Gold glitters at end of the world as we know it – Asia Times

Shareholders have been betting tremendously on an AI-driven coming over the past two decades, as tech stocks have led the S&, P 500 to a 60 % get. But they also bought the “barbarous artifact” of a financial era that preceded the economy’s identity, pushing the price of silver up by almost as much. Importantly, gold outperformed other hedges by a sizable percentage against the buck.

Why wall against severe distress amid effervescent tech-driven optimism? The answer is a bit could get wrong—catastrophically wrong, in reality. The dollar-based global economic system’s core asset is then tech stocks. The United States has sold US$ 24 trillion more of its property to immigrants than Americans have sold to immigrants.

That” net international investment position” of$ 24 trillion, up from$ 18 trillion at the end of Donald Trump’s first term in office, paid for America’s cumulative trade deficit over the past 30 years. For the past 10 years, immigrants have been buying stocks rather than US Treasury bonds, as in the history.

US federal loan is now lower than it was five years ago, thanks to international central banks. If the technology bubble turns out to be a balloon, so will the US dollar. The death of the money may depend on the competition for market share for AI. If, for example, China’s open-source DeepSeek beats ChatGPT and the other British large language concepts, tech shares was tank and, with them, the money.

There are many different ways to protect against the money. Some of them are interesting. An American budget deficit of 6 % to 7 % without a war or recession, as incoming Treasury Secretary Scott Bessent told Congress last week, is without precedent. But the currency’s position as a reserve money means that America has first rights on the nation’s capital.

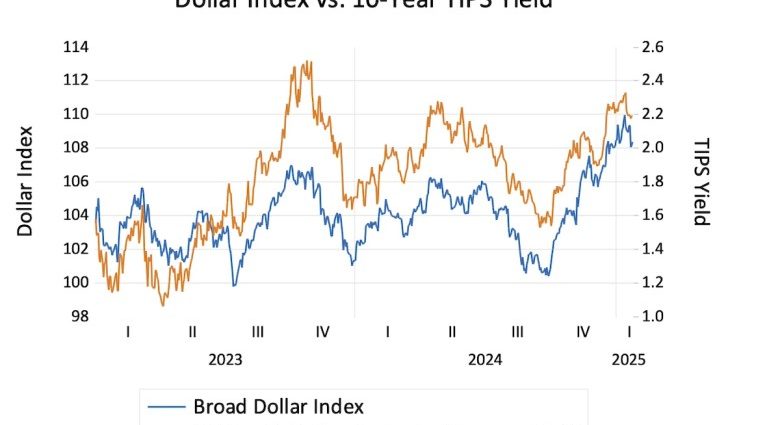

The inflation-indexed US Treasury yields surge, partially fueled by hopes for a higher US gap under Trump, propelled the dollar higher against all major currencies. If US prices increases, so does US interest charges, and the economy’s transfer rate will rise against other currencies, even while the money loses value.

But even while all currencies sank against the dollar in response to rising “real” ( inflation-indexed ) Treasury yields, gold rose, breaking a pattern that prevailed from 2007 through 2022.

The US and its supporters seized Russian resources in March 2022, breaking the long-term connection between TIPS and metal. China, Saudi Arabia, India, and other central banks slowly shifted resources away from Treasuries into silver. On paper, TIPS and silver offer similar payments: If the money tanks and US prices increase, both assets may gain value.

The distinction is that the Treasury cannot acquire central bank vault gold in the same way it is acquire central banks holdings of its own obligations. Up to 80 basis points ( 0.8 % ) of the rise in TIPS yields during the past six months, I showed in a January 10 analysis, can be attributed to foreign central banks ‘ sales of US Treasury securities.

The hedge fund group has turned northern banks into gold. The price of real gold and the option price on the gold price are both affected by a shift in the relationship. Implied volatility is a standardized measure of the cost of metal choices, and under normal conditions, it falls as the gold rate rises.

That’s because silver mining companies have been the biggest consumers of golden choices, when the gold rate falls, they buy alternatives to lock in their revenue, and vice versa. But in 2024, something fresh happened: The cost of gold possibilities rose along with the golden value.

The gold implied volatility against price forms a” V” in the scatter chart below. That indicates that hedge funds placed wagers on a rise in silver prices.

Gold is a standout in the complex of options on macro variables ( stocks, currencies, bonds, and commodities ). While other markets are softer in terms of risk and the price of gold options ( implied volatility ) is trading at a two-year high.

Gold’s virtue is that it has a government decree-free value; it is the only form of currency that can be accepted if all else fails. It is the economic resource of last resort. With some exceptions, the bill of nearly all of the major markets has increased alarmingly in relation to economic output over the past ten years.

President Trump is walking a rope, trying to stimulate financial growth through tax breaks while juggling a document non-war, non-recession budget gap. The dangerous nature of this is heightened by Gold’s outperformance.

Observe David P Goldman on X at @davidpgoldman