China has halted rare earth exports, can Australia step up?

BBC News

Getty Images

Getty ImagesIn the midst of rising trade tensions, Australia’s prime minister, Anthony Albanese, has pledged to invest A$ 1.2 billion ( £580 million ) in a strategic reserve for crucial minerals.

The news came after China imposed trade restrictions on seven rare earth elements, which are essential to the development of cutting-edge solutions like computers, fighter jets, and electric cars.

China’s restrictions apply to all nations, but they were commonly accepted as retribution for US President Donald Trump’s taxes.

Albanese stated that Australia had give priority to vitamins that are essential to both its safety and that of its companions, including rare earths. But had his strategy concern China’s dominance?

What are unique universe minerals and why are they significant?

A group of 17 components is known as “rare” when they are extremely challenging to harvest and enhance.

Rare earths, such as samarium and terbium, are crucial to the development of cutting-edge technology that will shape the world in the upcoming years, such as electric vehicles and highly developed weapons systems.

Rare planets as well as other crucial minerals, of which Australia is a leading producer, like potassium and chrome, are included in Albanese’s proposed stockpile.

Rare universe resources exist in both China and Australia. However, China has a significant amount of control over source, making 90 % of rare earth processing, which makes them useful in technology.

And European institutions have been spooked by this.

Why is China limiting the import of unusual world materials?

Beijing asserted that its restrictions on unique earths were in response to Trump’s extensive taxes, which are currently 14 % on Chinese exports to the US.

However, according to analysts, Washington’s inability to stable the supply of rare earths has grown to be one of the Trump administration’s main worries, especially as Beijing’s political tensions have gotten worse.

According to the US Geological Survey, between 2019 and 2022, about 75 % of US imports of rare earths came from China.

The US and EU “dropped the game,” according to Philip Kirchlechner, chairman of Iron Ore Research in Perth, Western Australia, as China quickly gained a monopoly over elegance.

He continued,” China has its base on the body vein of the US and European defense methods.”

Elon Musk, the CEO of Tesla, claimed this week that China’s decision to stop exporting rare earths used in innovative magnets was having an impact on the company’s ability to create humanoid robots, an early example of the problems Beijing has the power to impose on US businesses.

Getty Images

Getty ImagesWas Australia’s plan alter the game?

According to Albanese’s proposal, minerals in the reserve may be accessible to both “domestic business and international partners,” with a good research to allies like the US and EU.

However, Kirchlechner continued, saying that the proposal is” never going to solve the problem,” despite praising the move as “long overdue.”

The basic problem is that China will continue to be generally in charge of the refining process of rare earths, yet if Australia stocks more crucial materials.

An excellent example of sodium is certainly a rare world, but it is a crucial metal in the production of solar panels and batteries for electric vehicles. Only a small portion of the country’s sodium is refined and exported, accounting for 33 % of it. The International Energy Agency claims that China refines 57 % of the world’s lithium while mining only 23 % of it.

As part of its Potential Made in Australia initiative, Australia has been making an investment in rare earths to use the nation’s vast mineral deposits to promote the development of a green economy.

The second mixed plant and plant for rare planets in the world was founded last year by Arafura Rare Earths, headquartered in Perth, Western Australia, with funding from A$ 840 million coming in last year. Australia’s second rare earths processing facility, owned by Lynas Rare Earths, opened in Western Australia in November.

However, the nation is anticipated to rely on China for refining until at least 2026, according to the Center for Strategic and International Studies, which has its headquarters in Washington.

Getty Images

Getty ImagesWhat did China and the US do?

China has been attempting to capitalize on Trump’s uncertainty.

China’s adviser to Canberra criticized Washington’s strategy to global trade in a number of articles in American newspapers, which Albanese swiftly rejected.

In its discussions with Trump, Australia has praised its reference sector. He imposed a 10 % tax on the importation of the majority of Australia’s items on some crucial vitamins.

