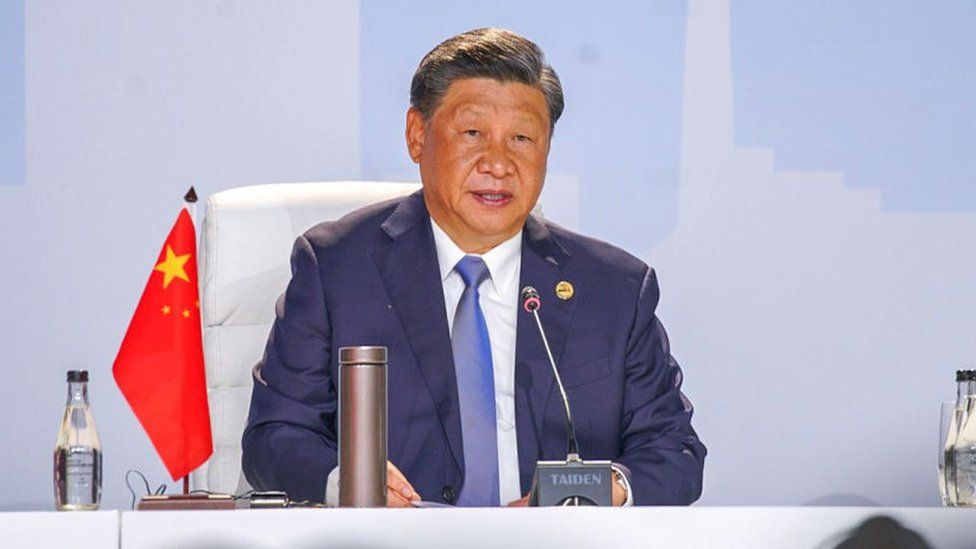

G20 admits African Union as permanent member at New Delhi summit

NEW DELHI: At the bloc’s summit in New Delhi on Saturday( Sep 9 ), Indian Prime Minister Narendra Modi announced that the African Union, which includes the richest and most powerful nations in the world, had been made a permanent member of the G20. The African Union, a western entityContinue Reading