Brij Bhushan Sharan Singh: India’s wrestling chief charged with sexual harassment

@b_bhushansharan

@b_bhushansharanIndia’s outgoing wrestling chief has been charged in court after months of protests by the country’s top wrestlers who accuse him of sexual harassment.

Brij Bhushan Sharan Singh is charged with stalking, making sexually coloured remarks, harassment and intimidation.

Mr Singh, an influential MP from the ruling BJP party, denies the charges.

However, police have suggested dropping charges involving a minor, which would have made his arrest imminent.

“No corroborative evidence” was found in allegations by the minor after a detailed investigation in the case, the prosecution lawyer said on Thursday.

The protests had made headlines globally, especially after the police detained the wrestlers as they tried to march to the new parliament building.

Footage of the Olympic medallists Sakshi Malik and Bajrang Punia and two-time world champion medallist Vinesh Phogat being dragged on the streets and carried off in police vans went viral, sparking criticism from top athletes and opposition politicians.

The International Olympic Committee (IOC) also condemned the way the wrestlers were being treated and called for an impartial inquiry into their complaints.

The wrestlers, who had been sitting on protests since April, agreed to pause their protests earlier this month after meeting Home Minister Amit Shah and Sports Minister Anurag Thakur.

Mr Thakur had assured them that charges would be filed against Mr Singh by 15 June.

Seven female wrestlers, including the minor, had filed complaints with the police accusing Mr Singh of molesting and groping them at training camps and tournaments. In the case of the minor, police had invoked the stringent Protection of Children from Sexual Offences (Pocso) Act.

Mr Singh, who has denied all the allegations, accuses the wrestlers of being “politically motivated” and recently said he would “hang himself even if a single allegation is proved” against him.

On Thursday, Delhi police submitted two separate sets of documents in two different courts – a 1,000-page charge sheet detailing their investigation into the overall allegations and a second shorter one in the case of the minor complainant.

In the past few days, reports said the minor had withdrawn her allegations amid allegations that she had been “pressurised into withdrawing the charges”. Mr Singh had refused to comment on the allegation, saying “let law take its course”.

Legal experts say now it’s up to the judge to decide whether to accept the recommendation and close the case or not. The case will be heard on 4 July.

On Thursday, as details of charges against Mr Singh began to be revealed, legal experts and analysts said most of them were bailable offences – which means Mr Singh is unlikely to be arrested soon.

The wrestlers had first protested in January but called it off after Mr Singh was stripped of his administrative powers by the sports ministry and the government promised to investigate their complaints. They resumed their protest, calling for his arrest.

Last month, they threatened to throw their medals into the Ganges – India’s holiest river. But leaders of an influential farming group, Bharatiya Kisan Union (BKU), persuaded them to not do so just yet, saying said he would launch nationwide protests if Mr Singh was not arrested.

The government of Prime Minister Narendra Modi has been criticised for not acting strongly or swiftly enough against Mr Singh as he’s a member of the governing party. The government has denied the charge and said law will take its course.

US Fedâs epic inflation fight likely already over

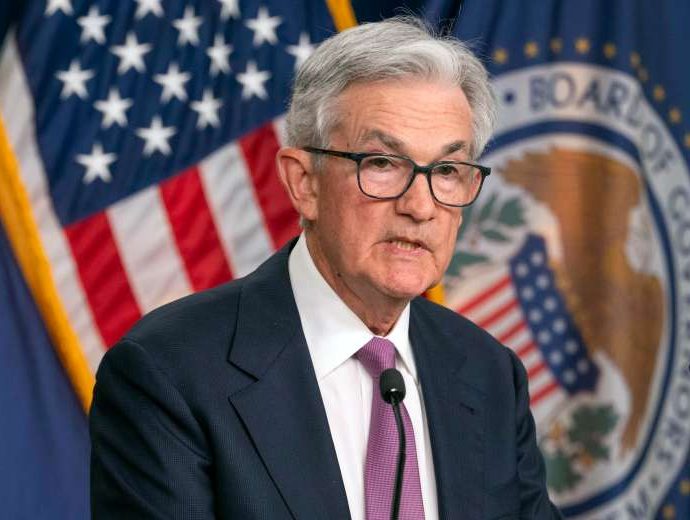

The Federal Reserve’s decision to hold rates steady signals that central bankers believe it is time to hit pause, at least temporarily, on their aggressive campaign to tame runaway inflation.

