Death clip ‘disrespectful’

Govt upset as UN shows Thais dying

PUBLISHED : 30 Oct 2023 at 05:53

The Ministry of Foreign Affairs (MFA) has voiced strong disapproval of Israel’s display of a video clip of the brutal killing of a victim, asserted to be a Thai national, at a recent United Nations General Assembly (UNGA) meeting.

The MFA said such horrific brutality has stirred a sense of outrage not only among Thais but undoubtedly among people throughout the world. It “disapproves of the display of such footage, which does not afford the proper respect and due consideration for the deceased and his family”, it said in a statement.

It refers to a short clip shown by Israel’s permanent ambassador to the United Nations, Gilad Erdan, while he was addressing the special session of the UNGA on the Hamas-Israeli violence on Oct 26. The Israeli envoy displayed the footage showing the decapitation of a foreign national with a garden tool during the Oct 7 attacks by Hamas. The victim was asserted to be a Thai worker.

The Wall Street Journal at the weekend ran an editorial about the screening in New York of the raw footage of Hamas’ atrocities during its Oct 7 invasion of Israel. “Why did the Hamas men, upon confronting the dead body of a teenage girl, start cheering? Why did they argue over who would get to decapitate a Thai guest worker they had shot, then proclaim ‘Allahu akbar’ with every swing at his neck?” the writer asked in horror.

The MFA said it condemned the killing of innocent civilians, regardless of nationality, by any group, and for whatever reason. It also reiterated its call for the immediate release of all hostages and all nationals detained. As of Oct 28, the number of Thai nationals killed in the Hamas-Israel conflict stands at 32 with 19 injuries and 19 abductions. With the violence escalating the government is pleading with all Thais in Israel to return for their own safety.

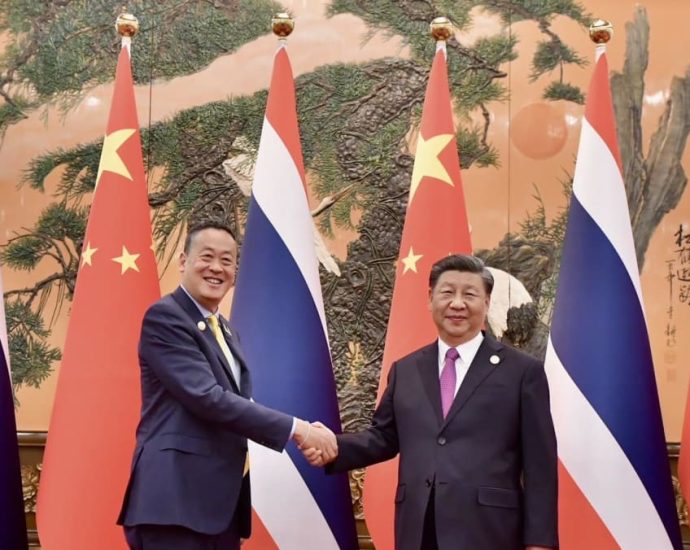

On the footage, Prime Minister Srettha Thavisin said the government is gathering facts surrounding the clip and said such footage should not have been displayed to the public. “It’s not suitable. War is cruel and it’s best not to add fuel to the fire. Thailand isn’t a party to the conflict. All we ask for is the safety of all Thais and the release of all hostages,” he said.

On the fate of Thais being held captive by Hamas, he said talks are underway to secure their safety and release and that a cabinet minister is expected to travel to the Middle East to discuss the hostage issue.

Mr Srettha repeated his call for all Thai workers in Israel to return, saying fighting is expanding and internal transport and evacuation will be hindered. Repatriation capacity has now been increased, he said, while giving assurances to the Thai workers of support and assistance after their return. “The cabinet is expected this week to approve a set of measures including low-interest long-term loans to alleviate debt problems for Thai workers in Israel,” he said. He also expressed concern for the safety and well-being of Thai officials in Israel.

Meanwhile, House Speaker Wan Muhamad Noor Matha said the team he sent to Iran to hold talks for the release of Thai hostages was to meet an adviser to the Iranian president and a key Palestinian leader on Sunday. “Things are proceeding smoothly and we are coordinating information. They insist all Thai hostages are safe and being taken care of. Their release is being negotiated,” he said.

Mr Wan said the team, led by former Narathiwat MP Areepen Uttarasin and Lerpong Syed, brother of Saiyid Sulaiman Husaini, leader of an association of Shia Muslims in Thailand, will hold talks to secure the release of the Thai hostages. Meanwhile, the Royal Thai Air Force on Sunday sent an A-340 aircraft to pick up Thai nationals evacuated to the United Arab Emirates and the flight is scheduled to arrive at Wing 6 in Bangkok at 2.20am today.