However, according to analysts, Albanese’s proposal is primarily intended to shield Australia and its companions from corporate adversaries like China.

Natixis ‘ chief economist for Asia-Pacific, Alicia Garca-Herrero, told the BBC that Albanese’s plan was “more advanced” than previous ideas because it allowed for the sale of Australia’s resources in times of economic pressure.

She added that Australia might start selling more of its nutrient reserves to support lower prices on world markets and release China’s influence over setting prices.

She did point out that Australia is still unable to fully remove China.

There are areas where China could have a strong foothold, and refining is the most crucial step if Australia’s goal is to serve the West, becoming more critical to the West, particularly the US.

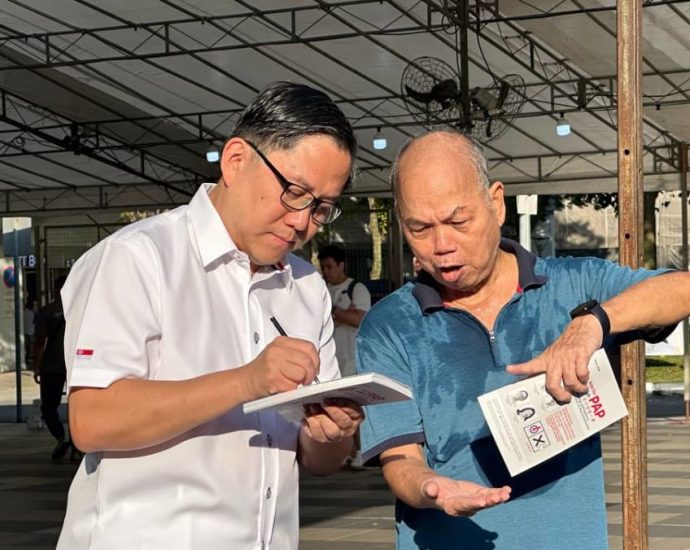

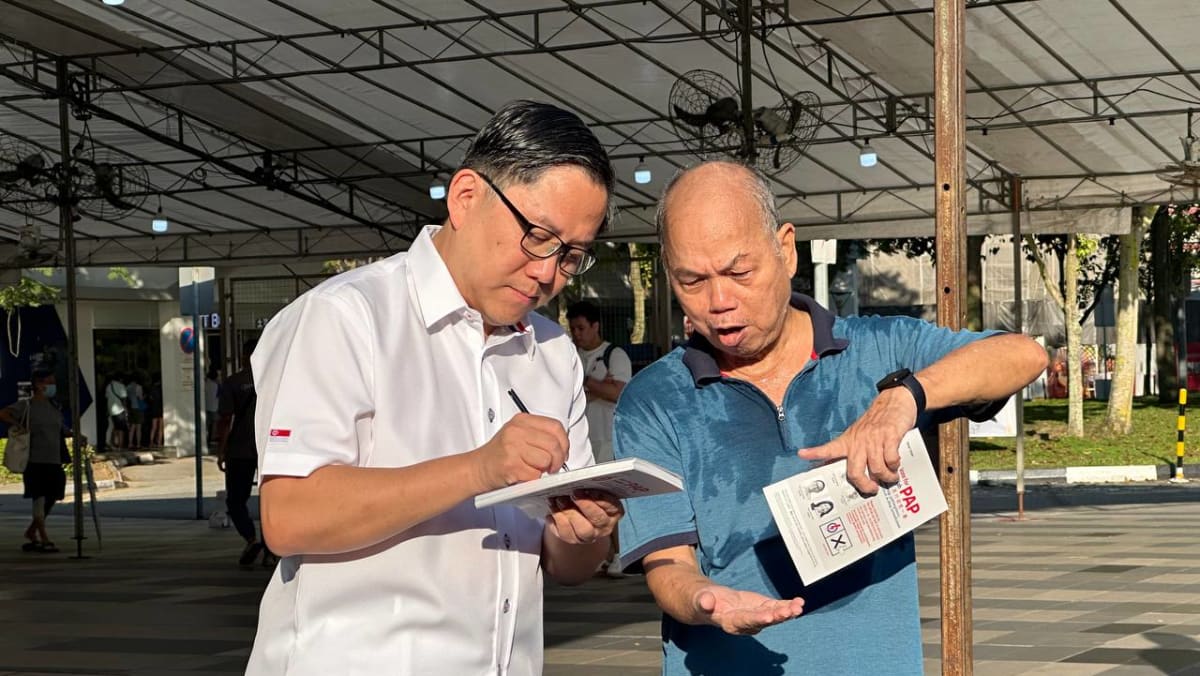

GE2025: PAP’s Alex Yam says SDP chief Chee Soon Juan broke pledge to stay in Bukit Batok

The difference between the ruling party’s Nomination Day swap of key Cabinet ministers across constituencies and Chee Soon Juan’s departure from Bukit Batok, according to People’s Action Party ( PAP ) organizing secretary Alex Yam, lies in the promise he made to voters before, Yam said.

Mr. Yam claimed on Friday ( Apr. 25 ) that the ruling party had “valid reasons” to support its decisions and that they were” not willy nilly” and that the PAP had been able to explain why they had done them.

The difference is that Dr. Chee made a common vow to stay in Bukit Batok and then made the switch-off decision days later. That is the central point, he claimed of the secretary-general of the Singapore Democratic Party’s ( SDP ) plan to run for the Sembawang West seat.

Health Minister Ong Ye Kung, who leads the PAP team in Sembawang GRC, addressed Dr Chee’s determination in his rally speech the night before, calling it a” determined social shift” that was made after a generation of not being interested in the northern area.

After a Yew Tee walkabout with Lawrence Wong, the outlet secretary of the PAP’s Marsiling-Yew Tee GRC staff, on Friday night, Mr. Yam spoke to investigators.