The latest data, not to mention several other factors, however, suggests it’s time for a full stop.

On June 14, 2023, the Fed chose not to lift rates for the first time in 11 meetings, leaving its target interest rate – a benchmark for borrowing costs across the global economy – at a range of 5% to 5.25%. Over 10 consecutive hikes beginning in March 2022, the Fed had raised rates a whopping 5 percentage points.

“Holding the target range steady at this meeting allows the committee to assess additional information and its implications for monetary policy,” the central bank said in a statement. The Fed indicated it still expects to raise rates two more times by the end of the year.

As an economist who follows the central bank’s actions closely, I believe there’s good reason to think the Fed’s brief hiatus is likely to turn into a permanent vacation.

Inflation is lower than it appears

The fastest rate of inflation since the 1980s is what prompted the Fed to hike interest rates so much. So it makes sense that inflation would be a key indicator of when its job is complete.

The latest consumer price index data, released on June 13, showed core inflation – the Fed’s preferred measure, which excludes volatile food and energy prices – falling to an annual rate of 5.3% in May 2023, the slowest pace since November 2021. That’s down from a peak of 6.6% in September 2022.

While the data shows inflation remains well above the Fed’s target of around 2%, there’s good reason to believe that it will continue to fall regardless of what the Fed does.

Shelter, a measure of the cost of owning or renting a home, is the largest component of the consumer price index, accounting for more than one-third of the total. In its latest report, the Bureau of Labor Statistics reported shelter costs rose 8% from a year ago. After stripping that out, inflation was up just 2.1%.

The thing is, the data reported by the bureau doesn’t reflect the reality of what’s happening in the current housing market.

The Bureau of Labor Statistics relies on a survey that gauges rental prices from 50,000 leases, many of which were signed during the rental bubble in 2021 and 2022. A better measure of current market rents is the Zillow Observed Rent Index. That index suggests rates are declining – rents rose 4.8% year over year in May, aligning with pre-pandemic rates.

Comparing the two measures suggests the official consumer price index data lags behind the market by four to six months. Using current rents would put inflation much closer to where the Fed wants it to be.

Jason Furman, former chair of the government’s Council of Economic Advisors, created a modified version of core inflation – which uses a market-based measure of shelter prices – at 2.6%.

The risk of more rate hikes

Moreover, it is likely that further rate hikes will do more harm than good – particularly to the banking sector – and without helping lower inflation below its current trajectory.

Several regional lenders, including Silicon Valley Bank and First Republic, collapsed earlier this year following bank runs. Combined, they had over a half-trillion dollars in assets.

While there were several factors behind the banks’ demise, an important one was the Fed’s aggressive rate hikes, which caused the value of many of their assets to fall.

The banks catered to depositors with accounts that exceeded the US$250,000 threshold protected by the Federal Deposit Insurance Corporation. These depositors ran for the hills when they learned about the extent of the bank losses.

This turmoil, in tandem with higher rates, is also cooling business activity. This means the Fed doesn’t need to go as high on rates as it otherwise would have.

Further troubles loom over the banking sector. In recent days, notable figures in the finance industry, such as Goldman Sachs CEO David Solomon and former US Treasury Secretary Larry Summers, have warned that nearly $1.5 trillion in commercial real estate loans will require refinancing over the next three years.

The combination of already high interest rates and low office occupancy rates will likely force banks to absorb hundreds of billions of dollars in loan losses, inevitably putting more banks on the brink of failure.

And if the Fed keeps raising rates, the situation is likely to get a lot worse.

Don’t make the same mistakes

The Fed was behind the curve in 2021 and 2022 in realizing inflation was getting out of control, and it has been historically slow in recognizing the impact of rental rates on inflation.

The June pause in raising rates should give the Fed time to take a break, look at the data and, I hope, realize inflation is closer to its target than it appears.

But if it continues to raise rates, I believe the central bank will be repeating the same mistakes it made in the past.

