Sri Lankaâs Foreign Minister hails Chinese investment, dismisses notion of âdebt-trap diplomacyâ

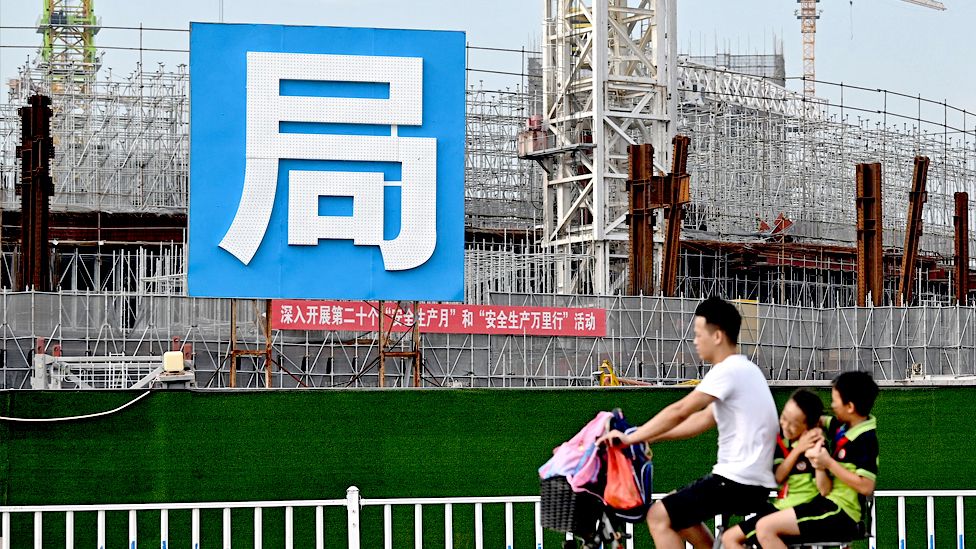

Another illustration of this was the southeastern Hambantota Port, which made the nation the poster child for the so-called Chinese debt trap story after a Taiwanese state-owned operator took command of the harbor after Sri Lanka defaulted on its money.

But, like Mr. Sabry, some researchers have also criticized the so-called debt trap diplomacy.

It’s never a debt trap that China created, Advocata Institute Murtaza Jafferjee, president of legislation think tank. However, we have debt problems because about 55 % of our total debt is private loan.

The remainder is external debt, he added, adding that it is thought that the public sector debt of the nation is among the highest in a middle-income nation at 128 percent of gross domestic product ( GDP ).

Sri Lanka has garnered significant attention not only from China but also from India and the United States due to its strategic location in the Indian Ocean, though the jury is still out as to whether Chinese income is more of a gift or curse.

Mr. Sabry responded that Sri Lanka is in the center and does not take sides in response to the question of whether the nation appears to be caught up in a major power play.

” We don’t want any conflict with anybody.” Without a doubt, we won’t permit anyone to harm another nation or establish their military bases in our yard. But he added,” We have a strategic relationship with each of them.