The International Monetary Fund ( IMF) announced a staff-level agreement with Pakistani authorities on June 29 as Pakistan struggles with an import backlog and declining export volumes, steadily depleting its precarious foreign exchange reserves.

A nine-month Stand-by Arrangement ( SBA ) worth 2,250 million special drawing rights( equivalent to roughly US$ 3 billion, or 111 % of Pakistan’s IMF quota ) is included in this agreement.

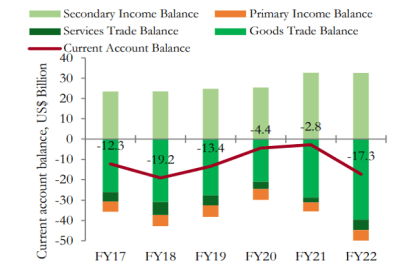

The current account deficit ( CAD ) reached an astounding$ 17.4 billion in the fiscal year 2022, a sizeable increase from the$ 2.82 billion gap seen in FY21. The government encountered various difficulties following the devastating floods of 2022, which resulted in a decline in forex reserves and the loss of creditors’ confidence.

In response, the government soon put in place austerity measures to prevent a possible default on international debt and import restrictions on all goods aside from basic food and medical supplies.

Despite the president’s work, the nation saw a significant decrease in CAD earlier this month, reaching stumbling lows of$ 242 million in January. This drop was accompanied by a drop in forex reserves to just$ 3 billion, making the economy vulnerable to economic shocks.

Pakistan’s Current Account Balance( in US billions ) is shown in Figure 1.

In order to maintain production, local companies rely on imported input, with 53 % of total imports coming from intermediate goods. The president’s mercantilist policies and trade restrictions caused them significant disruption. Higher attrition rates, decreased export productivity, and major disruptions in the commodity chains were the results of this.

international financial investments

Deficits in the current and capital accounts worsen the balance-of-payments ( BoP ) situation and impede Pakistan’s economic development. Foreign direct investment ( FDI ) has decreased as a result of the unreliable and hostile business environment.

It has consistently been difficult for foreign investors to fund private enterprises due to high tariff rates, political uncertainty, criminal concerns, strict duty and interest-rate regulations, and demanding security clearance requirements.

Labor output growth has been impacted by the reduction in FDI and insufficient technology transfer, which has resulted in lower production increases and impractical economies of scale for the past 20 years.

Due to favorable regional and external factors, there was a noticeable increase in FDI flows between 2003 and 2007.

To improve stability and increase investor confidence, the government took a number of actions. These included privatisation activities, liberalizing and deregulating the economy, streamlining administrative procedures, and fostering private-sector expansion. Both domestic and international participants found this to be an attractive investment opportunity.

During this time, the foundation for the China-Pakistan Economic Corridor( CPEC) was established, along with increased investments from China and various local nations. However, Pakistan’s energy crisis, political unrest, infrastructure bottlenecks, and the US-led financial crisis of 2007 – 2008, which stifled foreign investments, all hampered economic growth.

Figure 2: Foreign Direct Investment( percentage of GDP ) in Pakistan

BoP limitations

The small investment and savings routine, which drains foreign currency from Pakistan’s resources, is to blame for the drop in imports. Also, Pakistan’s limited involvement in the international and regional economies is a major deterrent for foreign investors.

Lack of industrialisation reduces producers’ productivity and competitiveness, shifting local use preferences toward imported goods and increasing the trade gap. The ability to increase exports in the face of a steadily declining currency reflects the general lack of efficiency across sectors.

In comparison to other emerging markets, Pakistan’s export capacity is still sluggish. The treatment of Pakistan’s BoP will be significantly hampered by this, necessitating ongoing changes to bring it down to acceptable levels.

Pakistan appears to follow a BoP-constrained growth model, which predicts that any growth-rate development will be accompanied by an immediate decline in the physical balance. Adjusted for its BoP and structural parameters, the projected growth rate of the nation is 3.8 %.

Different trade and diplomatic measures must be taken in order to break free from this period. Readjusting trade ability, diversifying and growing the industry base, and prioritizing efficiency over profit subsidies are all important steps.

It’s important to take lessons from nations like the Philippines and Vietnam, which have outperformed Pakistan in terms of business accessibility. In order to spur economic growth and increase foreign exchange reserves, Pakistan may increase the range of exported goods beyond textiles and grain, improving industry openness.

In order to accomplish this, Pakistan should think about diversifying its international purchase ties beyond its existing allies, such as China, Saudi Arabia, the United States, Britain, and the U.A.E. Pakistan may increase capital outflows and improve its economic prospects by forging new diplomatic ties and building strong ones.

Pakistan’s economy is caught up in a vicious cycle of unequal BoPs, and any growth rate growth is accompanied by an ongoing decline in the exterior balance. Detailed business and diplomatic measures are required to overcome this obstacle.

By reviving its import power, diversifying its business center, and prioritizing performance, Pakistan can break free from this period.

Pakistan’s economic development will be aided by emulating successful models from nations like the Philippines and Vietnam and growing international funding alliances through effective politics. This will also strengthen foreign exchange reserves and lay the groundwork for long-term sustainable growth.

& nbsp, Debt ad Infinitum: Pakistan’s Macroeconomic Catastrophe is the title of an article by this author that is more in-depth.