Europe warned to change fast or become a ‘shock absorber’ of US-China trade war

Senior European Union officials are breathing a sigh of relief over a US-China tariff deal that may delay a diversion of Chinese exports to Europe.

However, they have been cautioned that the union must quickly adjust or it will” impact absorb” global trade imbalances due to tectonic shifts.

The climbdown in superpower tensions following high-wire talks in Geneva last weekend has led to a mutual reduction in tariffs and a respite in the turmoil that has roiled markets since US President Donald Trump’s return to the White House in January.

Do you have inquiries about the most popular issues and styles from different parts of the world? With SCMP Knowledge, our innovative platform of customized content featuring explanations, FAQs, assessments, and visuals brought to you by our award-winning group, get the solutions.

However, it does not, according to academics, make a significant difference to Europe’s dark perspective if it doesn’t respond immediately to Washington’s attempts to reorganize commerce with China and the rest of the world.

embedded content ]

According to Michael Pettis, a finance professor at Peking University,” there is talk in Brussels about Europe becoming a” next pole” in a US and China-dominated world.” This passion risks remaining a phrase rather than a strategy because it doesn’t involve more political inclusion and better coordination of fiscal and business policies.

” Europe does not turn into a pole at all, but quite a shock absorption – forced to make decisions without making the decisions themselves,” said Pettis, a thought leader on the changing nature of international trade.

“I say this because of some pretty simple arithmetic,” he continued. “The US currently represents nearly half of global deficits, and with the UK and Canada they together comprise roughly two-thirds of all deficits.”

The Beijing-based doctor believed it may eventually come along and that Washington had put pressure on others to do the same. However, last year’s agreement does not lead to a reduction in America’s gaping trade deficit with China.

One of two things must happen, according to Pettis, who is also a member of the US think container Carnegie Endowment for International Peace.

According to him, “either world surpluses must decrease, and China accounts for roughly half of global surpluses, which implies that China’s surplus must decrease,” or” somewhere else must run the significant deficits needed to balance global surpluses, which typically refers to Europe,” he said.

Last year’s Sino-American agreement may have saved them time in what is thought to be a storm of diverted Chinese exports to EU ports, according to European governments.

” We are seeing signs of de-escalation on the British side,” said Michal Baranowski, Poland’s assistant secretary for development and technology.

” China has begun meetings with the US.” They came to an agreement with [the ] UK, which is a good thing, he continued. ” The EU is negotiating more quickly.”

The minister referred to the US-China deal as” a good first step,” claiming that it was” good for us as well because Europe is very focused on trade diversion.” We’re less probable to see it in Europe now that US-China conflicts are dwindling.

However, experts cautioned against preventing the EU from undergoing major inside reform that is necessary to survive in a severe new world order.

The bloc is divided, too, on areas of industrial policies that may afford it better financial means to compete with the US and China, with new German Chancellor Friedrich Merz appearing last week to rule out EU-wide joint borrowing.

” We cannot go into never-ending spirals of bill,” Merz said in Brussels last year.

Former part of the European Parliament and former participant of the London School of Economics Luis Garicano urged the EU to change its focus away from pursuing free trade agreements.

“The IMF puts the hidden cost of trading goods inside the EU at the equivalent of a 45 per cent tariff. For services, the figure climbs to 110 per cent, higher than Trump’s ‘Liberation Day’ tariffs on Chinese imports – measures many saw as a near-embargo,” Garicano wrote in a blog post.

The European Commission may be incorporating new domains, but it is leaving the single market as its primary goal to become more and more unoccupied.

A quick resolve is doubtful, despite EU leaders ‘ acknowledgment of the need for inner reform.

Instead, the bloc is expected to adopt a multipronged approach of trying to cut trade deals with partners including India and the Mercosur group of South America as it also negotiates directly with the economic superpowers themselves.

Trade captain Maros Sefcovic and US Commerce Secretary Howard Lutnick are still in conversation over a phone call on Wednesday. There hasn’t been a bargain in the past.

US Treasury Secretary Scott Bessent stated this year,” I think the US and Europe may be a little slower.” ” I have a feeling that Europe does have a social activity difficulty, that the Italians want something unique than the French,” I believe.

However, Brussels officials are awaiting the first results of a work force’s initial assessments of Trump’s taxes. They are prepared to implement safeguards that can quickly shut down the business from unexpected product surges that could harm local businesses.

embedded content ]

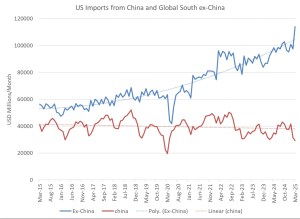

Traditions statistics suggest that circumstances may have changed even during the brief period of US and Chinese joint tariffs of up to 120 percent.

April’s Chinese industry statistics revealed significant increases in US supplies and significant increases in European shipments. China’s shipments to the US increased by 21 %, while its shipments to Germany increased by 20.44 %.

Union shipments to China are also cratering at the same time. According to the Post’s calculations of its official trade data, China’s imports into the EU fell 16.46 % in April. In the first four weeks of 2025, Bloomberg reported that China’s trade deficit with the EU exceeded history US$ 90 billion.

Amid these shifts, Brussels seeks to convince Beijing to take action that would address the potential trade diversion and China’s manufacturing overcapacity. Otherwise, officials say, the EU market will start closing down.

However, these challenges appear to be coming off as deaf ear.

The EU delegation’s head of trade in China, Marjut Hannonen, stated during a board debate in Beijing on Wednesday that the overcapacity problem is “hears large, it’s growing, it’s huge, and it affects all sectors.”

” Overcapacity is a problem that we don’t see China addressing at all,” Hannonen continued. On the other hand, they are simply doubling down on their production capacity, which will only make the situation worse and pose a global problem.

In a sign that Beijing was playing hardball with Europe, talks between French and Chinese ministers this week failed to yield a deal that would see tariffs lifted on France’s cognac imports, French Finance Minister Eric Lombard said following meetings with Chinese Vice-Premier He Lifeng.

The EU’s efforts to change Beijing’s political economy, according to Yanmei Xie, an independent researcher of China’s political business based in Barcelona, were likely to fail.

Europe is constantly enticing China to take action, but this is nothing short of enticing it to alter its financial system, according to Xie. The Chinese concept of techno-industrial upgrading requires unwavering manufacturing scaling, never overcapacity, according to the statement.

China needs to collect more Chinese products, according to her, while Europe demands that China reduce its export and import volumes. Their goals are “diametrically opposed.”

South China Morning Post’s latest news:

Download our smart application for the most recent information from the South China Morning Post. Copyright 2025.