At Yew Tee Square and Yew Tee Point stores, as well as the hard court in front of Yew Tee MRT place, the trio spent about two days shaking hands, taking pictures, and handing out flyers. Additionally, they made a trip to the nearby Sparkle Care senior care facility.

According to Mr. Yam, who has served in Marsiling-Yew Tee GRC since its founding in 2015, each political party has the right to choose which candidates to use” as they deem best in the interests of voters and in the interest of the representation.”

He reiterated Mr. Wong’s earlier assertion that the new Punggol GRC needed Deputy Prime Minister Gan Kim Yong so that” the east of Singapore has a good heavyweight minister who would be able to carry the ground there.”

According to Mr. Yam, the late deployments of Mr. Gan and Manpower Minister Tan See Leng were done for the sake of democracy, not” for exigency sake,” but were purposefully planned to give voters the best chance to make a choice.

He referred to Dr. Chee’s move to a different constituency for the May 3 elections as” but here you have an individual who made a promise, who made a public pledge to do so, but who then changed his mind right away.”

In the former Bukit Batok single-seat ward in the 2020 General Election and the 2016 by-election, the SDP leader ran and lost. Prior to that, he had failed to lead the SDP team for the 2015 hustings in Holland-Bukit Timah GRC.

In accordance with the most recent revision of the nation’s electoral map, the Bukit Batok seat was renamed Jurong East-Bukit Batok GRC.

Indian army chief in Kashmir as rising tensions with Pakistan spook markets

India’s army chief will conduct a security review on Friday ( Apr 25 ) and travel to the site of a deadly attack earlier this week in Indian Kashmir amid concerns that there will increase tensions with neighboring Pakistan’s spooky markets. Islamabad has denied any involvement in the assault, butContinue Reading

Salvage work nears end at collapsed building: ‘We will find everyone’

DNA tests were required to identify the missing persons

As the rescue operation gets closer to its conclusion, the Bangkok Metropolitan Administration ( BMA ) has promised to locate all of the people still encased in the crumbling State Auditorium building.

