 2.8 billion less than the government had hoped for. In addition, he now manages a second national crisis as a result of the Jeju Air jet‘s collision.

According to economist Gareth Leather of Capital Economics,” the crisis is already having an impact on the economy.” ” The crisis is unfolding against a backdrop of a struggling economy”, he says.

Gross domestic product, Leather notes, is expected to be just 2 % this year amid slowing global growth. ” Longer term, political polarization and resulting uncertainty could hold back investment in Korea”, Leather says, pointing to how Thailand’s turmoil since a 2014 coup undermined its economy.

Other economists are more optimistic. Yoon Suk Yeol is a side effect of the growth, according to economist Park Sang-in of Seoul National University, who spoke to AFP.” We have come from being one of the world’s most developed economies in very few years. Korea’s society was mature enough to refute his crazy deeds.

According to BMI Country Risk & Industry Research,” we anticipate only moderate effects on the economy and financial markets as the Ministry of Finance and the Bank of Korea have responded quickly by reassuring investors.”

Notably, according to BMI,” the central bank is committed to boosting short-term liquidity and implementing measures to stabilize the foreign exchange markets, which supports our position that the risks associated with the South Korean won should be kept under control for the time being.”

Krishna Guha, an economist at Evercore ISI brokerage, argues that” South Korea’s democratic institutions and culture have withstood the stress test. However, the fact that it took place at all is extraordinary and troubling.

However, the key is now, especially now that Yoon is facing an arrest warrant, when and how the political crisis ends. Its longevity is key to the Korean wo n’s outlook.

” If domestic political instability continues and external credibility in Korea decreases, the wo n’s price could fall further”, says economist Seo Jeong-hoon at Hana Bank.

According to economists at T Rowe Price, “political turmoil appeared to be continuing to weigh on investor sentiment in South Korea.”

Even before the blow-after-blow that hit Korea in December, Yoon’s presidency had been awash in challenges and controversies. Soon after Yoon took over, the Korean won fell into disrepute, North Korea launched a wave of provocations, and Seoul received heavy criticism for handling a 159-person crowdcrash that killed 159 people on Halloween 2022.

All too quickly, Yoon’s approval rating fell below 30 %, the danger zone for any leader in Seoul promising bold structural reform.

Yoon is the fourth leader of Korea to ascend to power since 2008, promising to produce more economic energy from the top rather than the bottom down. Broadly speaking, that meant taking on the” chaebol system” led by family-owned behemoths like Samsung that helped propel Korea into the ranks of the top 12 economies.

The reality is that Korea Inc. is aware that a lot of its business is being sold for profit. China and other rising Asian powers are now rivals in cars, electronics, robots, ships and popular entertainment. Taiwan is constantly upping its innovative game, while startups like Indonesia and Vietnam are boosting the competitiveness and dynamic of the race for tech “unicorn” startups.

The best way for Korea to maintain its high standard of living is to create innovations that increase the rate of economic growth. That’s why Yoon and the three leaders who preceded him pledged an innovative “big bang” to move Korea into higher-value sectors.

Between 2008 and 2013, Lee Myung-bak came and went without fundamental changes to the chaebol system. Then came Park Geun-hye, Korea’s first female president. In 2013, she took office with bold talk of devising a more” creative” economy.

Park vowed to expand tax breaks for startups, strengthen antitrust laws, and fine large corporations for stealing profits that could be used to bolster paychecks.

Park ended up going easy on the chaebols. Yet she did succeed in enlivening Korea’s startup economy. Her efforts to increase the cash flow to innovators helped make Korea one of the top 10 incubators for tech unicorns, or businesses with market capitalizations greater than US$ 1 billion.

Moon Jae-in, Park’s successor, expanded the program. The problem is that startups continue to be hogging the financial fuel they need to become major game-changers. That’s still Korea’s dilemma today.

It has loads of startups, but the conglomerates “don’t often allow space” for them to thrive and become medium-sized enterprises, notes Yukiko Fukagawa, an entrepreneurship expert at Waseda University.

Moon took power in 2017 with ambitious plans to pursue” trickle-up economics”. Moon, a more liberal leader than the previous two, aimed to stifle economic control from Korea’s rigid corporate structure to boost competition.

His signature strategy of enticing the middle class was essentially the opposite of the strategies that Trump, former Japanese Prime Minister Shinzo Abe, and Ronald Reagan championed decades earlier. Moon resigned and delegated his economic management responsibilities to the BOK once he realized how challenging the task was and how messy the political fallout would be.

So has Yoon these last 31-plus months. Now, as acting President Choi manages dueling crises, he faces a wildly uncertain 2025 – both domestically and internationally.

Despite the political unrest, Korea Inc. has a chance to up its game. According to Sohn Kyung-shik, chairman of the Korea Enterprises Federation,” companies must also make more proactive efforts to economic recovery and job creation during these difficult times.”

In top-down Korea, though, that might be easier said than done. Especially as the” Trump trade” approaches Korea, which causes utter chaos in domestic politics.

Follow William Pesek on X at @WilliamPesek