Ryan Herzog is Associate Professor of Economics, Gonzaga University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Runaway maid jailed for climbing back into employer’s house to steal items

SINGAPORE: After working for a household of five for about four months, a maid felt tired and stressed out and decided to run away. About a week later, she climbed back into the landed property through a toilet window and stole multiple items from the family. She also tried toContinue Reading

Extra immigration officers to be deployed to Johorâs land checkpoints to reduce congestion: Chief minister

JOHOR BAHRU: An additional 250 immigration officers will be deployed to the land checkpoints in Johor by September, said its chief minister Onn Hafiz Ghazi on Thursday (Jun 15). This on top of the 100 immigration officers that were already announced for June in order to address the traffic congestionContinue Reading

Senior officials arrested for sale of seized frozen fish

Arrests made in illegal fish sale: Customs officials and civilians involved

Five state officials and two civilians have been arrested for their alleged involvement in the sale of frozen fish seized from an illegal, unreported and unregulated fishing (IUU) vessel.

A combined team of police and officials from the Customs and Fisheries departments arrested the seven suspects, including a former director of the Bangkok Port Customs Office and senior customs officials, deputy national police chief Pol Gen Surachate Hakparn said during a media briefing on Thursday.

Frozen fish, weighing 147 tonnes, were seized from a Somali fishing vessel. Six of the seven containers were taken to the Bangkok Port Customs Office in Bangkok, while the remaining container was kept at Phra Samut Chedi Customs Office in Samut Prakan province, Pol Gen Surachate said.

When questioned, those who boarded the vessel failed to produce the required permit to import aquatic animals from the Department of Fisheries.

The confiscated frozen fish, with an estimated value ranging from 300 million to 400 million baht, were initially being held for sale or distribution to state officials and neighbouring communities as part of a rationing system. However, authorities discovered that the fish had not been properly sold through the rationing process due to the use of a fraudulent list containing 96 individuals posing as buyers. The seized fish were found to have been sold to a single buyer, and the proceeds from this sale were not handed over to the state as required.

Police investigators began tracing the money trails and identified the seven suspects, said Pol Gen Surachate.

Police have charged the suspects with violating sections 157, 147 and 86 of the Criminal Code.

Section 157 deals with dereliction of duty, Section 147 with abuse of authorities in the appropriation of funds, and Section 86 with assisting any person to commit an offence.

Pol Gen Surachate said the police investigators have already submitted the investigation report and indictments against the suspects. They are now widening the probe into allegations that a major fish agent in Samut Prakan sold some of the seized frozen fish to stalls at reduced prices.

Customs Department director-general Patchara Anuntasilpa and Phanthong Loykulnanta, adviser to the department’s development and tax collection management, were present at the briefing.

Mr Patchara said her department has set up a panel to take disciplinary action against the accused officials.

Of the seven suspects, three officials, identified only as Mr Keerati, who oversaw the confiscated goods, Ms Sudarat and Ms Panwad, who were members of a committee responsible for selling aquatic animals, have been charged with malfeasance and dereliction of duty.

Ms Chayakorn has been charged with supporting corruption while Mr Boonma, former director of the Bangkok Port Customs Office, was found to be the buyer of the confiscated frozen fish but did not report the proceeds from the sale. He has been charged with supporting officials to commit an offence.

The remaining two suspects, who are both legal experts at the department, have been charged with dereliction of duty.

US chipping away at semiconductor supply chains

On October 7, 2022, the US Bureau of Industry and Security issued new regulations on exports of semiconductors and certain semiconductor manufacturing equipment.

The rules attempt to block Chinese access to high-end artificial intelligence chips through a combination of new controls on software, people, knowledge transfers, manufacturing equipment and US components integrated into foreign products.

The new rules are a significant shift in an export control policy that the United States has been pursuing for nearly 30 years. The previous policy was designed to keep adversaries, primarily China, one or two generations behind the United States technologically. Under this policy, the United States would raise the level of controls as new technology emerged, before releasing older generations for export.

In other words, the controls were a deliberate moving target. That had three effects. China was denied access to the most advanced technology. US companies were able to sell older technology to China and use the revenue generated for research and development. And the provision of older US technology to China reduced the incentive for the development of Chinese alternatives.

Deteriorating relations between the United States and China as well as the realization that the third point above had diminishing returns — China embarked on its own path of independent technology development many years ago — led to the new US rules being implemented. The main difference in the new policy is the creation of a technological line of control that the current US administration does not intend to move.

The United States has shifted its policy from simply trying to keep China behind to actively seeking to degrade its military capabilities. Maintaining export controls at the same level regardless of future technology developments means that the universe of controlled items and technologies will become much larger over time. It also means that enforcement will become more difficult and the cost to US producers will increase.