As the rescue job gradually advances toward conclusion, BMA Deputy Governor Tavida Kamolvej told CU Radio on Friday that rescuers may not keep a single missing people about.

” We are determined to locate each and every one of them. We are certain to find 103, according to Ms. Tavida, who plays a crucial role in managing crisis responses. ” I will continue to look until we reach earth zero.”

34 people are still missing from the swift collapse of the 30-story building in Chatuchak area, which occurred as a result of Myanmar’s 7.7-magnitude disaster on March 28. Before the building’s full flattening, 103 people were employed in it. Nine people were seriously injured and 60 life lost in the event, all of whom have since been hospitalized.

The collapse caused the$ 2.14 billion-baht building to become a massive pile of steel, cement, and other materials, which stood 27 meters high on the day of the earthquake and covered an area of 1.6 % square kilometers. It has now been reduced to seven meters, and construction work is getting more and more close to the badly-failed state structure’s floor surface.

By the end of this month, according to Ms. Tavida, City Hall is anticipating to have all dirt removed from the ground floor, with work in the room expected to begin in May.

Because most body had been recovered from these regions, the activity remained concentrated in districts B and C of the construction. The two activity areas correspond to the areas where the stairways were constructed.

According to the lieutenant governor, numerous bodies were discovered in the two areas as a result of the collapse’s influence, which slanted in these areas and carried the workers with it.

On Thursday, bulldozers excavate the remains of the fell building. ( Photo: Bangkok Metropolitan Administration Facebook page )

Three omissions

Authorities are searching for DNA from the family of three people who are all people of Myanmar.

According to Ms. Tavida, City Hall has contacted the Foreign Affairs Ministry and requested that the Thai consulate in Myanmar help in locating their friends and facilitate the set of DNA tests.

More than 100 body parts have been discovered beneath the rubble, and criminal researchers at Police General Hospital are attempting to meet them with DNA from their families.

HDB resale price growth eases to 1.6% in Q1 2025, transactions up 2.6%

Prices of non-landmarked properties increased by 0.8 % in the Core Central Region in the first quarter of 2025, up from the 2.6 % increase in the previous quarter.

Pricing increased by 1.7 per share in Q1 2025 for the Rest of Central Region, compared to the 3.0 per cent increase in the previous quarter.

Prices in the Outside Central Region increased by 0.3 % in the first quarter of this year, up from the previous quarter’s 3.3 % increase.

The performance in Q1 2025″ suggests that demand in the secret resale segment continues to be resilient despite economic headwinds,” says Mr. Sandrasegeran.

The figures, in general, “underline a continued recuperation and interest in the resale market, especially from buyers looking for move-in available homes in the face of limited fresh launch supply.”

RENTALS

In terms of the public housing market, HDB reported that the number of uses for renting out apartments increased by 12.3 % in the first quarter of 2025, increasing from 8, 603 situations in the previous quarter to 9, 662.

This represents a 2.8 % increase compared to the same period last year, according to HDB. A total of 59, 567 HDB flats were rented out as of the end of Q1 2025, up 0.9 % from 59, 043 products in the fourth quarter of that year.

According to URA, rent of private home qualities increased by 0.4 % in Q1 2025 after remaining intact in the previous quarter.  ,

Rentals of landed properties increased by 0.3 % in the first quarter of 2025, compared to the 1.8 % decrease in the previous quarter.

Rent for non-landed qualities increased by 0.5 % in Q1 2025, compared to the 0.2 % boost in Q4 2024.

In light of the questionable economic outlook, which may have an impact on the personal rental market, Ms. Christine Sun, chief scientist and planner at OrangeTee Group, claimed that some businesses may slow down their getting of foreigners.

” The declining supply of finished homes, along with the lowering of interest levels, which helps reduce business financing expenses, does mitigate a substantial rental price correction,” she said.  ,

Rentals of non-landed properties  increased by 0.4 % in the Core Central Region in Q1 2025, compared to the 0.9 % increase in the prior quarter.

