Piyush Goyal: Commerce minister’s dig at Indian start-ups sparks debate

Mumbai, BBC News

Getty Images

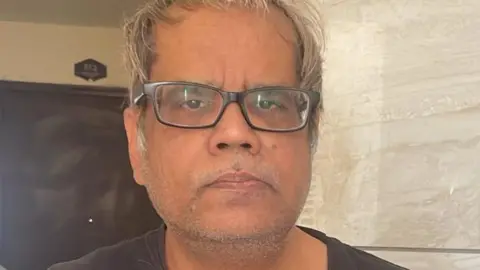

Getty ImagesPiyush Goyal, India’s commerce minister, recently made some controversial remarks about the nation’s startup habitat, which sparked a lot of discussion on social media and sparked outcry from some companies.

Goyal appeared to take a hard look at India’s customer start-ups at the next version of Startup Mahakumbh, a government-led start-up conference, last month, as he urged businesses to look into new technological developments to contribute to the country’s advancement.

He made fun of the increase of handmade brands, online gambling apps, and food delivery apps in the nation by contrasting them with those created by the “other side,” which many people thought to be China.

He claimed that India’s start-ups were still primarily focused on life items like gluten-free snow creams while” they” were making leaps in machine learning, technology, and creating “next-gen companies that can compete with the rest of the world.”

Major innovators in India responded to his comments in a flurry of reactions, some of whom claimed that he was only enabling creators to be more ambitious, and others that it was unfairly critical of the start-up ecosystem, which is a significant contributor to the nation’s economy.

Getty Images

Getty ImagesGoyal even praised the rapid growth of new businesses in the nation, lauding India as the third-largest start-up habitat in the world. He likewise urged American investors to invest more in supporting American artists.

But he appeared to want more to arise, and it was more quickly.

” We must be able to understand and progress.” The minister said,” If we want to be bigger and better, then we must be bolder and we must not fight back against the contest.”

Do we want to make ice creams or]semiconductor ] chips? he once asked the audience, which was brimming with businesspeople and investors.

Co-founder of the quick-commerce game Zepto, Aadit Palicha, slammed the minister for being rude.

He claimed in a blog on X that client online companies like his have been the driving force behind innovation in both domestic and international markets.

He noted that while the major players in AI immediately, like Facebook and Google, were again buyer internet companies, Amazon, which was formerly a consumer internet company, had grown cloud computing.

He exhorted American investors to back consumer internet businesses so that they can expand and use their profits to fund more idealistic innovations.

A well-known god investor, Mohandas Pai, claimed there was a lack of funding for deep-tech start-ups from the government and private people.

He explained that because they offered rapid results, buyers made a run for lifestyle-focused start-ups.

Deep-tech improvements take a long time to create and require costly equipment. Folks aren’t willing to take long-term averse actions. For serious technology start-ups to succeed, he said,” we need long-term person funding.”

He added that regulations limiting foreign investments in American start-ups were putting pressure on technology.

He continued, citing the success of an American company that just introduced a quick-charging device for buses but found no customers for its product.” Deep tech start-ups even struggle to find a market,” he continued.

Getty Images

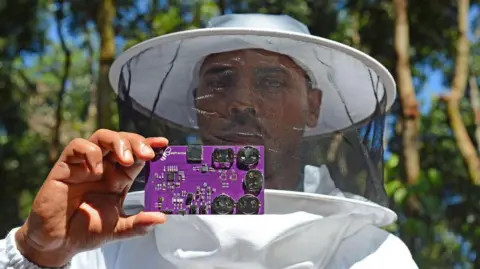

Getty ImagesSome social media users even shared their experiences with the difficulties they encountered when attempting to launch their own technology companies.

Some claimed they had trouble getting loans, others cited higher import taxes on some unusual natural materials and equipment, and others described unnecessary red tape that made getting approvals and documents a nightmare.

Some businesspeople praised the secretary, saying his remarks were well-intentioned and a necessary reality check for the start-up habitat.

Entrepreneurship in India depends on advances in AI and semiconductors, according to Vironika S, chairman of the startup app Substitute Gyan. However, she added that these limitations were present and that the government could help by lowering them.

Kushal Bhagia, an investment in India, claimed in a blog on X that Goyal was correct about the country’s lack of strong technology start-ups. We simply don’t come across plenty owners who are working on significant-scale, optimistic problem statements, he said.

He attributed this to a lack of deep-tech members for people to learn from and be inspired by as well as to India’s technical expertise leaving the country to work for US companies.

Getty Images

Getty ImagesThe leader’s remarks also caused the internet to examine the various adventures of Indian and Chinese start-ups.

Journalist Abhijeet Kumar wrote in the Business Standard newspaper that in 2023, just 5% of Indian start-up funding went into deep-tech sectors, compared to 35% in China. He also pointed out how Beijing actively promoted high-tech innovation – in 2024, it had slashed $361bn in taxes and fees for high-tech firms, including $80.7bn in research and development deductions.

In an editorial published on Monday, the newspaper also noted that India’s start-ups are more consumption-driven, focused on using technology to solve local problems at scale rather than global ones by creating path-breaking foundational models.

It cited a Nasscom report that stated that India’s deep tech start-ups attracted$ 1.6 billion in funding in 2024, which was a 78 % increase from the previous year and that India currently has 4, 000 of these are expected to reach 10, 000 by 2030.

But a long way remains to be traveled.

It is obvious that India will have to do a lot to catch up with these nations as the deep-tech race spreads globally, the editorial stated. Goyal’s remarks should also serve as a” call to action” for start-ups and investors as well as for the government.

This could include establishing deep-tech technology funds, establishing strong academic-startup partnerships, and providing incentives for faster hardware, AI, biotech, and clean energy developments, it said.

Follow BBC News India on Instagram, YouTube, Twitter and Facebook.