In October 2022, the Pakistani rupee showed promise by appreciating 3.9%, reaching 219.92 per US dollar. This positive trend was fueled by anticipated foreign-currency inflows from the International Monetary Fund (IMF) and foreign investors.

However, the Finance Ministry failed to foresee the ensuing volatility that would soon disrupt the market. Subsequently, in February 2023, the rupee experienced a sharp decline, hitting 275.5 per dollar and causing significant market disruption.

Currency crises have plagued economies since the 1960s because of fixed exchange rates under the Bretton Woods system. However, in the case of Pakistan, it was the inherent domestic structure of the economy, rather than the exchange-rate regime, that contributed to the rupee’s collapse.

The country found itself exposed to an increasingly volatile domestic situation, exacerbated by a fixed exchange rate, international tensions, and the impact of the Covid-19 pandemic. These factors pushed Pakistan into an inevitable currency crisis.

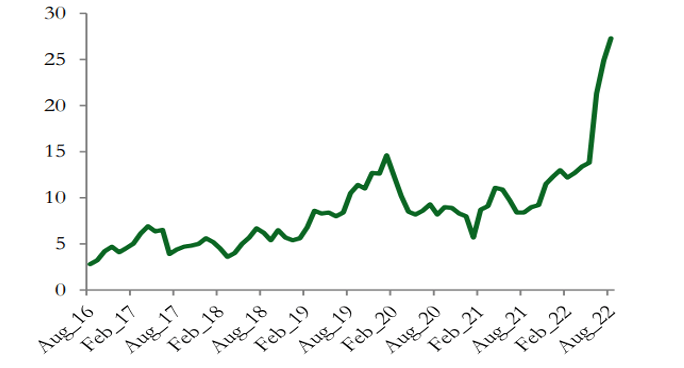

Figure 1: Pakistani Rupee per US$ (2010-February 2023)

Rising prices of essential imports, including fuel, edible oil and pulses, have burdened the government, leading to an inflated current-account deficit and mounting fiscal challenges. This has resulted in cost-push inflation that has escalated the costs of inputs, making it unviable for local producers to continue production.

Adding to the predicament, Pakistan’s foreign-exchange reserves are rapidly dwindling, and with no visible assistance from the IMF in sight, the country’s citizens are confronted with a humanitarian crisis of significant proportions.

Persistently high current-account deficits (CADs) are unsustainable and often lead to major balance-of-payment (BoP) difficulties. A high CAD attracts speculators who anticipate a fall in forex reserves, leaving the central bank incapable of defending the currency.

Furthermore, the deleterious effect on the scale of indebtedness weakens the country’s finances, making it increasingly difficult to access international credit.

The removal of the ceiling on the dollar-rupee exchange rate in January was part of efforts to revive the IMF loan program. This move led to a significant decline in the rupee, reaching a record low.

The devaluation of the Pakistani rupee against other major currencies such as the US dollar, the euro and the Indian rupee has been an ongoing trend since early 2018 when the Pakistani unit transitioned from a managed exchange-rate system to a free-floating exchange rate against the dollar.

While IMF lending can provide temporary relief, Pakistan should exercise caution regarding excessive borrowing, as large capital inflows can undermine the viability of the BoP in the long run.

It is likely that the funds will be utilized to boost consumption and meet existing debt obligations rather than enhancing the productive capacity. Such utilization of funds does not add to the productive capacity, and the inefficiency leads to low returns.

In the long run, it becomes increasingly difficult to procure external funds as the failure to generate foreign exchange earning capacity establishes the country as a defaulter.

Crisis upon crisis

Hence any further debt taken on by the government should be utilized while paying acute attention to the productive capacity of the sectors.

The rupee has undergone a series of depreciations since 2021. It fell to 176 from 160 rupees against US dollar by the end of 2021. A major reason was the collapse of the banking system in neighboring Afghanistan after the withdrawal of US forces in August that year.

Pakistan’s reliance on imports for essential commodities further pressured the currency. In 2022, the devastating floods and political upheaval worsened the foreign-exchange crisis.

With exchange rates fluctuating in the 200-rupee range, Pakistan faces a struggling currency and subsequent increase in imports, leading to soaring inflation and rising poverty levels.

The Consumer Price Index (CPI) in Pakistan rose by 27.5% year on year in 2023, with an average inflation rate of 25.4% for the first seven months of the fiscal year 2022-23, compared with 10.3% during the corresponding period of the previous year.

Furthermore, Pakistan has been grappling with a severe wheat crisis, leading to hoarding and stampedes in some provinces as the government struggles to provide subsidized flour supplies at 160 rupees per kilogram.

The demand-pull inflationary tendencies have been at play due to high demand and low supply, with imports held up at ports, exacerbating the shortage of dollars in the country. This situation contributes to rising inflation and puts strain on consumers’ income and savings.

Figure 2: Pakistan’s National Headline Inflation (Y-o-Y) before and after Covid-19

To combat rising inflation and stabilize the currency, the State Bank of Pakistan has increased the interest rate by 300 basis points, resulting in a cumulative increase of 1,050 basis points since January 2022. However, by early 2023, the country’s foreign-exchange reserves plummeted to a 10-year low of US$3.09 billion.

External debt repayments came to a halt, and import payments were suspended until appropriate fiscal measures were determined to address the dire situation.

In conclusion, Pakistan’s rupee volatility has been a tumultuous journey toward currency depreciation. The country’s inherent domestic structure, coupled with a fixed exchange rate, international tensions, and the Covid-19 pandemic, have pushed Pakistan into a currency crisis.

Rising prices of essential imports, persistent CADs, and dwindling forex reserves have further exacerbated the situation. It is crucial for Pakistan to exercise caution in managing its finances, avoid excessive borrowing, and focus on enhancing productive capacity to achieve long-term stability and economic growth.

A more detailed article by this author can be found here: Debt ad Infinitum: Pakistan’s Macroeconomic Catastrophe.