Rentals in the Rest of Central Region increased by 0.4 % in Q1 2025 from the previous quarter, when they were 0.3 % higher.

Rentals for properties located outside the Central Region increased by 0.7 % in Q1 2025, compared to the 0.8 % decrease in the previous quarter.

Mr. Hutton claimed that these financial risks have improved the standing of Singapore as a safe shelter.

” Ultra-high-net-worth individuals may choose to travel to Singapore and hire out luxurious houses in the Core Central Region,” he said.

” The Core Central Region may experience a very small supply of finished homes in the next two years.” In the upcoming times, he added, tenants may see better rent growth.

Asia stocks rise in wake of Wall Street rally

Hong Kong and Shanghai both increased by one percent, while Tokyo increased by one percent. Nissan, a struggling Japanese vehicle company, issued a stark income warning on Thursday, which predicted a significant reduction of up to US$ 5.3 billion in the 2024 to 2025 fiscal year. As Nissan stock roseContinue Reading

Myanmar: TikTok astrologer arrested for predicting new earthquake

An astrologer has been detained in Myanmar after he predicted a fresh disaster in a popular TikTok video, causing panic.

Only two days after a scale 7.7 earthquake that killed 3, 500 people and destroyed centuries-old churches in the South East Asian country, John Moe The made his forecast on April 9.

He was detained on Tuesday for making “false remarks with the intention of causing public panic,” according to Myanmar’s data government.

An earthquake had “hit every town in Myanmar,” according to John Moe The, on April 21. However, researchers claim that due to the complexity of the causes of disasters, they are unable to be predicted.

John Moe The urged citizens to “take important items with you and move away from structures during the shaking” in his film, which received more than three million sights.

The caption read,” People shouldn’t be in high buildings during the day.”

A citizen of Yangon claimed that many of her neighbors were believers in the forecast. They stayed in their homes and set up camp when John Moe The predicted the earthquake may occur.

His now-defunct TikTok bill, which has over 300,000 fans, promises to make astrological and palmistry-based projections.

In Sagaing, core Myanmar, a raid on his house led to his arrest.

The quake, which prompted a rare demand from the Myanmar junta for foreign aid, hit the locations of Mandalay and Sagaing particularly hard by the quake.

In Bangkok, a tower collapsed at a building site, killing lots, after the 28 March earthquake, which felt 1, 000 kilometers away, was felt.

Trump knows exactly what his China trade war means – Asia Times

The official start of massive global tariffs was announced on Donald Trump’s” Liberation Day” on April 2, 2025, cappiling the start of escalating disclosures since his election as president. Amplifying the financial patriotism of his first term, it marks the climax of Trump’s decades-old campaigning for raising taxes and reviving British market.

His most recent press builds on more than 20 years of earlier political attempts to reform trade in a much more aggressive way. Influenced by Project 2025’s section on fair business by longtime adviser Peter Navarro, it calls for quick, uncompromising business action to reduce deficits, lower bill and reshore production.

Similar to how Treasury Secretary Scott Bessent has framed taxes as part of a larger financial rebalancing to recover US industrial and economic supremacy.

Though often stated explicitly, Trump aims to crack the supremacy of China’s export-led financial model, with the understanding that there will be some effects for the US economy.

Although his strategy builds on previous attempts to restructure industry, the public’s understanding of Trump’s agenda and perception of how it is carried out are only moderately supported domestically. The bargain carries the dangers of global financial instability, backlash from allies and handing China even more energy on the international stage.

Protectionism, free industry, and renewed skepticism are all at odds with one another.

From 1798 to 1913, tariffs covered 50 % to 90 % of income and shielded American industry from foreign competitors. Nevertheless, the US sought to restore allied markets and ward off communism by opening its buyer, professional, and capital markets following World War II. Trade imbalances emerged by the 1970s, but abandoning the gold standard in 1971 let the US printing money more quickly and support the imbalance.