The short-term impact of the new rules appears to be fairly small for chip makers, since a relatively small number of chips were directly affected. But it has been larger for the equipment manufacturers, who have a significant market in China.

Assessing the long-term impact requires examining three questions. What will be the effect of the new rules on US company revenue? Will the new controls accelerate China’s policy of indigenous technology development?

Will the new controls eventually lead to “designing out”, a scenario where other countries develop products that contain no US technology and are therefore outside the scope of US export controls?

Currently, these questions cannot be fully answered, but there are some hints at what might happen. With respect to US company revenue, the immediate impact is likely to be small on chip manufacturers and large on equipment makers.

Over time, as the universe of controlled items grows, the negative revenue impact will also grow and US companies could find themselves strapped for capital. This will adversely affect their research and development expenditure on future generation technology to the competitive detriment of companies.

With respect to China’s policies, the new US rules will almost certainly accelerate China’s plans for indigenous technology development. Those were already underway, but the sweeping nature of the new rules will push China to move more quickly.

A report to the 20th Party Congress in October 2022 included the mandate to “achieve greater self-reliance and strength in science and technology.” They may also increase Chinese overcapacity of legacy chips that would further reduce revenue for US firms.

The third question is harder to predict. We have seen the “design out” phenomenon before — most notably in the case of commercial communications satellites in the late 1990s and early twenty-first century.

In the short run, there do not appear to be any countries capable of developing chips or equipment entirely free of US technology, but the “short run” in the semiconductor industry is a matter of a few years.

As US controls cover more and more items, the incentives to develop non-US alternatives will grow and we may see a repeat of the satellite episode, which saw the US satellite industry’s global market share shrink from 75% to 25% in a few years.

In the long term, the rules could present significant challenges to US companies in maintaining market share and revenue expectations.

US companies will inevitably face more competition from China as it continues down its own path of independent development, and companies could also face new competition from other sources lured into the market by the US export constraints.

That will not be an immediate issue since entry barriers in this industry are very high in terms of both capital and technological expertise. But the longer the controls stay the same or expand in scope, the more likely it is that competition will grow.

This situation presents opportunities for other Asian nations from two opposite directions. First, as existing companies seek to remove Chinese content from their supply chains, they will look for alternative locations for manufacturing. Southeast Asia is an obvious choice, though the opportunities vary in individual countries.

Second, new entrants to the market seeking to develop products without US technology could look to Asia as a suitable location for parts of their new supply chains. Several countries in the region have significant experience both in manufacturing chips and in other parts of the supply chain, including assembly, testing and packaging.

Japan has already joined the United States in applying additional controls on semiconductor products, and others, such as South Korea and Taiwan, are under increasing pressure to join.

As the United States considers the effects of the current and future controls, it must take into account not only the limitations and costs of the controls but also the political and economic costs it is asking allied countries to incur.

William A. Reinsch holds the Scholl Chair in International Business at the Center for Strategic and International Studies (CSIS) and is Senior Adviser at Kelley, Drye & Warren LLP.

Emily Benson is Director, Project on Trade and Technology and Senior Fellow, Scholl Chair in International Business at CSIS.

This article was originally published by East Asia Forum and is republished under a Creative Commons license.

Worker found dead at site of collapsed Tanjong Pagar building structure after hours-long rescue effort

SCDF deployed 11 emergency vehicles, about 70 officers and two search dogs to the scene.

They included members of the elite DART team, the 1st SCDF Division and the Marina Bay Fire Station.

“A fibre optic scope, life detection equipment … were also deployed to detect for signs of life,” said SCDF. “The operation involved the coordinated use of heavy machinery from the construction site as well as rescue equipment to cut and lift the reinforced concrete slab.”

Colonel Firoz Ramjan, commander of the 1st SCDF Division, told reporters that SCDF took “measured” actions to remove the body from the rubble, adding that the operation was challenging due to an estimated 40 to 50 tons of reinforced concrete slab that is about half a metre in thickness.

Search operations will continue through the night to ensure that no one else is trapped under the rubble, although CCTV footage shows there appears to be no other person under the structure.

Worker dies after building structure collapses at Tanjong Pagar work site

“VERY SHOCKING”

An employee at Napolizz Pizza, located across the affected site, said she saw police running towards the scene of the incident.