The US was convinced that it could continue to control worldwide industry on its own terms after the Cold War’s close in the first 1990s. It pushed for global tariff cuts and free trade deals like the North American Free Trade Agreement ( NAFTA ), while US corporations helped build up foreign manufacturing, particularly in China, which benefited from preferential trade terms under its most-favored-nation trade status. While corporate profits rose and global overproduction was absorbed by American consumers, many American workers were becoming significantly indebted.

These policies added to the anti-globalization movements of the late 1990s, most visibly at the 1999 World Trade Organization ( WTO ) summit in Seattle, prompting a rethink of trade policy. Domesticated companies like steel were crashing out as a result of cheap imports, and former US President George W. Bush reintroduced steel tariffs quickly in 2002 before the WTO ratified them.

The 2008 global financial crisis brought republican calling for economic reform, with the Obama administration pledging to reshore manufacturing work. Obama later distanced himself from the Trans-Pacific Partnership ( TPP ), a free trade agreement, in a move that Hillary Clinton repeated in her 2016 presidential campaign.

Trump’s first-term business plan broke from the previous prudence. He withdrew from the TPP in 2017 and fought with the WTO, favoring punitive motion, and renegotiated NAFTA. He therefore imposed tariffs on important business partners, especially China. The cost of outsourcing had already gotten clear by that time.

With US multinational support, China had gained investment and technology skills to become the “world’s factory”. Beijing became the world’s top exporter and creditor in 2024 thanks to low-tariff access to the US market, which resulted in a$ 300 billion surplus over America in 2024.

President Biden struck a less aggressive develop upon assuming office in January 2021, but he also raised taxes on China. He aimed to address the issue of his trade deficits with the US, which the EU and Japan did, but the US’s commitment to global unity and its role in global affairs attenuated condemnation. Despite lowering tariffs on Europe, Biden yet passed the Inflation Reduction Act and CHIPS and Science Act, both criticized by the EU as mercantilist.

Trump’s second-term target has once more targeted allies, but the focus is still on China, with increased tariffs on Beijing and personal tariffs halted on April 9.

Apart from direct exports, Washington also seeks to target China’s role in global business. The limitations of decoupling were exposed by Biden’s force to “nearshore” manufacturing in nations like Mexico, where Chinese companies immediately established themselves in brand-new Latino industrial parks.

Many goods shipped to the US from different countries also contain Chinese elements, meaning Trump’s 10 cent “baseline” tax hike on all imports is meant to counter additional countries serving as conduits for Chinese goods.

In Project 2025, Peter Navarro emphasized the impact of non-tariff barriers like stringent safety standards, customs delays, and local content requirements on US exports. The US uses these, too, and in early February 2025, Trump cited fentanyl smuggling as justification for raising tariffs on China, Mexico and Canada.

Trump’s tariff increases and the resulting supply chain rerouting may prove challenging to reverse even if a more conventional president comes along. Critics question whether this transition can be fast, affordable or effective, but the Covid-19 pandemic proved supply chains can reorient under pressure relatively quickly, just as China showed its agility by setting up operations in Mexico during the 2020s.

Internal dangers

A tariff war will nonetheless raise prices for consumers and businesses, ending the era of cheap global goods that the US economy has depended on for decades.

Countries kept close ties to protect consumer access to the market and invested US dollars in American stocks, bonds, and real estate. Uncertainty over Trump’s policies saw a fake tweet about tariffs on April 7 trigger multi-trillion-dollar swings. Pensions, household wealth, and corporate valuations would be impacted by continued stock volatility or declines.

Some argue that if the stock markets crash, money could flow into and lower the price of US treasuries, reducing their prices and allowing the government to refinance long-term bonds with cheaper debt.

However, many traditional US debt holders may want concessions before continuing to finance it. Treasury yields have already risen, making new debt more expensive, and China, the second-largest holder of US debt, is suspected of shedding bonds to help do so.

China has also retaliated by enforcing its own tariffs and recently halting exports of some rare earths and essential minerals that are essential to modern technologies. Its state-backed firms can flood global markets with cheap goods and advanced tech, squeezing out competitors.

Beijing, which is increasingly present in international organizations and trade blocs, could become a more influential force in shaping global economic norms if these organizations and agreements become more fluid and the US steps back.

Trump also wants to devalue the dollar to make US exports more competitive, but insists on keeping the dollar as the world’s reserve currency, which eases access to cheap debt. Even if no obvious alternative has been found yet, his strategy is undermining global confidence in the dollar.

Trump’s pressure on a resistant Federal Reserve to cut interest rates further reflects limited borrowing options and coordination in US financial policy as he embarks on major economic upheaval.

Democrats have largely avoided serious opposition to Trump’s policies because they believe it may be a losing political strategy. Still, some top members like Chuck Schumer and Gavin Newsom have marked early opposition, along with seven GOP senators who recently voted against Trump’s Trade Review Act.

The US business class, which once viewed China as a promising market but now views it as a rival, has some backing for Trump’s policies. No longer limited to cheap goods, Chinese companies like Temu, Shein, and BYD increasingly threaten giants like Amazon and Tesla.

Any success in restoring manufacturing will largely come from automation rather than high-paying positions, which will benefit major US corporations. Still, decades of cooperation with China means that these businesses remain exposed, with major corporate figures expressing public concern and Elon Musk publicly criticizing Peter Navarro’s role in the tariff push.

Trump has since framed tariffs as a source of revenue to offset other taxes in addition to serving as leverage over trading partners. His 2024 campaign called for cutting the corporate tax rate to 15 %, down from 21 %, already lowered from 35 % during his first term.

However, the anticipated economic boom did not materialize before Covid-19 arrived, and his suggestion that personal income tax be replaced with tariff income is unlikely to produce enough money, even in the most optimistic scenario.

And while the US needs to expand production for both domestic use and exports, current capacity falls far short. While tariffs may encourage new habits in businesses and consumers, blanket protection without government initiatives in infrastructure development, skills training, and research and development risks doing more harm than good, leaving the private sector with little guidance.

Compared to Trump’s unpredictable approach, China and the EU have positioned themselves as stable anchors of the global economy. Due to tariffs and strained ties, US demands to coordinate with major economic allies like the EU and Japan to stifle trade with China, including limiting Chinese imports and preventing its companies from establishing themselves risk falling on deaf ears.

Global risks

A major pillar of global economic stability is also at risk as a result of restricting access to US consumers. The US accounted for roughly 13 % of global import consumption in 2023, acting as a safety valve for global overproduction by absorbing excess goods.

China has pledged to “vigorously boost domestic consumption,” as per the People’s Daily, to help replace American consumers, as it is facing a property crisis, high youth unemployment, and mounting local government debt.

However, its$ 300 billion trade surplus with the US demonstrates how dependent it is and has less room for retaliation. The EU has signaled it will not tolerate a flood of Chinese goods, as it, like the US, increasingly finds itself competing with China in high-end products.

The US has also experienced tariff increases from the EU and Canada. The Trump administration has tested EU unity by courting globalization-skeptic allies like Italy’s Prime Minister Giorgia Meloni, though tensions are likely to deepen before they ease.

The dangers of deindustrialization are being highlighted by Europe’s struggle to maintain support for Ukraine and Russia, a trend that the US is now trying to reverse systematically. And, by targeting allies with tariffs too, the US ensures that any self-inflicted economic pain is matched abroad, making the cost of reshaping trade a shared burden.

A escalating tariff conflict between Canada and China in 2025 is a surefire sign that China’s export-focused model will likely become even more vulnerable. As the US signals a reduced role in safeguarding global maritime trade, already strained by disruptions like Houthi attacks in the Red Sea and rising piracy, geopolitical tensions could disrupt other key routes. Free trade will have to increase shipping and insurance costs without US assistance.