“Then we saw people started to walk (that way) and that’s when we went out and saw that the building had collapsed,” said the 29-year-old, who only wanted to be known as Ms Avinisha.

Mr Chen Xiao Wei, who works across the road at Anson House, said he felt a “vibration” at about 2pm but did not hear anything.

“It was not so strong but can feel something. Then my colleague told me that the building collapsed,” said the 50-year-old, who works on the 12th floor.

More than 1,000 new private homes sold in May, highest in 12 months

SINGAPORE: Sales of new private homes in Singapore have risen for the fifth consecutive month, reaching their highest level in 12 months.

Analysts said the increase was buoyed by two projects – The Reserve Residences on Jalan Anak Bukit and The Continuum on Thiam Siew Avenue.

Excluding executive condominiums (ECs), developers sold 1,038 units in May – a 17 per cent increase from the 887 units sold in April, according to figures released by the Urban Redevelopment Authority (URA) on Thursday (Jun 15).

On a year-on-year basis, however, sales fell by 23.4 per cent from the 1,355 units sold last May – which also marked the last time more units were sold.

A total of 1,595 units were launched, almost double that of April’s figure.

The sales were mainly driven by the launch of The Reserve Residences on Jalan Anak Bukit in the Rest of Central Region (RCR). A total of 523 units were sold at a median price of $2,461psf.

“The project was very well received due to its attractive pricing and proximity to many top schools in the Bukit Timah area,” said Ms Christine Sun, OrangeTee and Tie’s senior vice president of research and analytics.

“Moreover, integrated developments are rare and have always been popular among buyers for their convenience and high rentability.”

Another RCR project that pushed sales in May, The Continuum on Thiam Siew Avenue, sold 225 units at a median price of $2,720psf.

Huttons Asia’s senior director for research Lee Sze Teck noted that The Continuum is the first freehold project with a large land size above 200,000 sq ft since Haig Court in the Katong area in almost 20 years.

He added that buyers were also drawn to the property’s freehold tenure, proximity to good schools and the Paya Lebar sub-regional centre.

The bulk of last month’s transactions came from the Rest of Central Region (81.6 per cent). Another 14.6 per cent was in the Core Central Region (14.6 per cent), while the remaining 3.8 per cent was in the Outside of Central Region.

According to data from Huttons, almost 99 per cent of the buyers at The Continuum and The Reserve Residences are Singaporeans and Permanent Residents.

The proportion of residential property purchased by foreigners dropped significantly in May, said Mr Lee. He added that this was partly due to the property cooling measures imposed on Apr 27, where the additional buyer’s stamp duty (ABSD) was doubled to 60 per cent for foreigners.

However, he noted that the full effect of the cooling measures will only be evident in June. He put this down to “a transition provision to allow the exercise of option to purchase on or before May 17, 2023 to fall under the previous ABSD of 30 per cent”.

However, ERA Realty Network’s key executive officer Eugene Lim remains optimistic that in the longer term, increasingly more foreigners may return to the market even though Singaporeans and Permanent Residents are expected to continue to be the key demand drivers for private homes.

He said: “Singapore is a safe haven for them to bring their families. Their children can be educated here. Many may want to sink their roots here, because it is a very secure and comfortable environment for them.

“Those that do business use Singapore as their base camp. After comparing amongst all the countries in Asia, Singapore still remains at the top of their list.”

Analysts also predicted that new home sales will decrease in June due to the lack of project launches and ongoing school holidays.

But after that, there will be some high-profile projects slated for launch in the coming months, including Lentor Hills Residences and Grand Dunman, said Ms Sun.

She said: “Some developers may also bring forward their project launches before the lunar seventh month, which may boost new home sales.

“We anticipate that 7,000 to 8,000 new homes could be sold this year.”

Structure collapses at Tanjong Pagar work site, one worker reported missing

“We are deploying heavy machinery at (the) site to be utilised in the cutting and lifting operations,” Colonel Firoz Ramjan, commander of the 1st SCDF Division, told reporters at the scene.

“Apart from the missing worker, our rescuers will also carefully comb the entire area to ensure no one else is left trapped,” said Colonel Firoz, who is also the incident commander for the operation.

A video sent to CNA showed a collapsed structure, with debris falling out of the construction hoarding and onto the pavement outside the work site.

Multiple SCDF and police vehicles were seen, while a road was cordoned off.