Trump frequently changed tactics in his first term, mixing threats with negotiations. Voices like Kent Lassman’s in Project 2025, calling for a return to free trade, may gain traction if his tariff strategy falters.

But Trump has been warning of trade imbalances since the 1980s, when Japan and West Germany were his main targets. He seems determined to make China the centerpiece of his legacy by focusing on it this time.

Scrapping the old, in his view, unreformable system and embracing whatever follows is based on the belief that the US is best positioned to shape the new system. Which nations will support or be forced to do so at this point?

Whether a complete globalization teardown occurs or not, he appears ready to push as hard as possible within constraints. Dismantling Beijing’s advantages in global trade will not be simple, as evidenced by the fact that a large portion of MAGA’s products still are produced in China.

John P Ruehl is an Australian-American journalist living in Washington, DC and a world affairs correspondent for the Independent Media Institute.

He contributes to a number of foreign affairs publications, and his book,” Budget Superpower: How Russia Challenges the West With an Economy Smaller Than Texas,” was published in December of 2022.

This article was produced by Economy for All, a project of the Independent Media Institute, and is republished with kind permission.

GE2025: SM Teo Chee Hean turns up in Aljunied GRC, lends support to PAP team

On Friday morning ( Apr 25 ), Senior Minister Teo Chee Hean, who is retiring from politics and won’t contest this General Election, made an unanticipated appearance in Workers ‘ Party stronghold Aljunied GRC.

Mr. Teo spoke with the Aljunied candidates for the People’s Action Party ( PAP ) in a media interview and described them as a “young strong team.”

Chan Hui Yuh, 48, Jagathishwaran Rajo, 37, Daniel Liu, 40, Adrian Ang, 41, and Faisal Abdul Aziz, 37, the head of the Serangoon tree, are on the PAP stone.

Mr. Teo emphasized that the five each have a unique background and skill set.

They want to speak for you in congress. They are prepared to make creative suggestions, not only ones to resist, he said.

When asked if he would accompany the PAP Aljunied group or if he would travel to other districts, he responded,” They invited me through and I’m very happy to support them, because I know them, and they are great people, and they will work rough for the people.”

GE2025: PAR chief Lim Tean dismisses impact of pending court cases on campaign, says he’s a ‘renowned lawyer’

LIM TEAN:” I AM A Influential LAWYER.”

The 60-year-old asked whether his judgment and pending charges would have an impact on his chances of winning this election, saying,” Not at all.”

He claimed to be a “very top attorney” who has handled some of the region’s “most famous, most prominent cases” in the last five years. He brought up his position in the defamation cases involving then-Prime Minister Lee Hsien Loong that Leong Sze Hian, a journalist and economic adviser, and The Online Citizen Terry Xu, the director of alternative news site.

He continued, adding that he had also defended” a significant number of clients” in disputes involving constitutional and administrative law, including those involving corrections orders issued by government agencies under the Protection from Online Falsehoods and Manipulation Act ( POFMA ).

Mr. Lim said,” I do not want to overcome my own disc, but I am a famous lawyer,” adding that he would not continue to “hide my hearth under the pounds any more.”

He added that, in contrast to the lawyers who were MPs before the parliament was disbanded, as well as those who were in the past, he claimed he had handled” a lot more important” cases in Singapore without naming them.

Mr. Lim stated that Line is “fully into the election strategy” and has programs to keep three demonstrations, with the first allegedly scheduled for Saturday in Jalan Besar.  ,

In the Group Representation Constituency ( GRC ), a four-member PAR team includes private tutor Mr. Chiu Shin Kong, businessman Mr. Mohamad Hamim Aliyas, nurse Ms. Sarina Abu Hassan, nurse Ms. Vigneswari V. Ramachandran, and preschool educator Ms.

They square off against Josephine Teo, the minister of modern development and information, on the PAP slate.